Ethereum Rallies 60% in One Month—$3.4 Billion Floods Into ETH as Traders Chase Momentum

Ethereum just pulled off a jaw-dropping rally—up 60% in 30 days—as whales and retail piled in. Nearly $3.4 billion worth of ETH got scooped up, proving once again that crypto markets move faster than Wall Street analysts can downgrade their price targets.

Why the frenzy? Speculation around ETF approvals, layer-2 adoption, and good old-fashioned FOMO. Meanwhile, Bitcoin maximalists are quietly recalculating their ’flippening’ spreadsheets.

Smart money’s betting on Ethereum’s ecosystem—but let’s see how long the party lasts before the next ’macro headwind’ excuse rolls in. After all, in crypto, fundamentals are optional until they’re not.

Ethereum Investors Gobble Up Supply

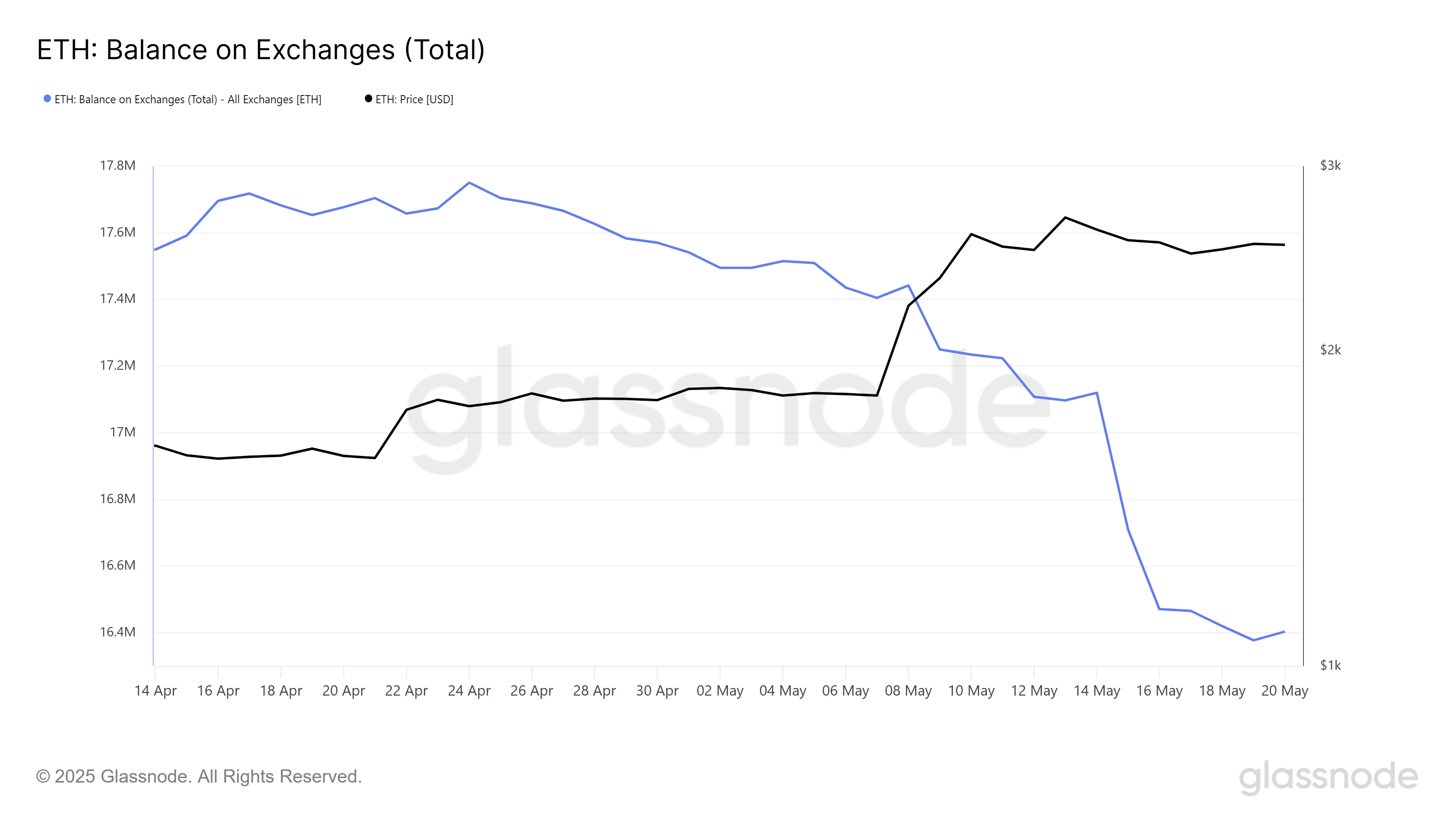

Ethereum’s balance on exchanges has dropped by 1.34 million ETH in the past month (April 21 to May 21), marking a significant shift in market conditions. This supply reduction is valued at over $3.42 billion and is largely due to the Pectra upgrade, which has boosted investor confidence in Ethereum’s long-term growth.

The drop in exchange supply reflects a growing belief that ethereum could continue its upward trajectory. This rush to acquire Ethereum has created a FOMO (fear of missing out) effect, contributing to the price rise.

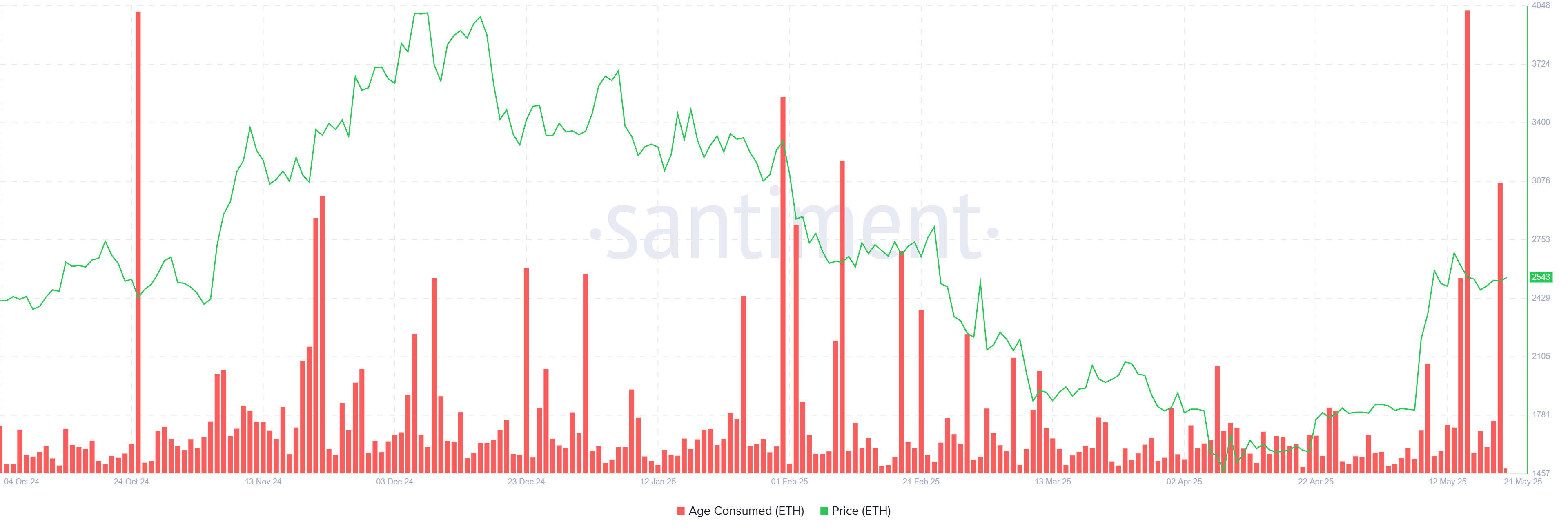

However, the macro momentum surrounding Ethereum is mixed, with long-term holders (LTHs) exhibiting behavior that suggests caution. The Age Consumed metric has spiked twice this week, indicating that significant portions of ETH are being sold by LTHs to lock in profits.

This is the largest wave of selling in the past seven months, which suggests that these holders believe Ethereum may have reached its market top. The sell-off by LTHs is drawing attention to potential risks that could affect Ethereum’s future performance. If this trend of profit-taking continues, it could hinder the cryptocurrency’s growth prospects.

ETH Price Rallies

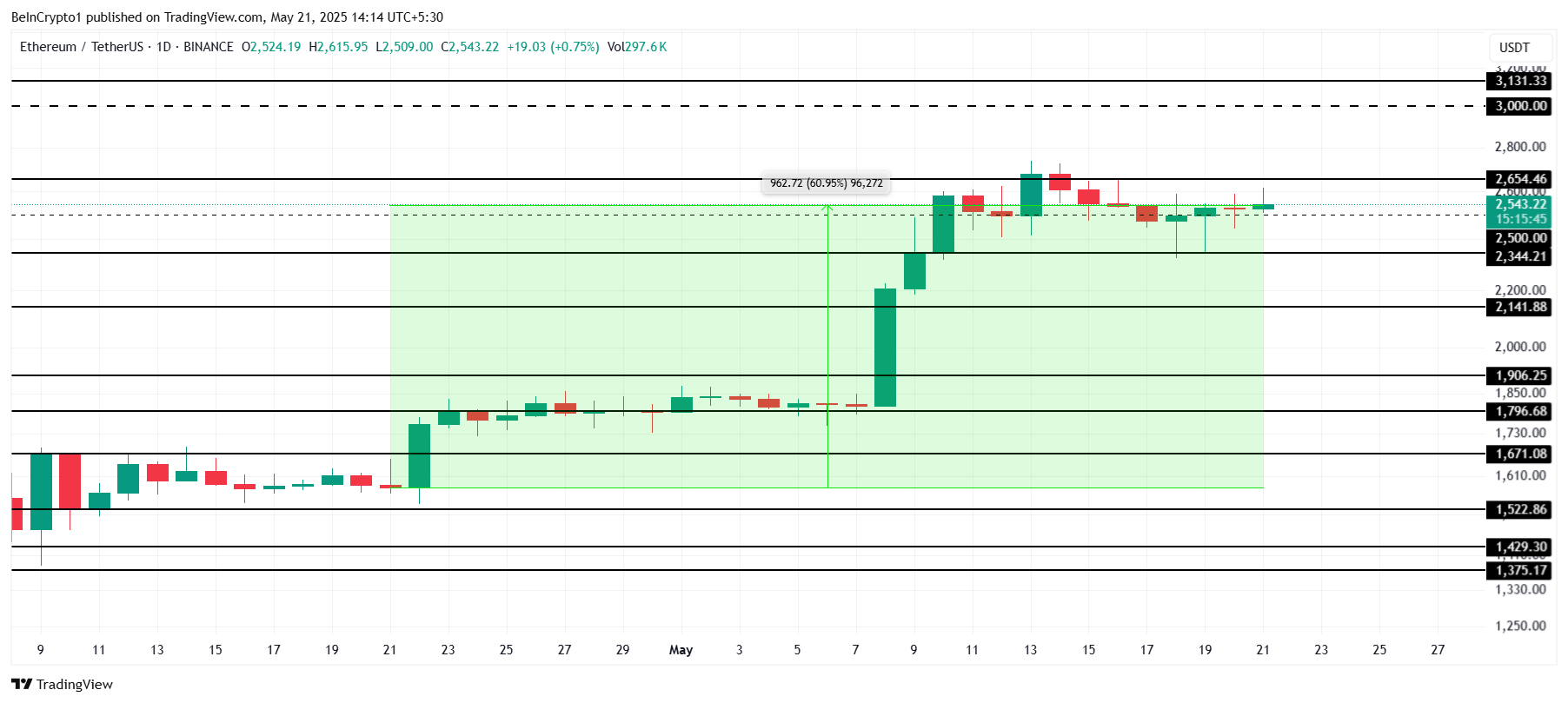

Ethereum price is currently trading at $2,543, marking a 60% rally over the past month. However, the price faces resistance at the $2,654 mark. Breaching this resistance is crucial for Ethereum to continue its rise.

The price will likely surge beyond this level if Bitcoin forms a new all-time high (ATH), as Ethereum has a strong correlation with Bitcoin. This move could push Ethereum closer to $3,000, further solidifying its bullish outlook. If the broader market remains positive, Ethereum’s price could see continued upward momentum.

However, the market comes with its risks. If the selling pressure from LTHs intensifies and the accumulation phase halts, Ethereum’s price may struggle to maintain its upward trajectory. Losing support at $2,344 WOULD likely lead to a decline towards $2,141, invalidating the current bullish thesis and creating a bearish outlook for the cryptocurrency.