Bitcoin Dethrones Gold as America’s Favorite Safe Haven—Here’s Why

The king is dead—long live the king. Bitcoin just flipped gold as the preferred store of value for US investors, and Wall Street’s old-guard goldbugs are sweating. What’s fueling the coup?

Institutional adoption turbocharges demand

BlackRock’s spot BTC ETF became the fastest-growing fund in history, sucking up billions while gold ETFs bleed out. Meanwhile, boomers finally noticed the 10,000% ROI on that ‘internet funny money’ they mocked in 2017.

The inflation hedge that actually hedges

With real yields negative and the dollar printing like a degenerate gambler, BTC’s hard cap beats gold’s ‘trust us, we won’t mine more’ pinky promise. Even central banks are quietly stacking sats—ironic, given how they’d ban it if they could.

Tech wins over tradition

Gold’s ‘digital transformation’ involved slapping blockchain stickers on vault receipts. Bitcoin actually moves at the speed of the internet—settling $10B cross-border while gold bars gather dust in London basements.

One cynical footnote: Goldman Sachs will launch a ‘digital gold’ product next week, promising all of Bitcoin’s volatility with none of the upside. Some traditions never die.

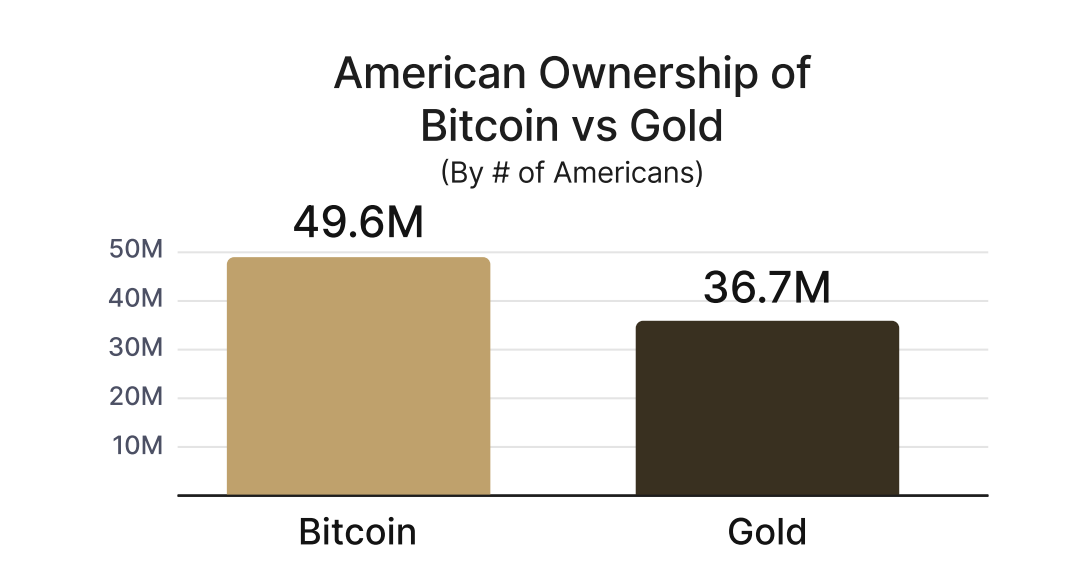

Bitcoin Surpasses Gold in US Ownership

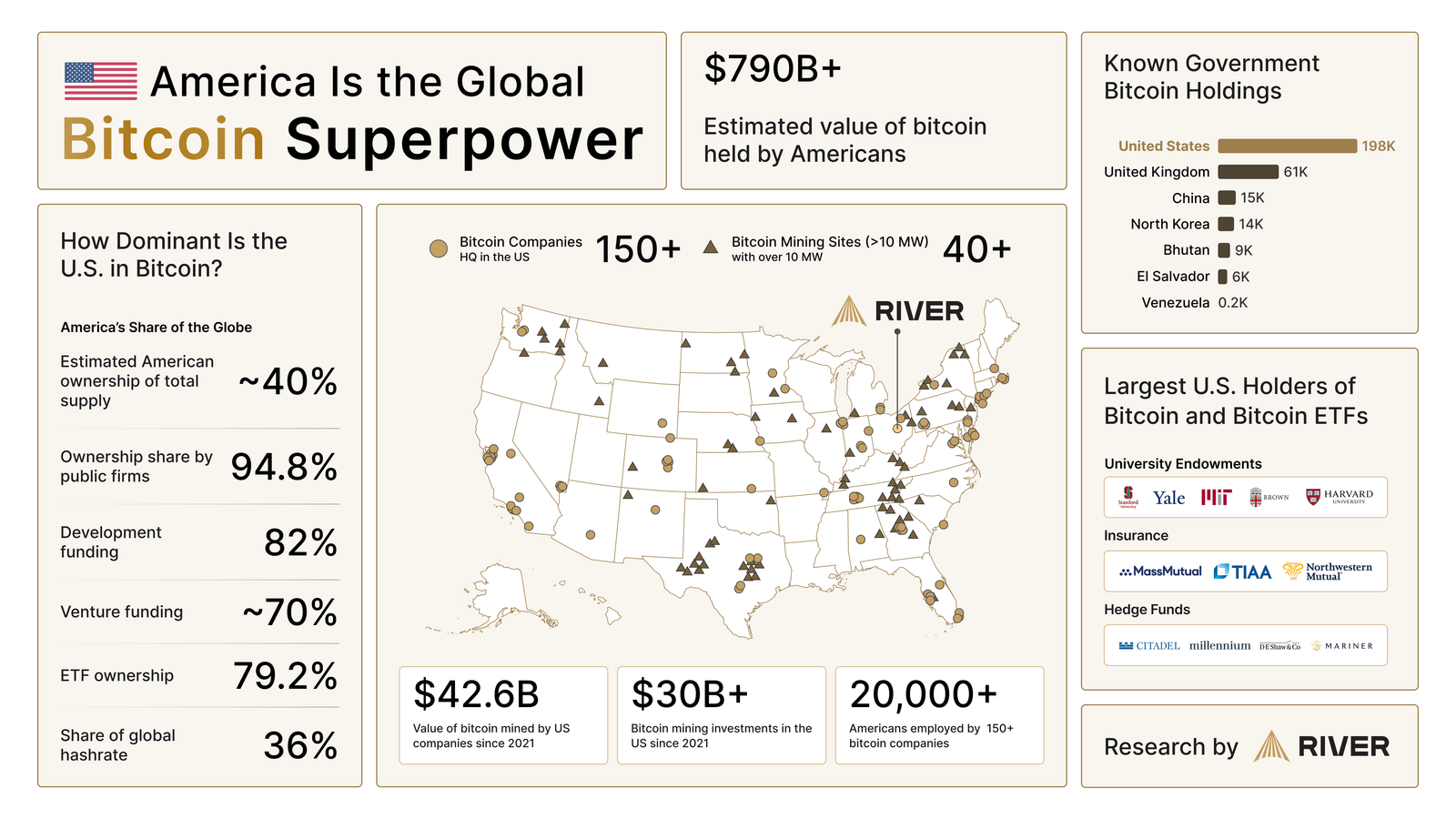

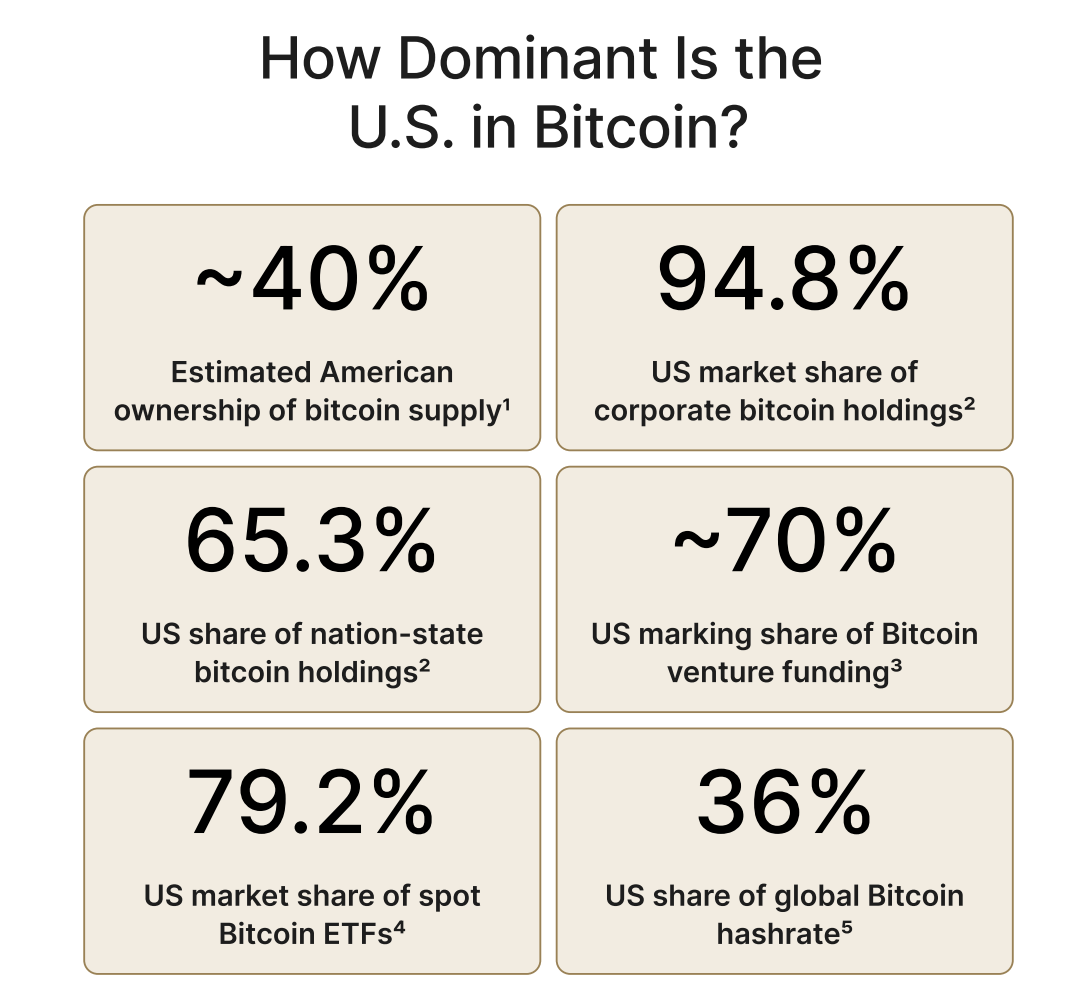

A May 20 report from bitcoin investment firm River emphasizes that the US is leading the way in Bitcoin adoption, with significant investments and infrastructure supporting its dominance. Bitcoin’s outperformance over gold in American ownership marks a significant milestone, signaling a major shift in public perception of investment assets.

The report also highlights that the US is at the forefront globally in adopting Bitcoin, with 40% of global Bitcoin companies headquartered there. Also, American firms account for 94.8% of all Bitcoin owned by publicly traded firms worldwide.

This reflects the US’s strong investment in Bitcoin infrastructure, from startups and ETFs to policies supporting cryptocurrency.

Another noteworthy point is the trend of considering Bitcoin as a modern reserve asset alternative to gold. River’s report shows that Bitcoin is becoming an “underestimated pillar” of American economic dominance.

With 790 billion USD worth of Bitcoin held by Americans, Bitcoin is not just an investment asset. It is also integrated into the nation’s economic plans and financial systems.

“Bitcoin is an underestimated pillar of American dominance. Americans have a larger estimated share of the bitcoin supply than of global wealth, GDP, or Gold reserves.” River stated

Growing confidence in Bitcoin is reinforced by factors such as the ease of digital storage and transfer and expectations that the US might establish a strategic Bitcoin reserve, as proposed by some politicians. This indicates that Bitcoin is gradually reshaping how Americans perceive safe-haven assets during economic uncertainty, surpassing the traditional role of gold.

Moody’s US credit downgrade ends a century of top ratings, boosting Bitcoin’s appeal as a hedge against fiscal instability.

However, this shift also raises questions about sustainability and risks. While Bitcoin is considered a SAFE haven asset, its price volatility may make some investors cautious.

Nevertheless, with support from major financial institutions like BlackRock and an increasingly clear regulatory framework, Bitcoin is solidifying its position in the US.