LAUNCHCOIN Rockets 9,336% in Under Two Weeks—Whale Wallets Fuel Suspicion

Another day, another moonshot—LAUNCHCOIN just pulled off a 9,336% gain in 12 days, turning early bagholders into overnight ’geniuses.’ But here’s the kicker: the supply distribution looks more centralized than a Wall Street boardroom.

Pump now, ask questions later? The token’s meteoric rise reeks of classic crypto volatility, with a side of concentrated ownership that’d make even the most reckless hedge fund manager blush. Proceed with caution—this rocket might have a single passenger.

Funny how ’decentralized finance’ keeps finding new ways to mimic the old boys’ club. Maybe next they’ll start charging $50,000 for a telegram group invite.

LAUNCHCOIN Red Flags: Slow Holder Growth and Supply Concentration

The number of LAUNCHCOIN holders surged from 7,738 to 31,683 in just 18 days. However, this growth has significantly slowed down in the last week, with fewer than 600 new holders joining. This pause in growth, coupled with the price rally, hints that the token might be reaching a market top.

This slow pace of holder growth raises questions among investors about the altcoin’s long-term potential. While the massive price surge initially attracted many, the lack of new investors could indicate that LAUNCHCOIN is running out of momentum. Investors are likely realizing that the market has become overbought, and price corrections may be ahead.

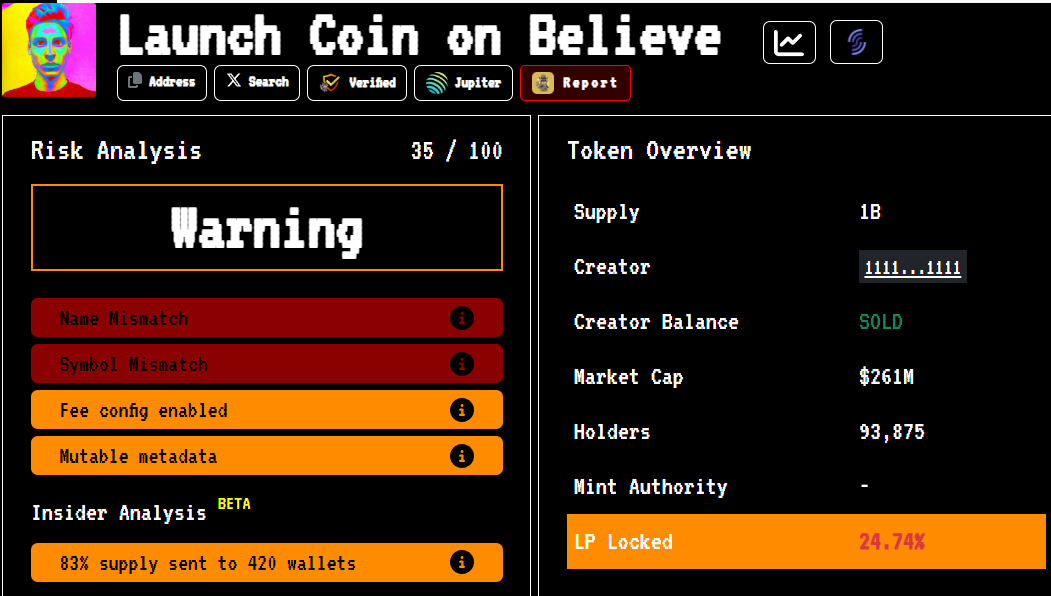

Beyond the erratic growth of holders, some red flags are emerging for LAUNCHCOIN. Earlier this month, the altcoin changed its name from Bob Pasternak (PASTERNAK) to LaunchcoinOnBelieve, which is likely an effort to appear more legitimate. However, data from RugCheck reveals that 83% of the total LAUNCHCOIN supply was allocated to just 420 wallets, which is highly concentrated.

This suggests that a small group of holders controls most of the coin’s supply, increasing the risk of price manipulation.

Additionally, less than 25% of LAUNCHCOIN’s liquidity pool (LP) is locked. In the early stages of an asset’s lifecycle, larger LP locks help provide stability and instill investor confidence. The current lack of LP locking raises concerns that the token may be vulnerable to sudden volatility, which could deter investors from holding long-term positions.

LAUNCHCOIN Price Consolidates

LAUNCHCOIN is currently sitting with a market cap of $258 million. The Internet Capital Markets token has rallied 9,336% in the span of 12 days.

Its demand arises from the prospect of creating tokens by simply posting a tweet, which has been a surging narrative in the crypto space. If the demand for this asset continues, it could be looking at further gains. Trading at $0.249, the altcoin could rise to $0.384 to reach $0.600.

On the other hand, if the investors realize that the Internet Capital Markets token has hit its top, evident in the week-long consolidation, they could MOVE to sell. This could result in a price drop below the support of $0.149 to fall to $0.050.