BlackRock’s Bitcoin ETF On Fire: 5 Straight Days of Inflows Signal Institutional Stampede

Wall Street’s love affair with crypto just hit a new milestone—BlackRock’s spot Bitcoin ETF has now soaked up capital for five consecutive trading days. The world’s largest asset manager is leading the charge as traditional finance finally caves to the digital gold narrative.

Who needs Satoshi when you’ve got Larry Fink? The irony isn’t lost as the same institutions that once mocked Bitcoin now fight for ETF market share. Five days of inflows suggest the ’smart money’ is done waiting for the perfect entry—they’re buying the rumor and the fact.

Meanwhile, crypto OGs smirk as Wall Street pays a 0.8% premium to play catch-up. The revolution will be institutionalized—and expensively fee’d.

Bitcoin ETF Inflows Hit 5-Day Streak

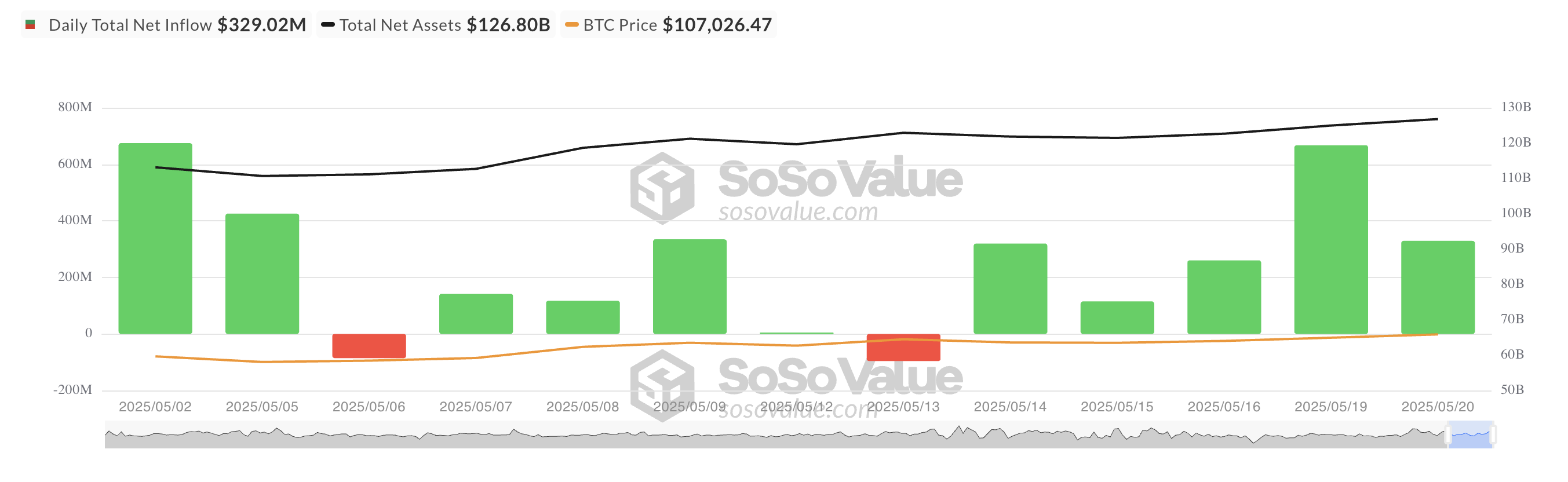

Yesterday, net inflows into BTC spot ETFs totaled $329.02 million, marking the fifth straight day of inflows into these products.

The steady pace of inflows over the past five days indicates a broader shift in market sentiment. Institutional players appear increasingly confident in BTC’s medium-term trajectory, prompting them to consistently allocate capital to the funds backed by the coin despite short-term market fluctuations.

On Tuesday, BlackRock’s ETF IBIT recorded the largest daily net inflow, totaling $287.45 million, bringing its total cumulative net inflows to $46.15 billion.

Fidelity’s spot Bitcoin ETF, FBTC, recorded the second-largest daily inflow that day, attracting $23.26 million. This brings its total historical net inflows to $11.81 billion.

Bitcoin Blasts Past $107,000

Today, the king coin has broken above the psychological $107,000 resistance level, indicating a spike in bullish pressure in the spot markets. As of this writing, the leading cryptocurrency trades at $107,421, noting a modest 2% gain over the past day.

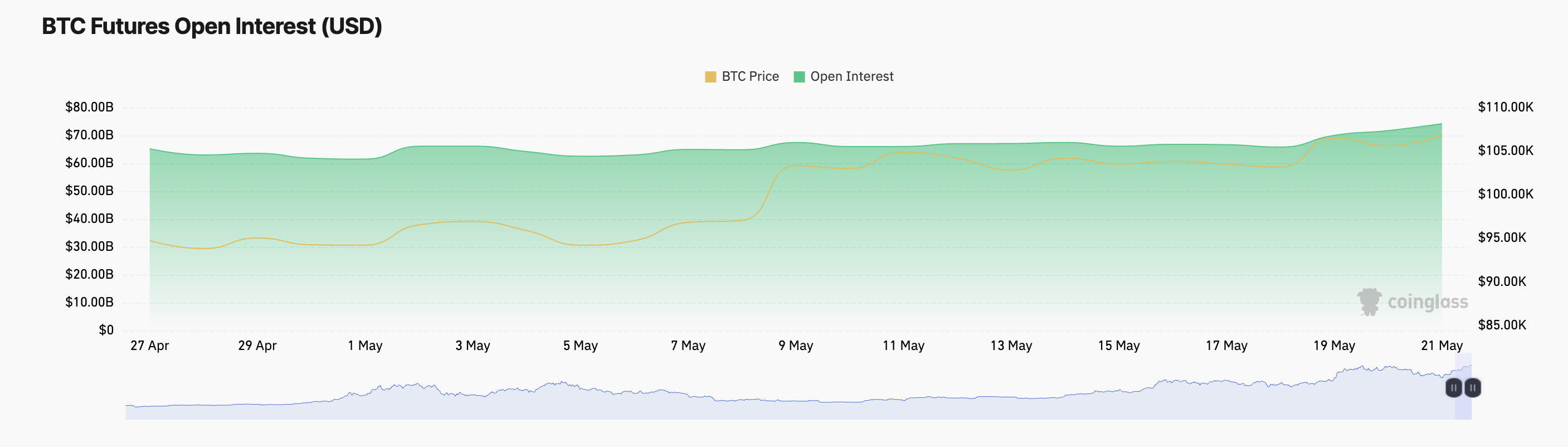

Open interest in BTC futures has also surged as the price climbs, indicating increased capital inflow across its derivatives markets. At press time, this is at $74.24 billion, up 4% during the review period.

When an asset’s price and open interest increase, it signals that new money is entering the market and that the current trend, usually bullish, is gaining strength. This trend reflects growing investor confidence behind BTC’s price move.

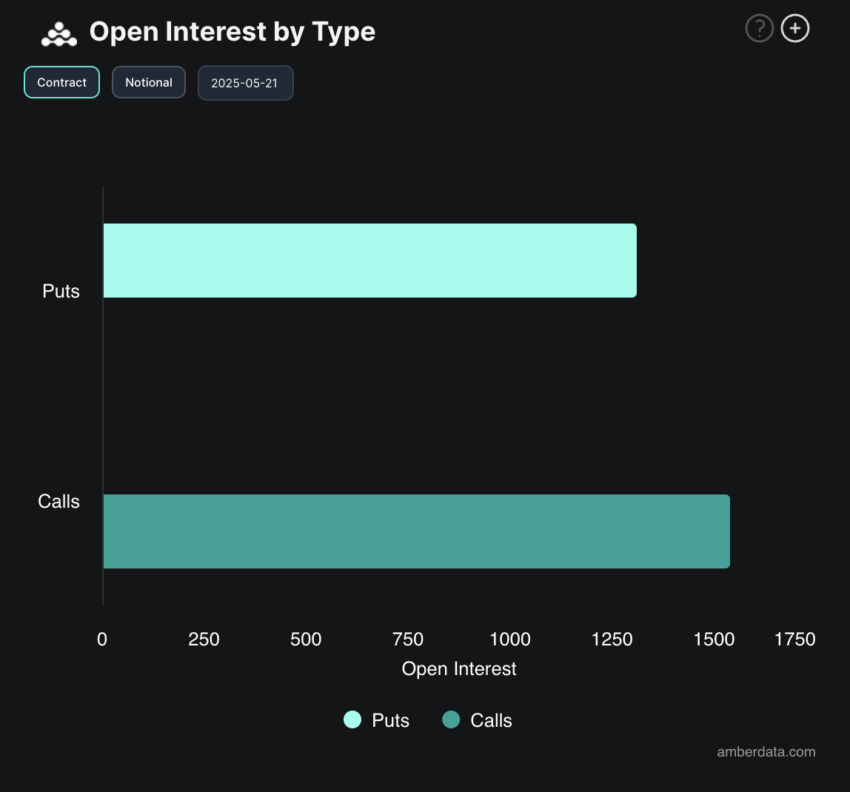

Moreover, options market data shows growing demand for call contracts, supporting the bullish outlook above. This indicates that traders continue to position for further upside in BTC’s price.

If these trends persist, the leading coin may be entering a new phase of accumulation, pushing it to a new all-time high in the NEAR term.