CME Launches XRP Futures Amid ETF Fever—Wall Street Plays Catch-Up With Crypto

XRP bulls just got a new weapon: CME’s freshly minted futures contracts hit the market today, giving institutional traders their first regulated playground for Ripple’s embattled token.

Why now? The timing reeks of opportunism—with BlackRock’s spot Bitcoin ETF hauling in $20B AUM last quarter, suddenly every trad-fi desk wants skin in the game. Never mind that XRP’s legal clarity came only after the SEC’s humiliating courtroom defeat.

ETF whispers grow louder: Sources say Invesco and Galaxy are drafting XRP ETF filings, betting the SEC’s bruised ego won’t spark another fight. Meanwhile, crypto OGs smirk—retail traders have been levering up on XRP for years via unregulated offshore books.

The bottom line: When CME rolls out crypto derivatives, hedge funds follow. But remember 2017’s ’institutional wave’ promises? Exactly. This time, the suits might actually mean it—or they’ll just collect fees until the next narrative collapses.

Much Needed Institutional Exposure for XRP?

After several months of anticipation, the CME Group is finally offering XRP and Micro XRP Futures contracts. The CME first announced that it WOULD list these offerings in late April, and they’ve gone live right on schedule.

According to Ripple CEO Brad Garlinghouse, the first trades took place on Hidden Road, a brokerage platform that Ripple bought recently:

“The launch of regulated XRP Futures on the CME marks a key institutional milestone for XRP…and very excited to report that Hidden Road cleared the first block trade on the CME at the opening!” Garlinghouse claimed via social media.

Since these markets just opened, no trading data on the XRP Futures is publicly available yet. Even so, the opening came with a lot of fanfare, and XRP enthusiasts have several things to look forward to.

The advent of CME futures trading brings a few key advantages to XRP. For one, it has long been assumed that it massively boosts the XRP ETF’s chances of success.

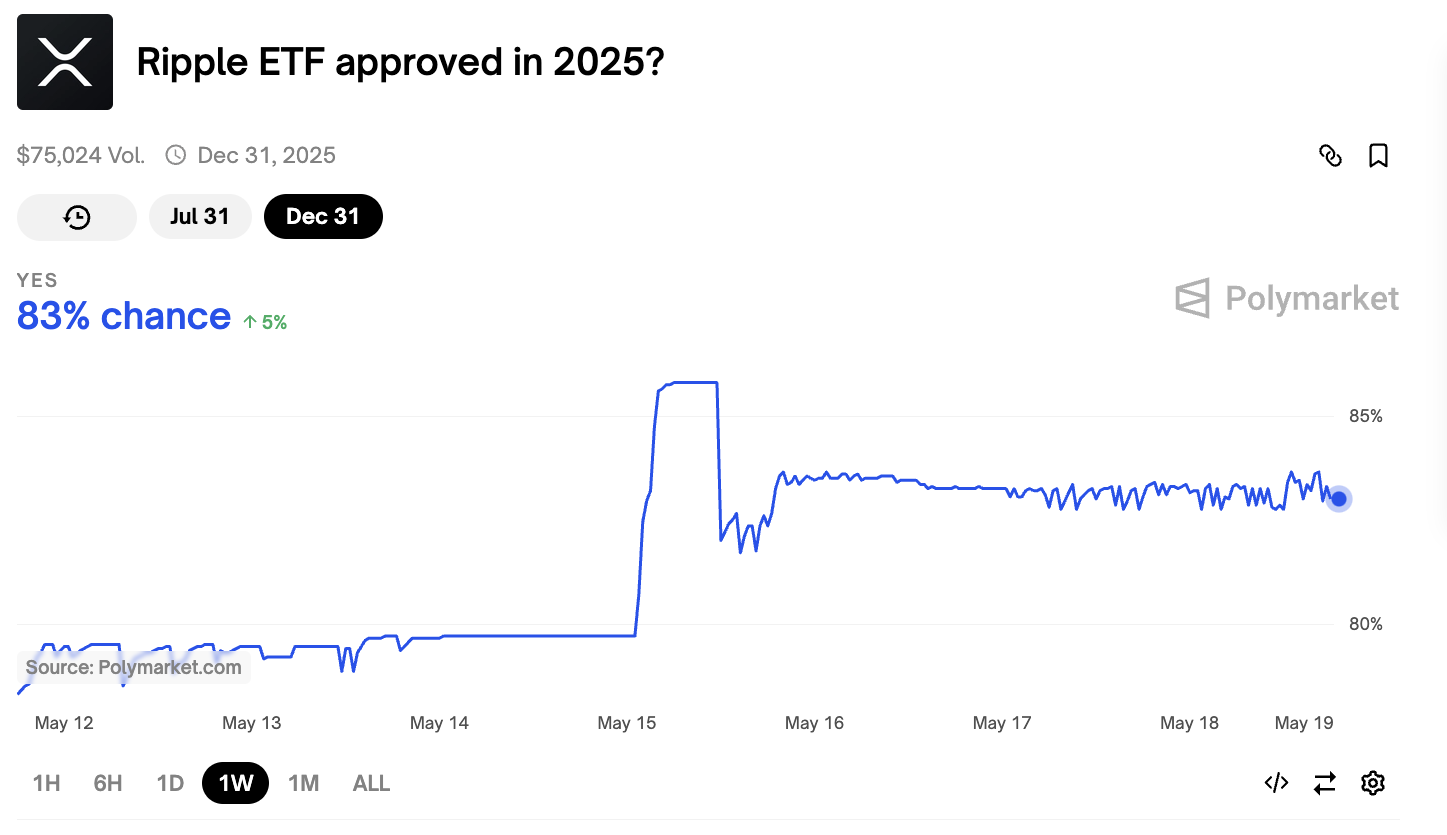

According to Nate Geraci, a popular ETF analyst, SEC approval is now “only a matter of time.” Odds of success remain over 80% on Polymarket, but today’s developments haven’t boosted them.

Despite this, a lot of things are still uncertain about XRP’s future. Since a judge denied a settlement in the SEC v Ripple lawsuit last week, there is a growing debate within the community.

Is XRP a security or a commodity? Although it’s generally treated like a commodity, one reclassification could seriously gunk up the ETF proceedings.

For now, XRP Futures are live on the CME, and this is a significant milestone. To be fair, the price of XRP hasn’t increased much yet, but this date was announced well in advance.

In any event, this development is focused on long-term growth, introducing new liquidity and institutional exposure, and laying more foundations for eventual ETF recognition.