Pi Network Crashes 44% in 96 Hours – Dead Cat Bounce or Final Nail in the Coffin?

Pi Network’s token just got mauled by the crypto bears—plummeting nearly half its value in four brutal days. The ’mobile mining’ project now faces its make-or-break moment as traders flee.

What’s bleeding PI dry? The usual suspects: zero utility, vaporware promises, and that classic crypto combo of hype chasing liquidity. Even the most diamond-handed Pi holders are sweating as exchanges treat the token like radioactive waste.

Meanwhile, Wall Street quants are having a field day—turns out ’free money from your phone’ has the same longevity as a meme stock. The project’s closed mainnet now looks less like a strategic play and more like a life raft.

Last chance to pivot? Pi’s core team either delivers real-world adoption fast... or watches their brainchild become another cautionary tale in the crypto graveyard. Place your bets—this is either the dip before the moon mission or the elevator to oblivion.

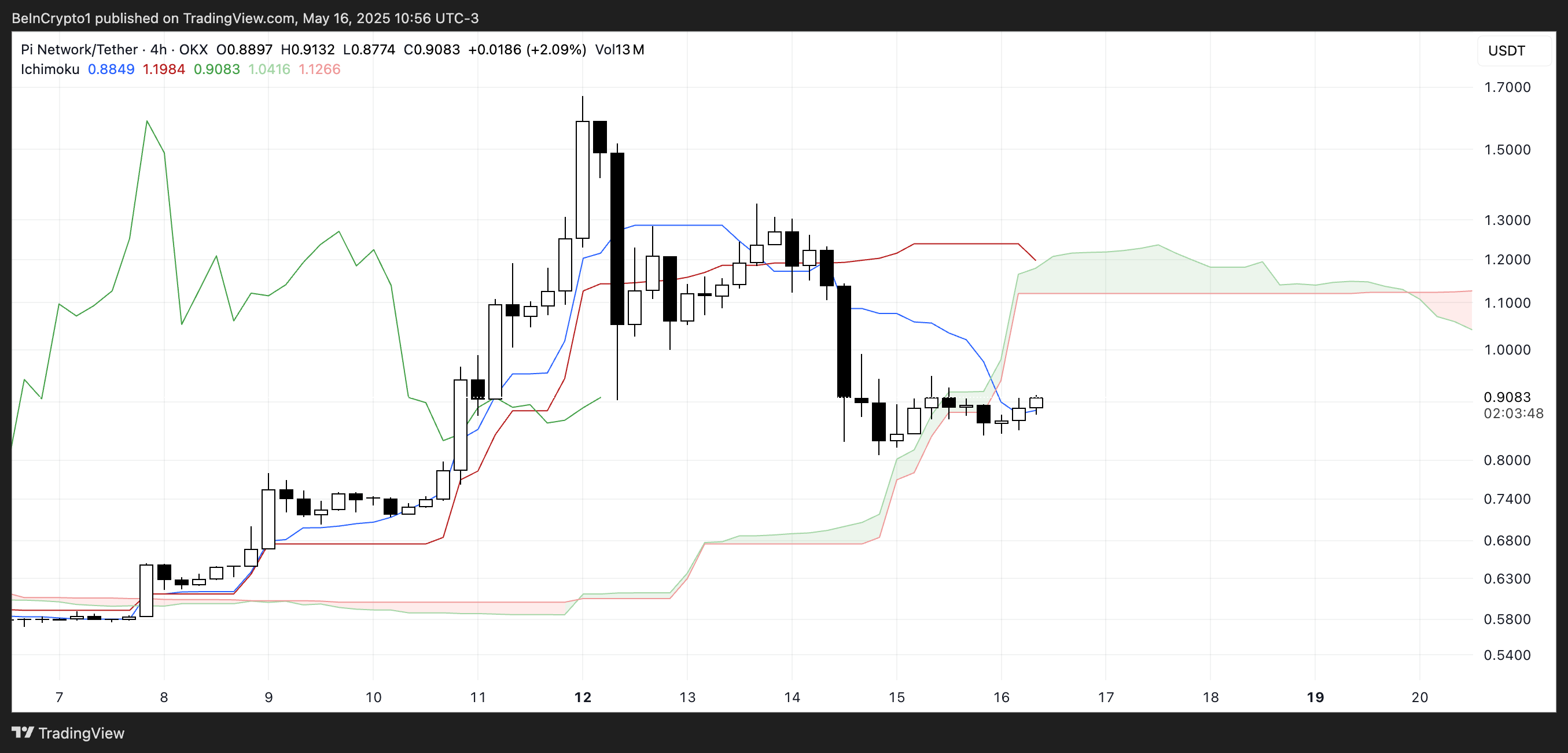

PI Struggles Below Cloud as Bearish Momentum Persists

The Ichimoku Cloud chart for PI Network (PI) shows signs of ongoing weakness following a sharp decline. Price action is below the Kijun-sen (red line) and close to the Tenkan-sen (blue line), indicating that short-term momentum remains bearish.

The recent candles also interact with the lower boundary of the Kumo Cloud (green/red shaded area), showing hesitation in regaining upward traction.

The Chikou Span (green lagging line) is now positioned below the price candles, further reinforcing a bearish outlook.

Despite the current consolidation NEAR the cloud’s edge, there’s no strong signal yet of a reversal. The leading span lines that form the Kumo ahead are flat and slightly downward-sloping, suggesting limited bullish support in the near term.

For sentiment to shift, PI must break decisively above both the Kijun-sen and the cloud, confirming a potential trend reversal.

Until then, the chart favors caution, with bears still holding the upper hand.

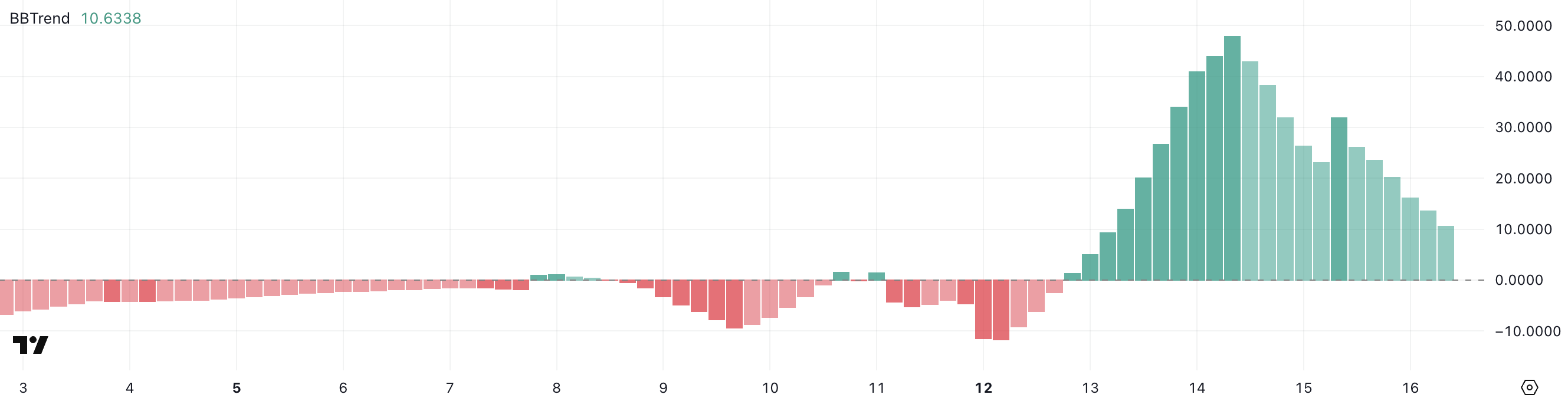

Pi Network Trend Strength Collapses as BBTrend Falls to 10.63

Pi Network’s BBTrend indicator has sharply declined to 10.63, after peaking near 48 just two days ago and dropping to 32 yesterday.

This steep fall reflects a significant weakening in trend strength over a short period, suggesting that the recent bullish momentum is fading quickly.

The rapid loss in trend intensity may indicate a transition toward consolidation or even a potential reversal if no new buying pressure emerges.

The BBTrend (Bollinger Band Trend) measures the strength of a price trend by comparing the width of Bollinger Bands to price volatility.

Higher values typically reflect strong trending behavior—either bullish or bearish—while lower values suggest sideways movement or weakening momentum.

At 10.63, Pi’s BBTrend suggests the asset may enter a neutral phase, where volatility contracts and price could range without clear direction unless a new breakout or breakdown develops.

Community Backlash Grows as Pi Network Drops Below $1 After Fund Launch

Following the announcement of its $100 million Pi Network Ventures fund, Pi Network is facing growing pressure from both its community and the market.

Despite launching the initiative to boost ecosystem growth and real-world adoption, critics argue that the project has failed to deliver on key promises—such as launching 100 decentralized apps (DApps), timely KYC processes, and referral rewards.

Many Pioneers see the fund as a distraction from unresolved issues, especially since applications are collected via a simple Google Form. Market sentiment reflected this frustration, with PI’s price dropping below $1 and falling 44% over the last four days.

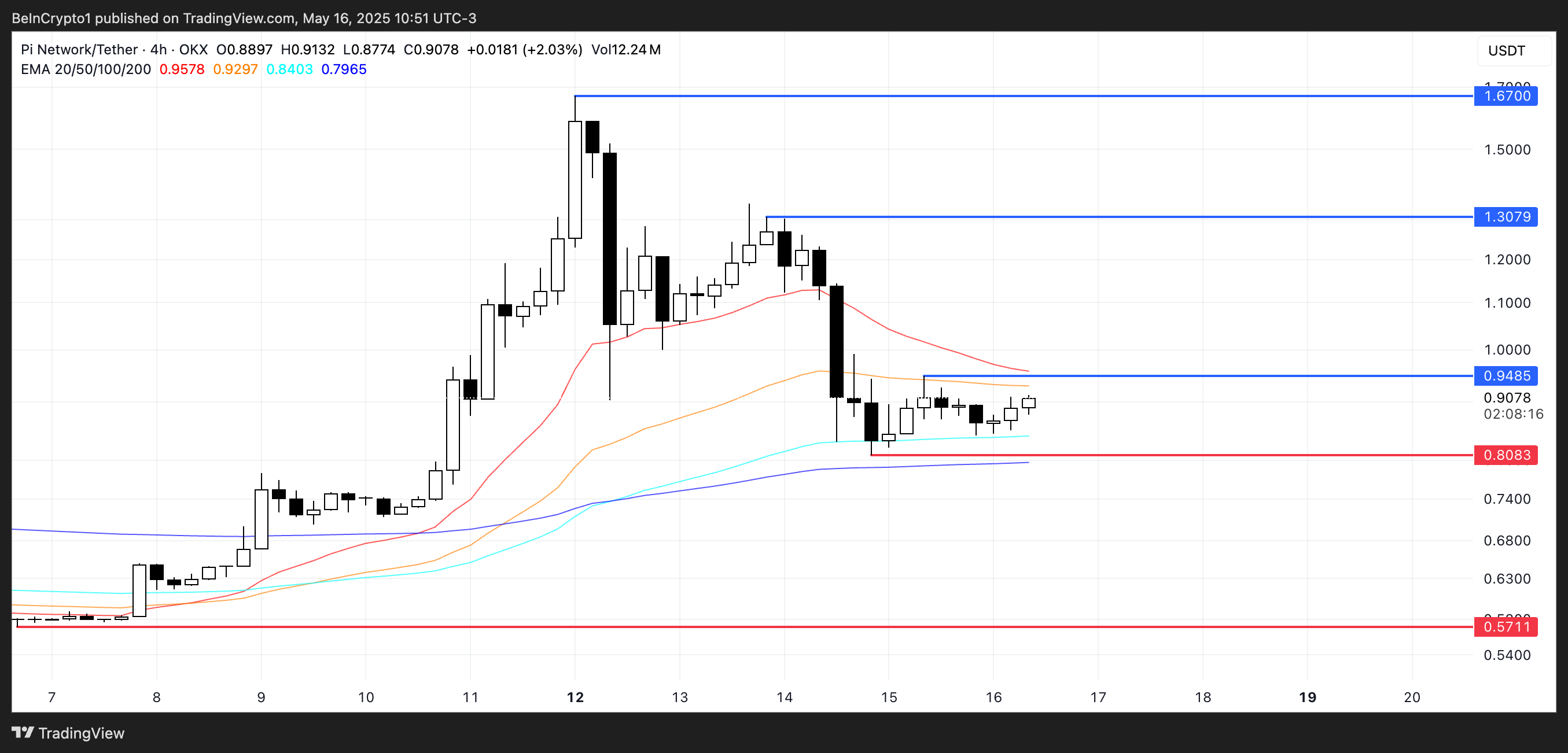

Technically, PI’s indicators support the bearish outlook. Momentum signals like the DMI and CMF show declining strength and increased distribution, while the EMA lines are tightening and hinting at possible death crosses.

Even though PI has been up 23% over the last seven days, the recent price action suggests a loss of confidence and potential for further downside.

If the token fails to hold the key $0.80 support level, it could decline toward $0.57—but if momentum returns, a breakout above $0.94 could open the path to $1.30 or even $1.67.