Blockchain Giant Bets Big on Ethereum: $57.8M Investment Signals Shift Away from Bitcoin

A major blockchain technology firm is making waves with a bold $57.8 million commitment to Ethereum—leaving Bitcoin maximalists scrambling to justify their ’digital gold’ narrative.

The smart money moves: This strategic allocation highlights Ethereum’s growing dominance in decentralized applications and institutional adoption, while Bitcoin struggles with its store-of-value thesis.

What they know that you don’t: The investment comes as Ethereum’s ecosystem continues to outpace competitors in developer activity, TVL, and real-world utility—proving once again that in crypto, evolution beats dogma.

Wall Street analysts—still trying to understand wallets while managing their AOL email accounts—predict this could trigger a ’flippening’ of institutional portfolios.

BTCS Makes Bold $57.8 Million Ethereum Bet

In the latest press release, BTCS revealed that it had issued the first batch (or tranche) of convertible notes worth $7.8 million. There is also scope for issuing more notes up to an additional $50 million.

Nonetheless, this requires mutual approval from BTCS and ATW Partners. The notes are convertible into common stock at a price of $5.85 per share, a 194% premium to BTCS’s stock price of $1.99 on May 13.

They have a two-year maturity, with a 5% discount on the original issue and a 6% annual interest rate. Investors also received warrants for the purchase of nearly 1.9 million shares of common stock at $2.75 per share.

BTCS CEO Charles Allen contributed $95,000 to the initial offering, with an additional $200,000 provided by a trust from which he benefits.

“Similar to how MicroStrategy Leveraged its balance sheet to accumulate Bitcoin, we are executing a disciplined strategy to increase our Ethereum exposure and drive recurring revenue through staking and our block building operations—while positioning BTCS for meaningful appreciation should ETH continue to rise in value,” Allen said.

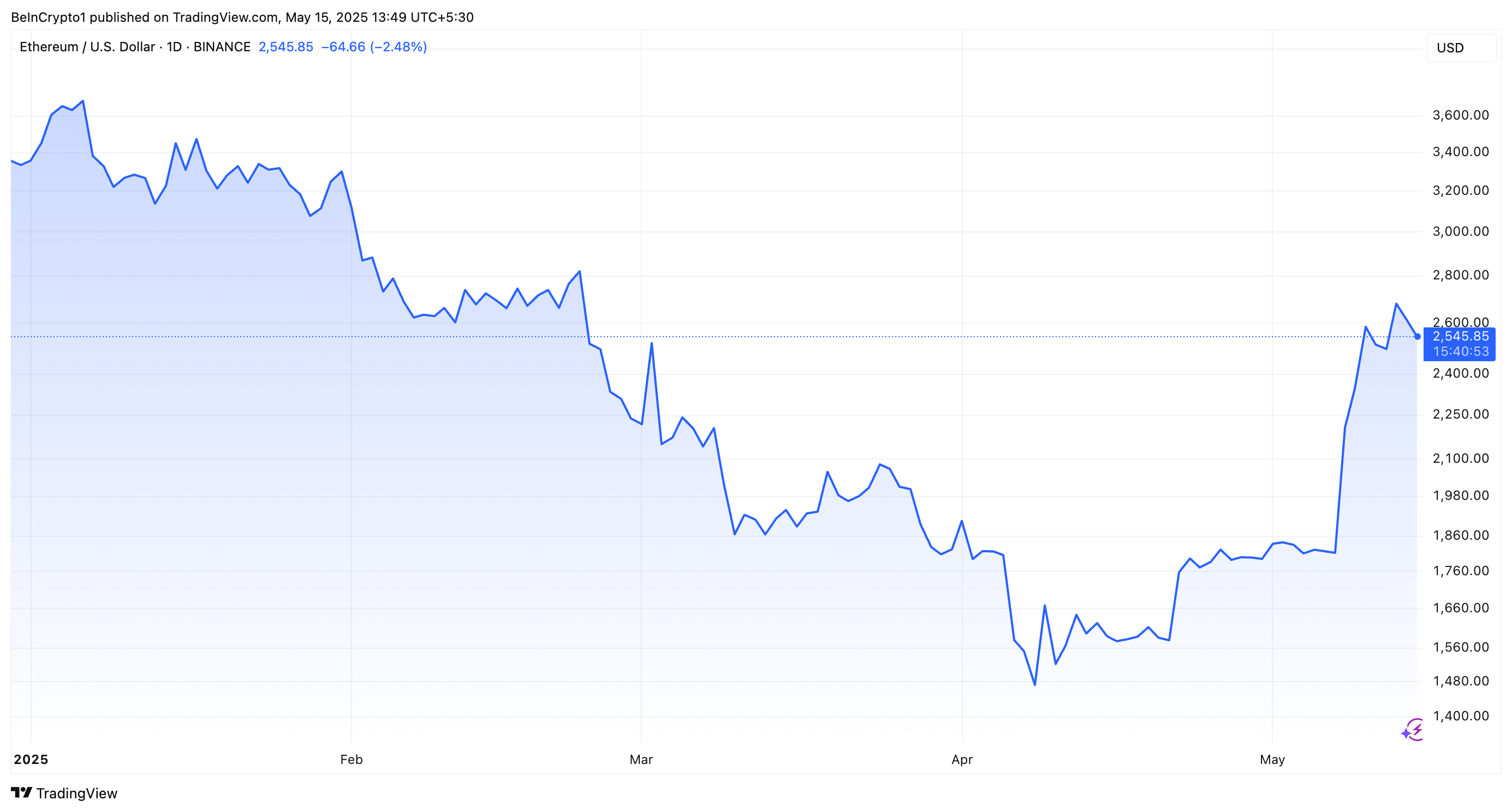

He believes this decision to acquire ETH comes at a crucial moment in the altcoin’s growth. BeInCrypto reported that the recent Pectra upgrade implementation boosted the ethereum network, catalyzing an increase in the number of active addresses and the burn rate.

Moreover, the price also jumped to two-month highs, but a modest correction followed. According to BeInCrypto data, over the past day, ETH has dipped by 3.8%. At the time of writing, it traded at $2,545.

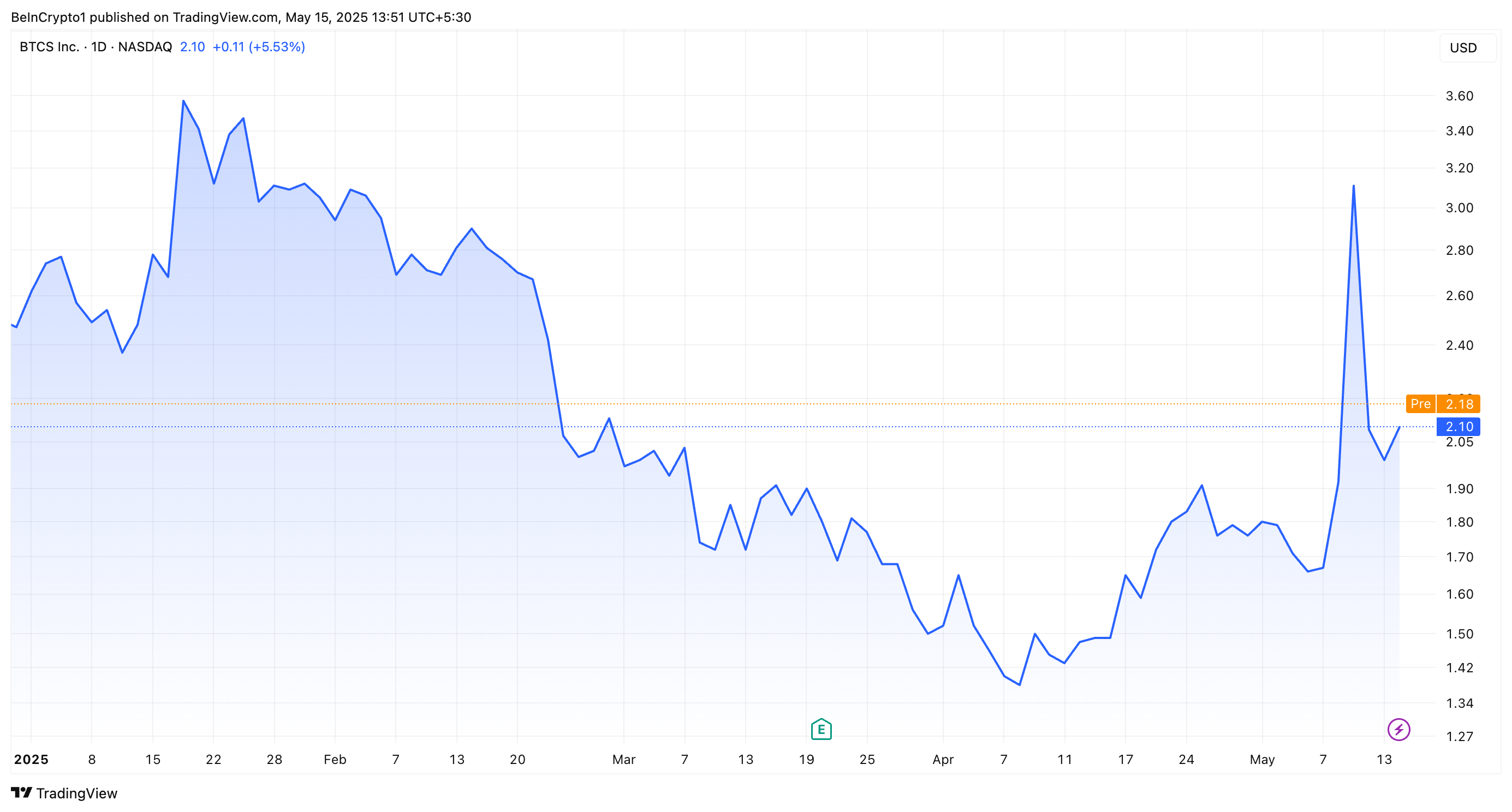

While Ethereum didn’t benefit from BTCS’ news, its own stock did. This reflected investor confidence in the company’s strategic pivot.

Google Finance data showed that the stock price jumped 5.5%. However, year-to-date, its value has declined by 14.9%.

Meanwhile,the announcement comes amid a broader trend of publicly traded companies diversifying their balance sheets with digital assets. However, BTCS’s approach positions it as a contrarian player in the space, diverging from the Bitcoin (BTC)-focused strategies adopted by firms like Strategy (formerly MicroStrategy), Metaplanet, and 21 Capital.

While these firms have benefited from BTC holdings, BTCS’s initiative, if successful, could influence other firms to explore alternative digital assets beyond Bitcoin. This could potentially reshape corporate treasury strategies.