Metaplanet’s Bitcoin Bet Pays Off: $5.3M of $6M Q1 Revenue Comes From Crypto

Who needs traditional revenue streams when you’ve got Bitcoin? Metaplanet just posted a $6 million Q1 haul—with a staggering 88% ($5.3M) coming from crypto holdings. Guess those ’risky digital assets’ are looking pretty stable now.

While legacy finance clings to bonds and dividends, Metaplanet’s pivot to Bitcoin mirrors MicroStrategy’s playbook—and it’s printing money. The company’s treasury strategy now looks less like corporate finance and more like a degen trade that actually worked.

Here’s the kicker: This isn’t some crypto-native startup. It’s a publicly traded company proving institutional adoption isn’t coming—it’s already here. Cue the Wall Street analysts scrambling to update their ’blockchain is a fad’ PowerPoint decks.

Bitcoin Strategy Powers Metaplanet’s 8% Q1 Revenue Growth

The bitcoin Income Generation strategy, launched in Q4 2024, is now Metaplanet’s primary revenue driver. The strategy has enabled it to achieve an operating profit of ¥593 million(~$4.0 million).

This represented an 11% increase from the last quarter, marking a new company record. Moreover, total assets grew 81% to ¥55 billion (~$376.6 million). Meanwhile, net assets surged by 197% to ¥50.4 billion (~$345.1 million).

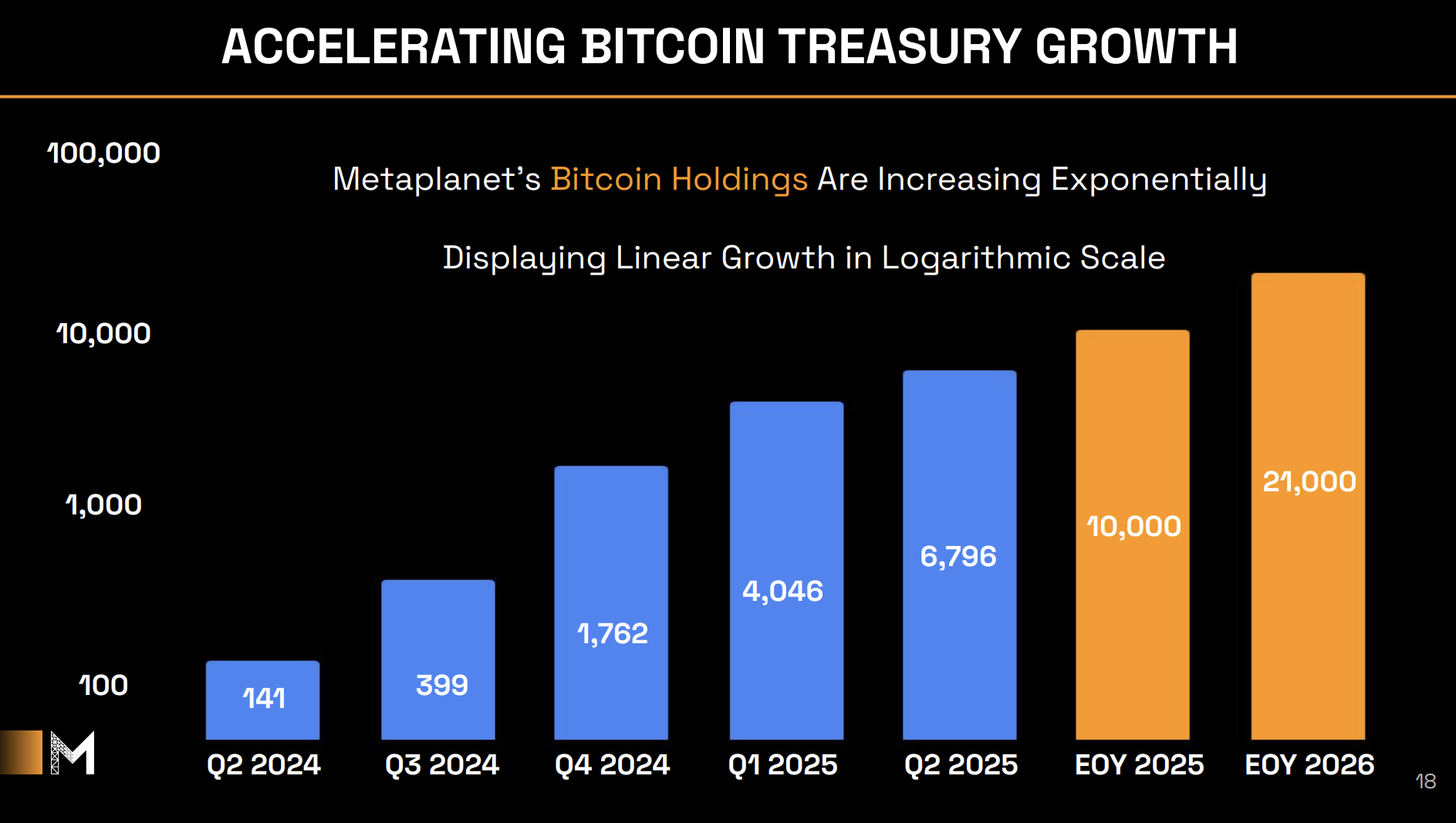

Metaplanet’s Bitcoin holdings, bolstered by the recent 1,241 BTC purchase, total 6,976 BTC, more than El Salvador’s national reserves. The firm has now achieved 68% of its 2025 goal to hold 10,000 BTC within just over four months.

“We booked a ¥7.4 billion valuation loss as BTC price at end-March was lower than year-end, but BTC has since rebounded — as of May 12, we hold ¥13.5 billion in unrealized gains,” CEO Simon Gerovich wrote on X.

The report also highlighted that the company recorded a BTC Yield of 95.6%, following a 309.8% yield in Q4 2024. For 2025, the firm is targeting a 232% yield. Additionally, the Q3 and Q4 2025 yield target is 35%.

Lastly, Metaplanet’s shareholder count also experienced a remarkable growth of 500% over one year. In Q1 2025, the company reached 64,000 shareholders, reflecting the significant expansion of its investor base.

“This was the strongest quarter in our company’s history,” Gerovich added.

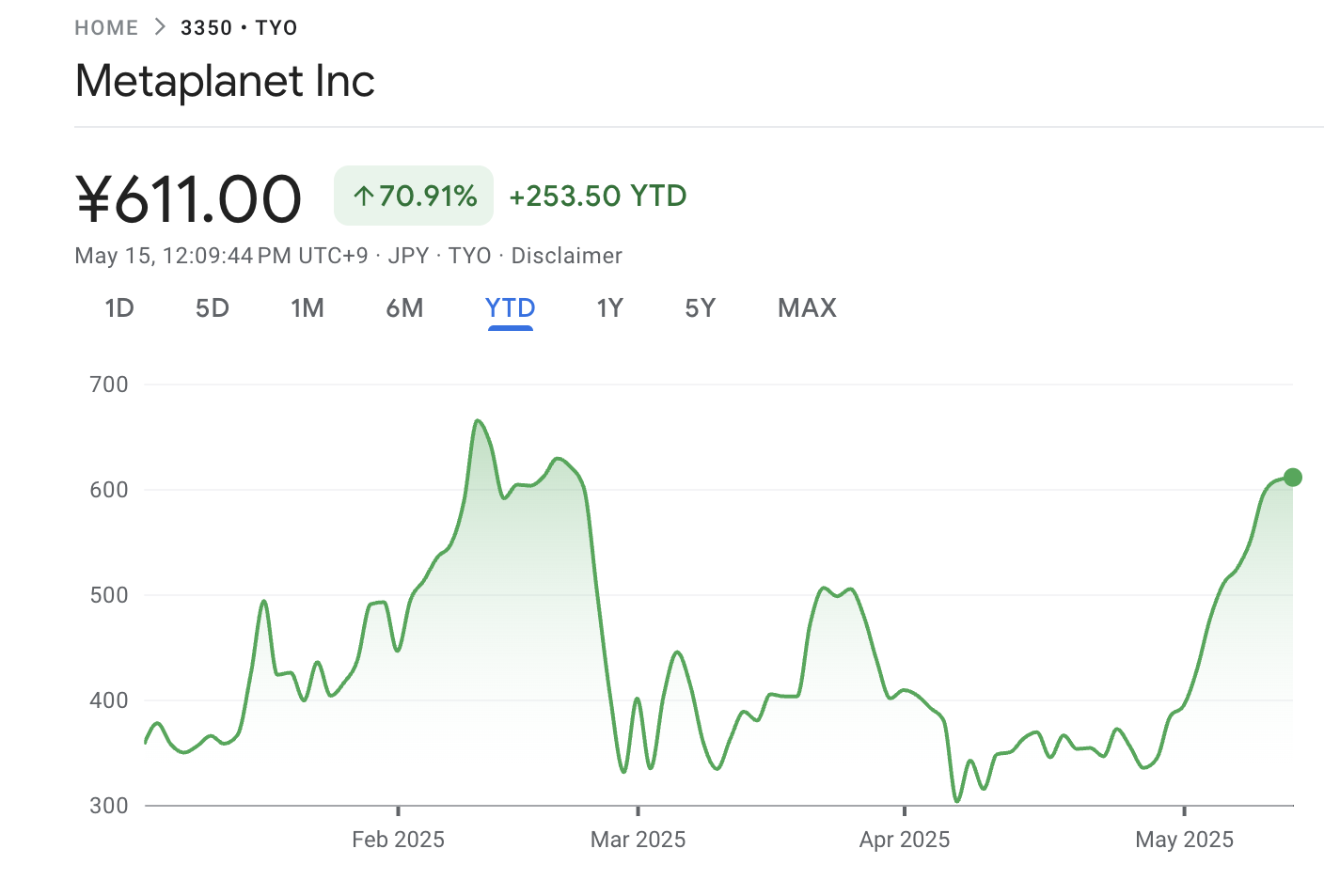

This growth has positioned Metaplanet as the 11th-largest public Bitcoin holder globally and Asia’s leading Bitcoin treasury company. The company’s stock price has also seen significant gains. According to Google Finance data, 3350.T has appreciated 70.91% YTD.

Moreover, BeInCrypto reported that the stock price has grown more than 15-fold since April 2024, when Metaplanet made its first BTC purchase.