SHIB Pumps 24%—But Traders Already Cashing Out Signals Impending Dip

Shiba Inu rockets past resistance as meme coin mania returns—until the profit-hungry wolves start circling.

The rally that barked too loud

SHIB’s 24% surge this week had degens cheering, but on-chain data shows whales dumping bags faster than a leveraged trader during a margin call. Classic ’buy the rumor, sell the news’ play—except the ’news’ is just another hype cycle in crypto’s endless rinse-repeat.

Tread carefully

Technical indicators scream overbought, and that 24% gain could evaporate quicker than a shitcoin liquidity pool. But hey—when has rationality ever stopped crypto gamblers? Just remember: the house always wins (and by ’house,’ we mean the guys with the algorithmic trading bots).

SHIB Faces Growing Bearish Pressure

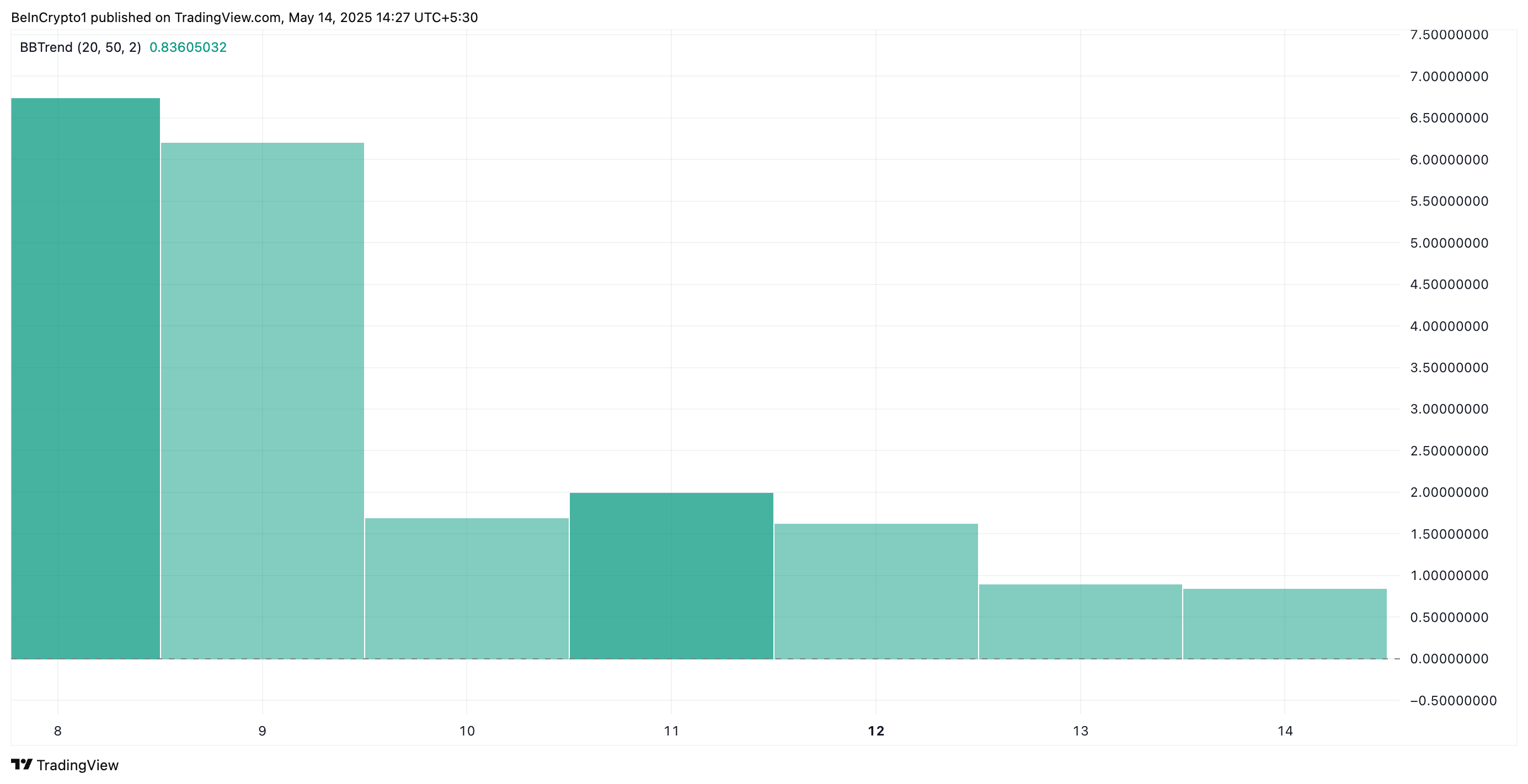

One of SHIB’s primary indicators used to gauge market momentum, the Bollinger Band Trend (BBTrend), has begun to show a decline.

The indicator’s histogram bars have gradually shrunk in size over the past few days, signaling a steady decline in buying pressure in the meme coin’s market.

The BBTrend indicates when an asset is experiencing excessive upward or downward movement. When the size of its green bars reduces, buying momentum is weakening.

This could reduce SHIB’s upward price movement. If the trend continues, the meme coin is at risk of a potential pullback or consolidation in the NEAR term.

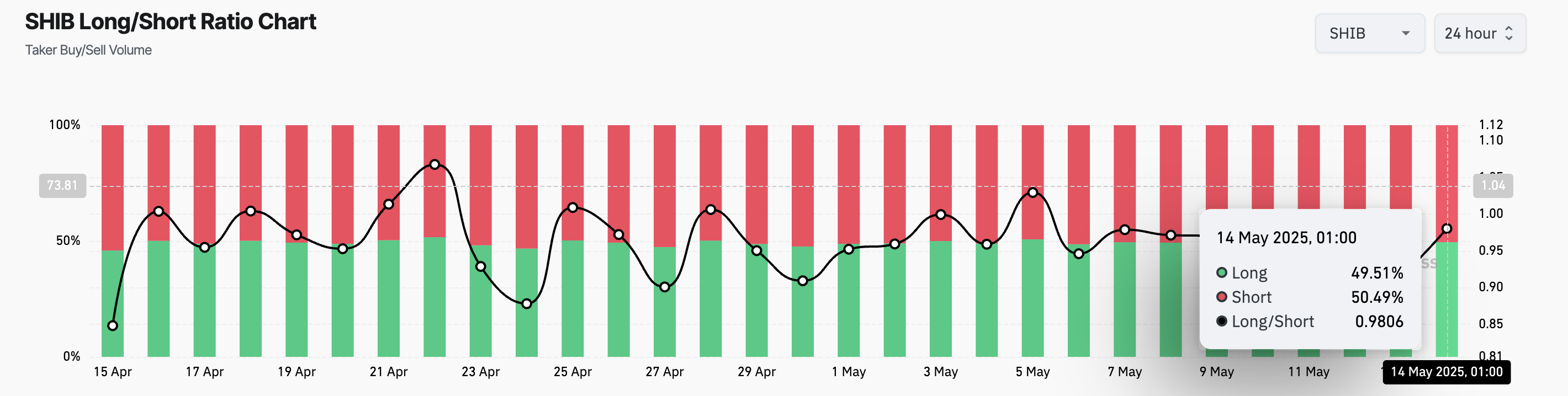

Moreover, there has been a noticeable uptick in demand for short positions on SHIB since May 6. According to Coinglass, the coin’s Long/Short Ratio has returned values below one since then, indicating a growing preference for short bets. As of this writing, the ratio stands at 0.98.

When traders increase short interest like this, it indicates a lack of confidence in the coin’s ability to maintain its upward trajectory. The rise in short positions suggests that investors are preparing for a potential decline, confirming the likelihood of a price dip in the near future.

SHIB Eyes Potential Pullback

The coin’s falling Chaikin Money FLOW (CMF) highlights the dropping buying pressure among SHIB traders. This momentum indicator is trending downward and attempting to break below the zero line.

A breach of the zero line WOULD confirm the negative shift in the market trend. This could cause SHIB to erase some of its recent gains and fall toward $0.000010.

On the other hand, if SHIB’s price maintains its uptrend, it could trade at a multi-month high of $0.000019.