Bitcoin ETFs Bleed $96M—And Nobody Cares

All 12 spot Bitcoin ETFs just got slapped with net outflows—$96 million vanished into the crypto ether. Yet the market barely blinked. What gives?

Wall Street’s shiny new Bitcoin toys are having a moment. Or rather, the absence of one. After months of hype, today’s outflows feel like finding an empty Lambo in a hedge fund parking lot—all show, no go.

Meanwhile, Bitcoin’s price chart looks like it’s stuck in a Groundhog Day loop. Guess even institutional money can’t cure crypto’s mood swings.

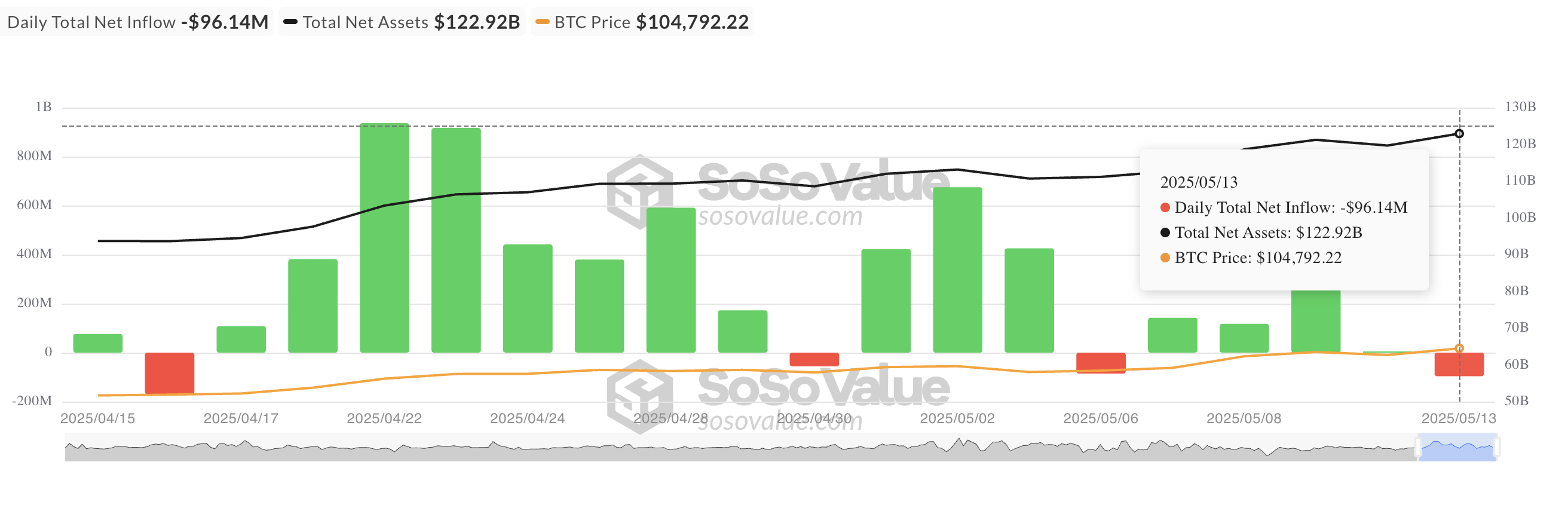

Bitcoin ETFs Record $96 Million in Daily Outflows

On Tuesday, Bitcoin-backed ETFs saw a net outflow of $96.14 million, marking their largest single-day net outflow since April 16. The capital outflow came amid a slight pullback in the general crypto market, which saw BTC’s price fall to an intraday low of $101,429.

This decline likely unsettled institutional investors, many of whom had been waiting to see if the coin could build momentum above the $105,000 mark, especially amid recent signs of progress in US-China trade relations.

Yesterday, Fidelity’s FBTC led the exit, recording the highest outflows among all ETF issuers. The fund’s capital outflow totaled $91.39 million. As of this writing, its total historical net inflow is $11.61 billion.

With all twelve BTC ETFs recording no inflows yesterday, it was clear that sentiment had turned risk-off, at least temporarily.

BTC Derivatives Signal Optimism

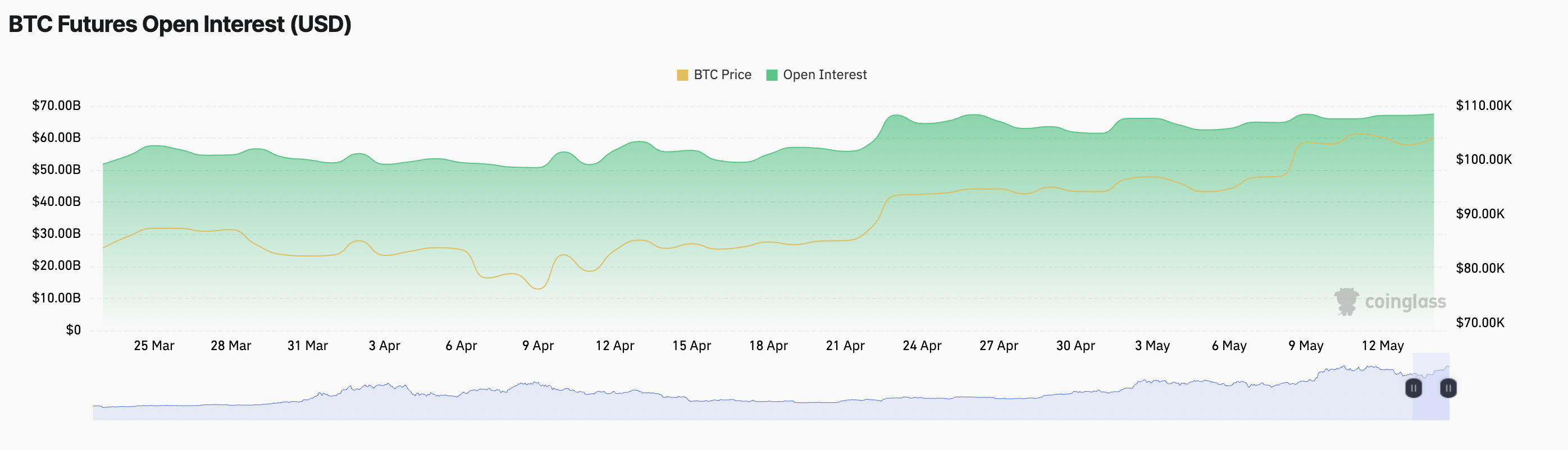

In the past 24 hours, BTC has staged a modest recovery, climbing 1%. This rally is fueled by the steady rise in trading activity over the past day. In its futures market, this is reflected by the coin’s open interest, which currently stands at $67.47 billion, noting a 1% rise.

While BTC’s price and open interest rallies are modest, the trend suggests a gradual return of confidence among traders. The uptick in open interest indicates that market participants are re-entering the market with fresh positions, potentially anticipating more upside.

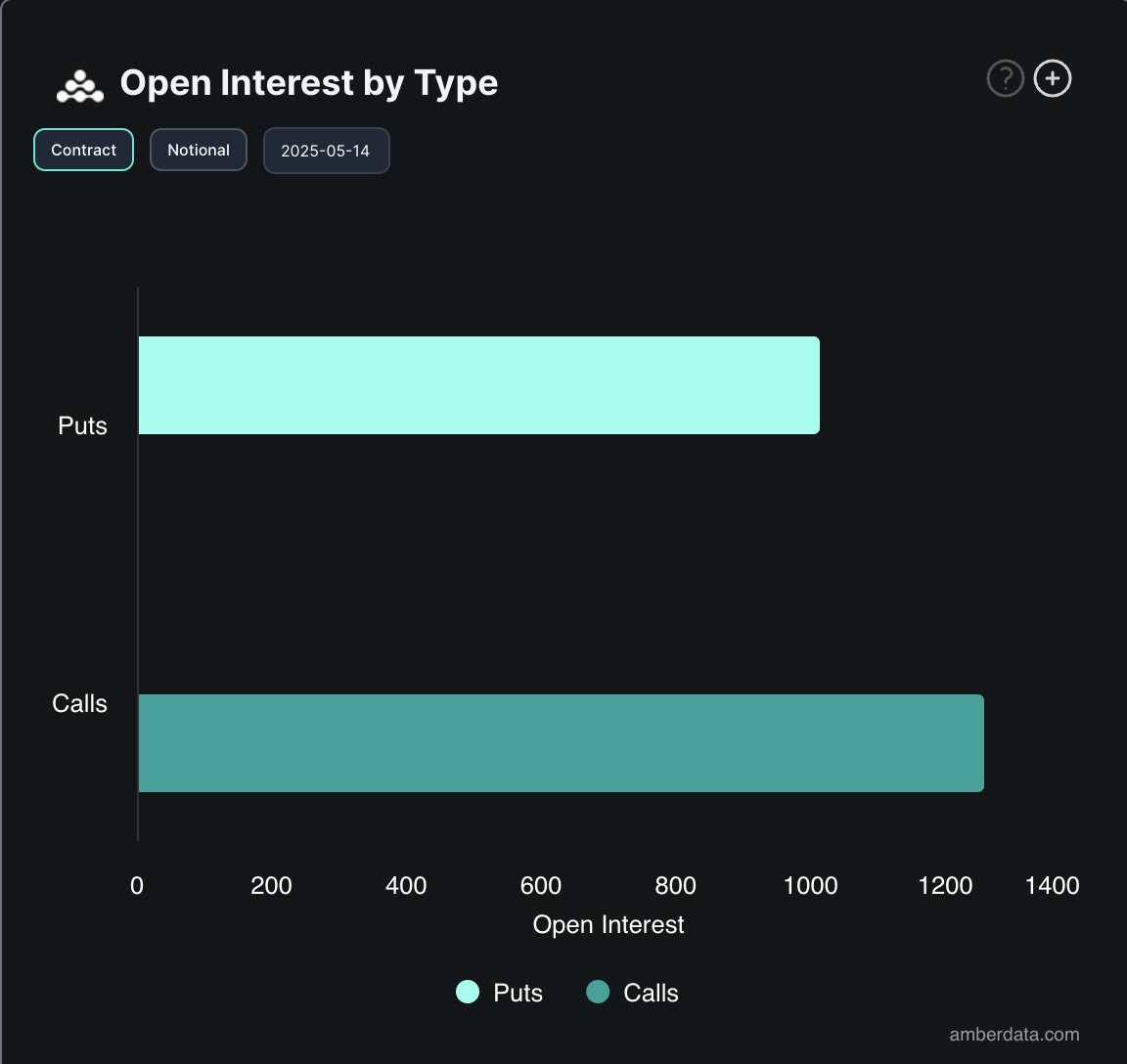

Further, the BTC options market confirms this bullish outlook. Today’s higher demand for calls over puts indicates that traders are positioning themselves for potential upside in the coin’s price.

The resilience shown in the BTC derivatives market signals that the market remains ready to capitalize on any positive momentum.