Retail Investors Flock Back to Crypto as Bitcoin and Ethereum Defy Gravity—Just in Time for the Next Liquidity Crunch

Bitcoin punches past $70K while Ethereum clears $4K—and suddenly, everyone’s a ’long-term holder’ again. Experts are split: Is this organic demand or just leverage junkies reloading before the next margin call?

The retail cavalry arrives... right on cue. Every bull run needs bagholders, and your Robinhood notifications just turned into a bat-signal. Bonus irony? Wall Street’s now hawking ’decentralized’ ETFs while quietly shorting the miners.

Mixed Signals About Retail Investor Presence

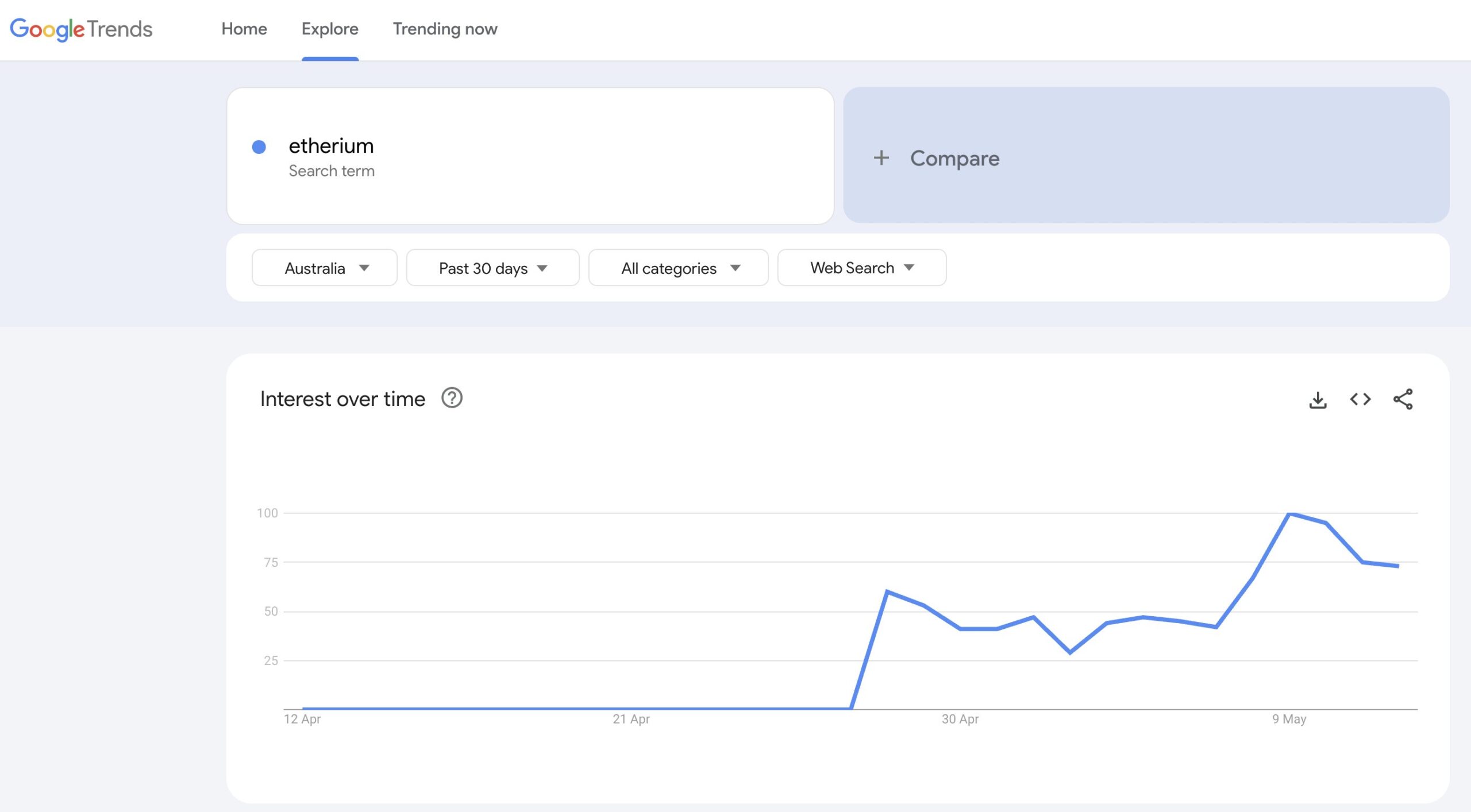

S4mmyEth from Decentralized AI Research pointed out a notable indicator: a sharp rise in Google search interest for “Etherium” (a common misspelling of Ethereum) in Australia over the past 30 days.

“Retail is coming. There’s been a spike in Google search trends for ‘Etherium’ rather than Ethereum,” S4mmy predicted.

Google Trends data shows a significant increase at the end of April and the beginning of May, with peak interest. S4mmy also noted similar spikes for other misspelled keywords like “Etherum,” “Eferium,” and “Ifirium.” These trends suggest a wave of interest from users unfamiliar with the correct terminology—a common sign of retail investor activity.

However, not everyone agrees with S4mmy’s perspective. Nic, co-founder of Coin Bureau, offered a different view.

According to Nic, the recent surge in altcoin prices, including Ethereum, may stem from institutional investors or whales—those holding large amounts of crypto. In addition, capital-allocated investors are showing a shift in sentiment, with growing expectations for an upcoming altcoin season.

“Retail isn’t here. This isn’t a retail-driven altcoin pump. It’s crypto natives chasing price & coming back for another run at altseason,” Nic stated.

Recent reports from BeInCrypto also highlight this changing investor sentiment, which has been influenced by improving macroeconomic factors such as easing tariff tensions.

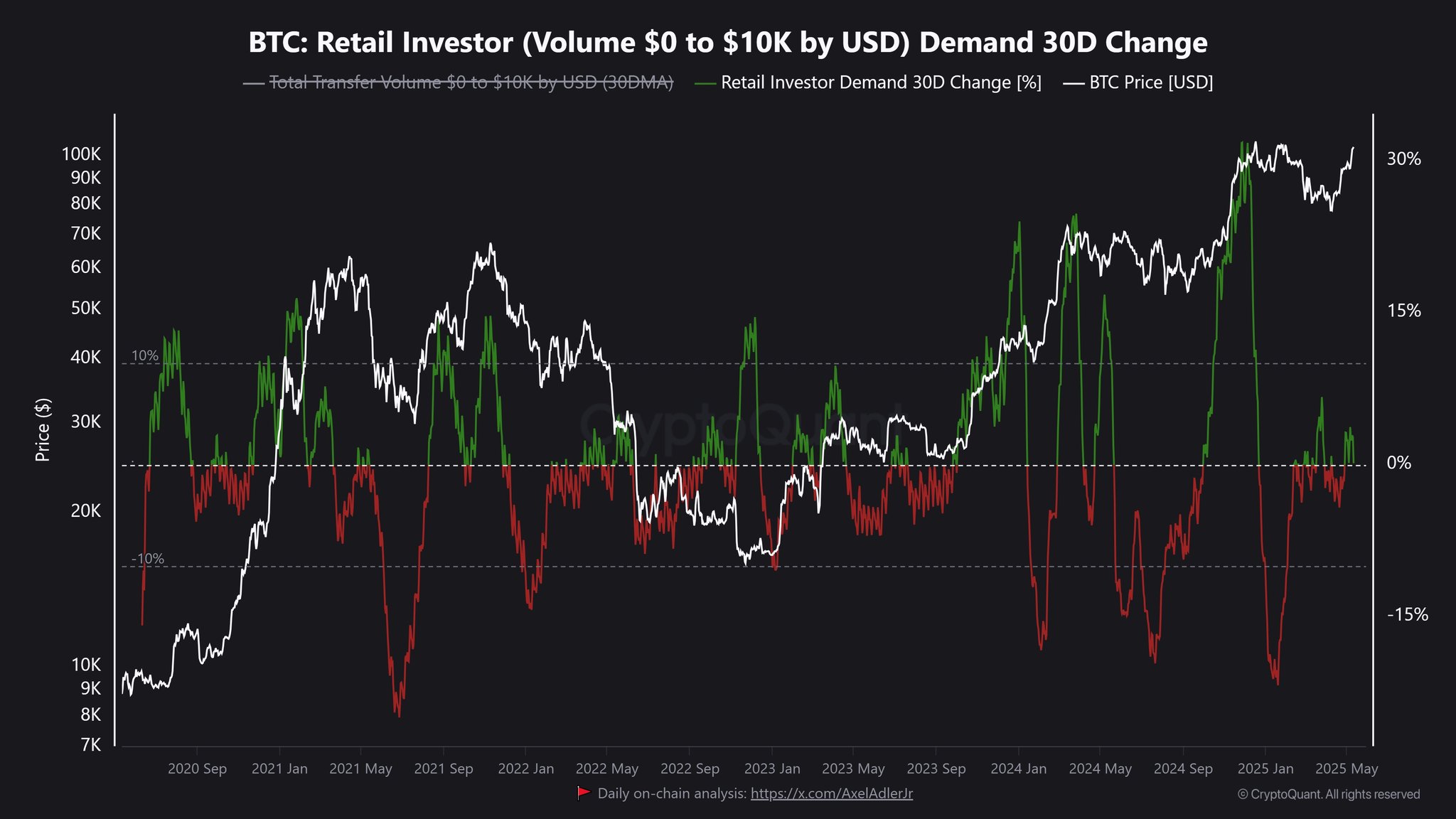

It’s not just Ethereum. Bitcoin also lacks small-volume transactions, typically linked to retail investors. Data from CryptoQuant reveals that transactions between $0 and $10,000 haven’t increased, even as Bitcoin crossed the $100,000 mark.

Nic’s argument gains further support from data provided by Wu Blockchain. Their latest report shows no signs of recovery in exchange trading volume or traffic over the past month.

Specifically, spot trading volume across exchanges fell by an average of 12.3%, with Binance’s spot volume dropping 16.8%. Additionally, exchange traffic declined by 8% on average, with Binance down 16% and Coinbase down 14%.

These figures suggest that despite recent price rallies, the absence of retail investors may make the uptrend unsustainable.

Alternatively, retail interest may be limited to online searches and has not yet translated into actual trading activity.