Ethereum Stakers Back in Black as ETH Rallies 40% – Wall Street Still Scratching Heads

ETH stakers breathe easy as the asset claws back losses with a blistering weekly rally. The crypto’s surge leaves traditional finance ’experts’ scrambling to justify their bearish takes—again.

Proof-of-stake pays off: Validators who held through the dip are now seeing green, while ETH flirts with key resistance levels. The move comes amid renewed institutional interest and DeFi TVL growth.

Funny how these ’speculative bubbles’ keep funding real-world infrastructure, isn’t it? Meanwhile, your bank’s savings account still yields less than inflation.

Ethereum Staked Coins Back in the Green After Market Rally

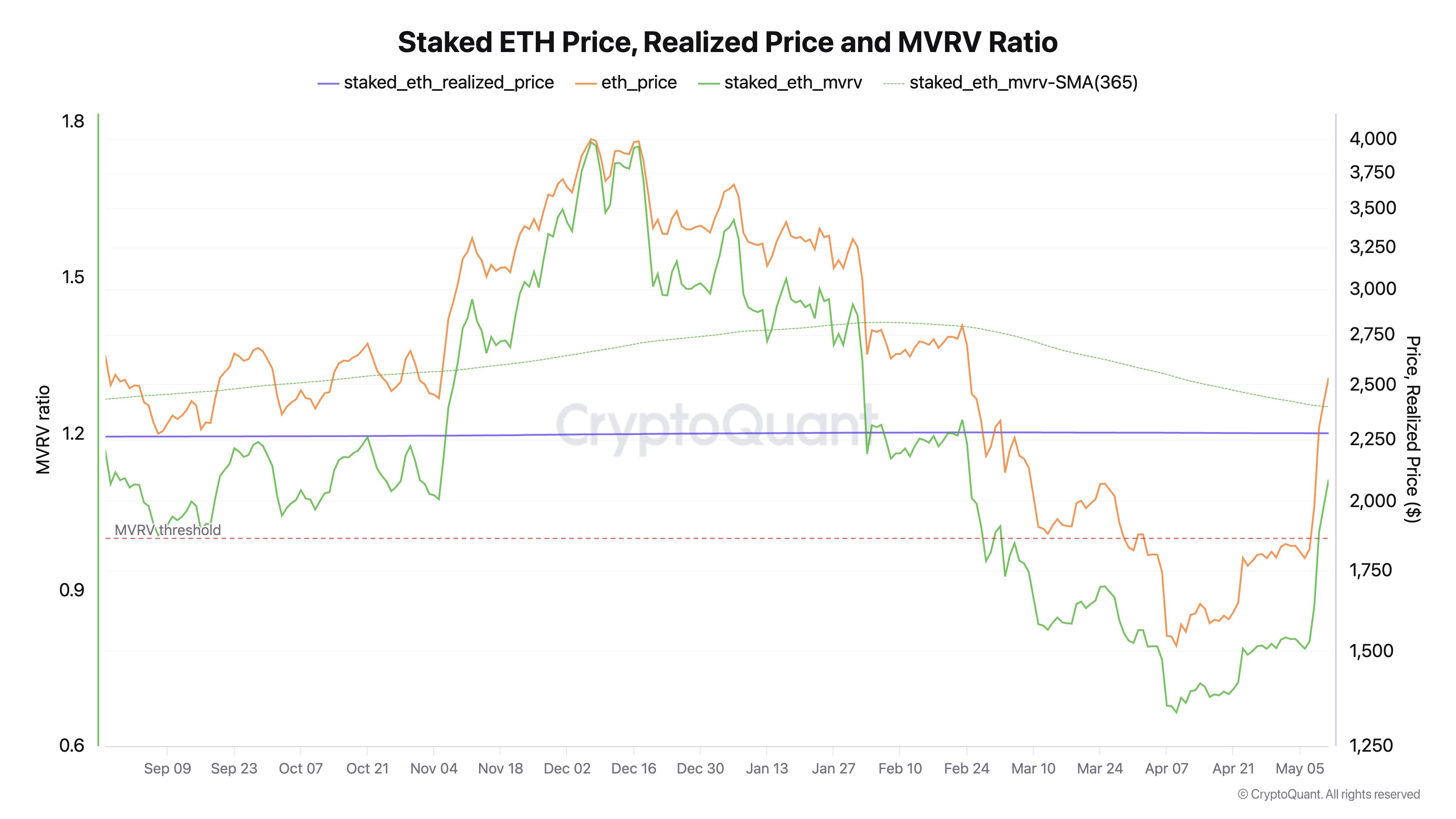

According to CryptoQuant’s data, staked ETH coins, which are not part of the circulating supply and are often held by validators and long-term investors, have been in unrealized losses since March 3, 2025. At that time, the realized price of staked ETH stood at $2,279, while market prices had dipped below this level.

However, the past week’s broader market rally pushed ETH’s value above $2,279 on May 9. This lifted staked coins above their realized cost basis, signaling a return to profitability.

When stakers MOVE from losses to gains like this, it triggers renewed confidence in the protocol and encourages further network participation. This can also translate to reduced sell pressure as more holders are incentivized to maintain their staked positions.

Adding to the bullish sentiment is ETH’s positive funding rate in the derivatives market. At press time, this is at 0.001%.

This suggests that ETH futures traders are increasingly willing to pay a premium to hold long positions. The uptick in demand for Leveraged exposure confirms the upward momentum and reflects strong market conviction.

Trading Volume Spikes Fuel ETH Rally

On the price chart, ETH’s climbing on-balance volume (OBV) highlights the rising demand for the coin. The key momentum indicator stands at 26.05 million amid strengthening trading activity.

When an asset’s OBV spikes, it signals that buying pressure is building, which can lead to continued price increases. If this trend persists, ETH’s price could climb to $2,745.

On the other hand, if sellers regain market control, they could drive ETH’s price down toward $2,424. Should the bulls fail to defend this support floor, the price decline could reach $2,243.