PI Token Smashes Through $1 Barrier—First Time Since March as Bulls Take Control

PI Token’s rally defies the broader crypto slump, punching past $1 with a 24-hour surge that’s got traders whispering ’bull trap’ through gritted teeth.

Momentum builds as retail FOMO meets suspiciously timed exchange listings—because nothing fuels a pump like fresh liquidity and hopium.

Watch the order books: if this holds, the ’undervalued project’ narrative might just survive another earnings season.

Pi Network Bulls Take Control

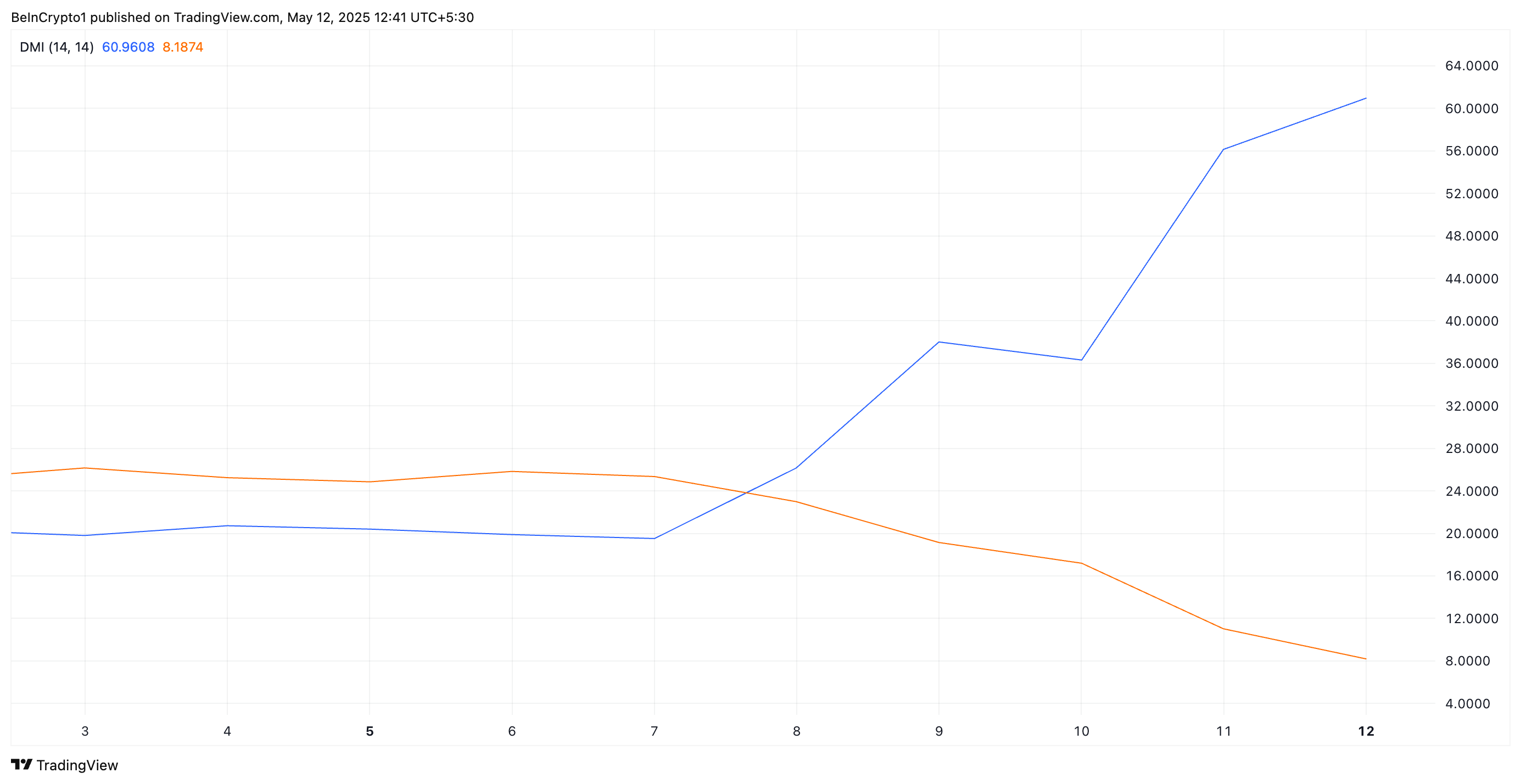

An assessment of PI’s Directional Movement Index (DMI) shows its positive directional index (+DI; blue) resting above its negative directional index (—DI; orange). At press time, it stands at an all-time high of 60.96.

This indicates a clear dominance of bullish momentum, with the +DI surpassing the -DI by a significant margin. When an asset’s +DI rests above its -DI in this manner, it suggests that market participants are overwhelmingly favoring buying pressure over selling pressure.

This offers confirmation that PI’s current price surge is backed by significant demand for the altcoin.

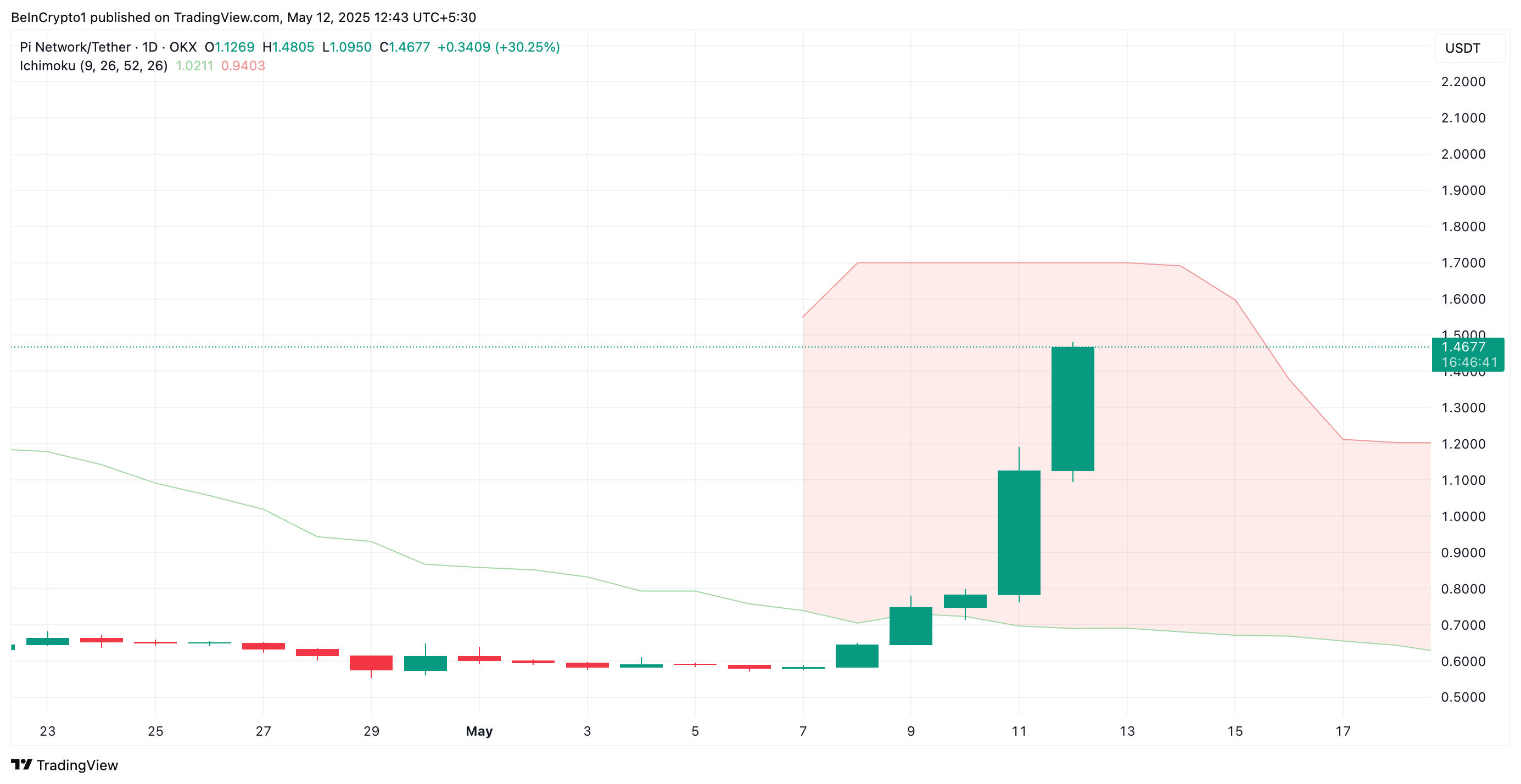

Further, PI’s double-digit gains today have pushed its price above the Leading Span A of its Ichimoku Cloud and toward the Leading Span B of the same indicator.

This indicator tracks the momentum of an asset’s market trends and identifies potential support/resistance levels. A break above the Leading Span A suggests that PI has overcome significant resistance.

If it breaks above the Leading Span B and sustains its position, it could see more uptrend, attracting increased market interest.

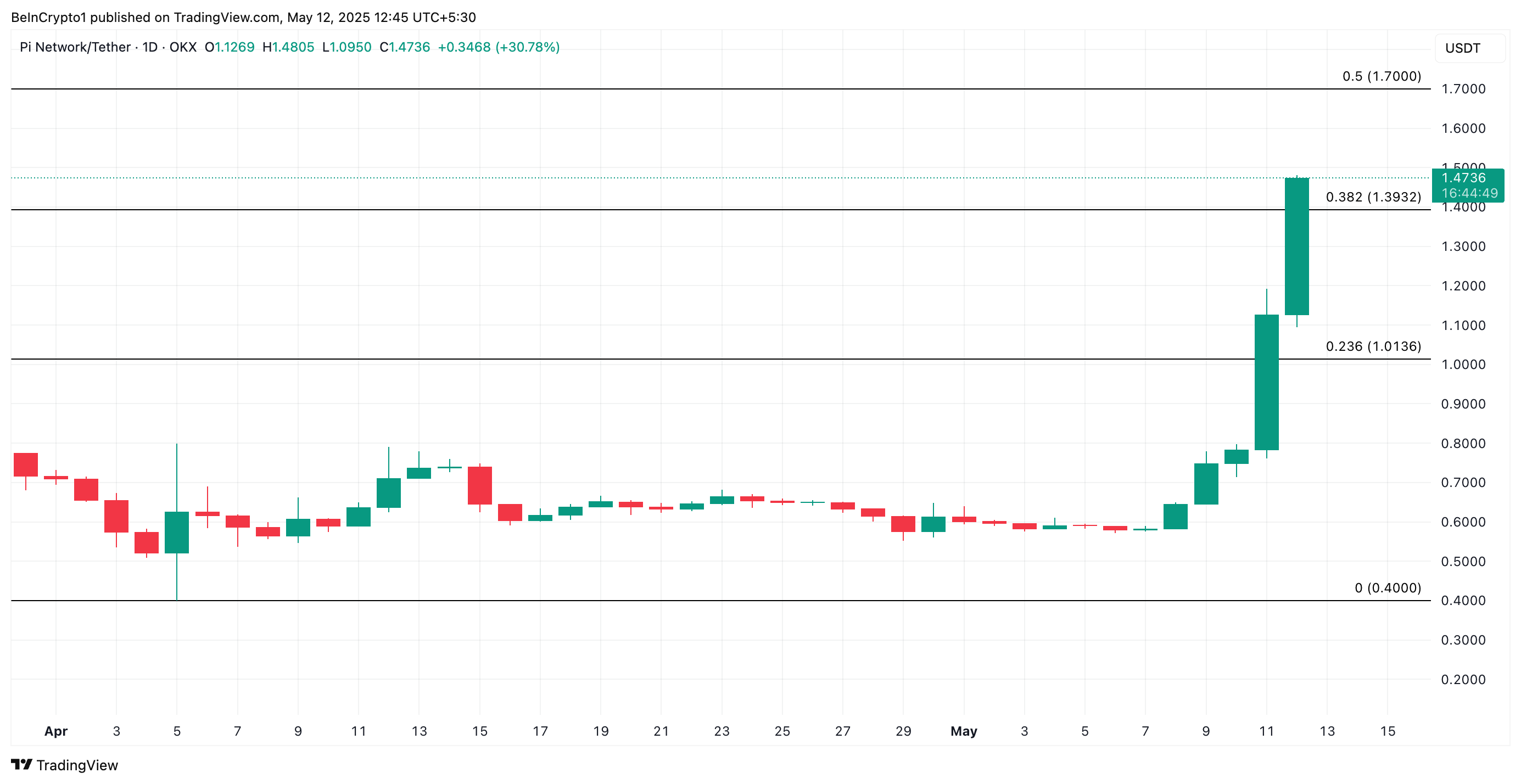

PI Sets New Support at $1.39: Can the Bulls Push it to $1.70?

PI trades at $1.47 at press time, resting above the newly formed support floor at $1.39. If buying pressure grows, this level could strengthen and propel PI’s price to $1.70.

However, this bullish outlook is invalidated if profit-taking resumes. In that case, PI’s value could break below the $1.39 support and fall to $1.01.

If the bulls fail to defend this level, the PI token may extend its decline below $1 to return to its all-time low of $0.40.