US Bitcoin ETF Inflows Smash Records—Even as Prices Stumble

Wall Street’s crypto love affair defies logic—again. US Bitcoin ETFs just posted their biggest inflow week ever, sucking up $2.7B while BTC bled 8%. Institutional FOMO trumps fundamentals.

Behind the numbers: BlackRock’s IBIT alone grabbed $1.5B, proving TradFi will chase yield even into volatile assets. Meanwhile, retail traders panic-sold the dip—classic.

The punchline? These ETFs launched months after Bitcoin’s last ATH. Nothing like paying premium prices for yesterday’s momentum. Stay sharp out there.

Bitcoin ETFs Break Inflow Records Again

Since the bitcoin ETFs first launched in 2024, they’ve totally transformed the crypto industry. Analysts called BlackRock’s IBIT “the greatest launch in ETF history,” reflecting their outsized market appeal.

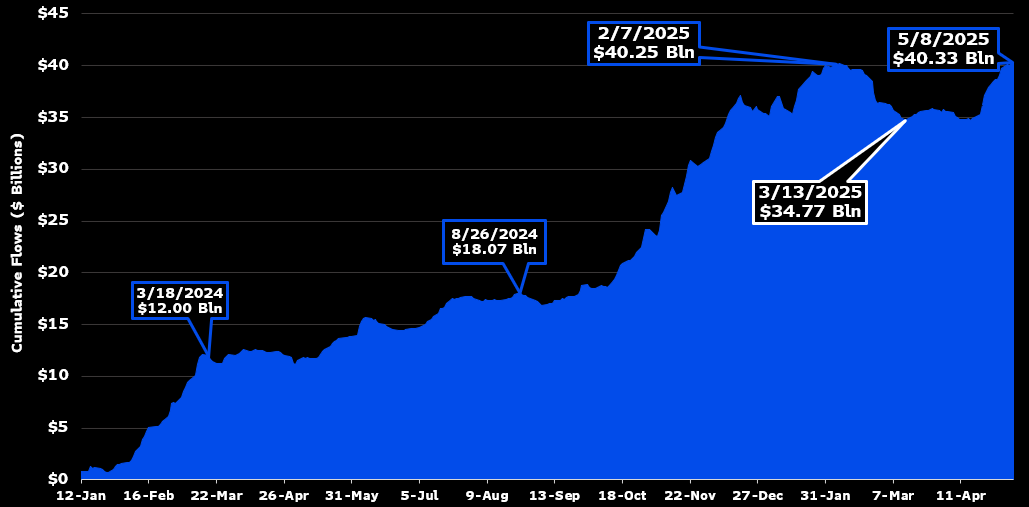

Today, the data reflects another encouraging victory for Bitcoin ETFs, as their inflows surpassed an all-time record set in February:

Shortly after Bitcoin Spot ETFs surpassed $40 billion in inflows, the market saw a massive reversal. Over $5 billion in outflows devoured all the gains in 2025, causing issuers to partially offload their BTC reserves.

These firms collectively had a ravenous demand for Bitcoin, so their collective market dumping raised concerns of broader trouble.

These losses were clearly caused by fears of a recession and the threat of Trump’s tariffs. However, a recovery began in late April.

Even as Bitcoin ETFs started their rebound, inflows fell to a 2025 low. This dynamic is part of why ETF analyst Eric Balchunas finds this metric so useful in market analysis: it’s very difficult to fake.

“Lifetime net flows is the most important metric to watch in my opinion: very hard to grow, pure truth, no BS. [It’s] impressive [that] they were able to make it to new high water mark so soon after the world was supposed to end. Byproduct of barely anyone leaving, left only a tiny hole to dig out of,” Balchunas claimed over social media.

In other words, the crypto community’s “diamond hands” mentality may have defined this sharp turnaround. At the height of the tariff panic, markets were in Extreme Fear, the lowest level of investor confidence since the FTX collapse.

In this light, these products performed extremely well. Two months later, the Bitcoin ETFs are enjoying consistent inflows yet again.

Of course, this inflow record doesn’t guarantee that everything will remain sunny for BTC ETFs. Bitcoin recently reclaimed $100,000, sparking a surge in inflows for this market, but a few bearish signs linger in options trading.

For now, however, this accomplishment is very noteworthy. The ETFs’ successes have been explosive, and Bitcoin has seen increasing TradFi liquidity in recent weeks.