XRP Surges 8% as SEC vs. Ripple Lawsuit Reaches Dramatic Conclusion

After years of legal wrangling, Ripple’s native token XRP rockets upward as regulators finally drop the hammer—or in this case, the gavel.

The End of an Era (Or Just the Beginning?)

No more courtroom drama—the SEC’s case against Ripple wraps with a verdict that sends shockwaves through crypto markets. Traders celebrate; lawyers cash checks.

Price Action Speaks Louder Than Legal Arguments

XRP’s sudden pump proves what crypto nerds knew all along: nothing moves markets like regulatory uncertainty... followed by clarity. Even Wall Street’s compliance drones can’t ignore those green candles.

A Win for Ripple, a Sigh for the SEC

The lawsuit’s resolution sets precedent—but let’s be real, the real winners are the speculators who bought the dip while ’experts’ waffled about ’unregistered securities.’

Another day, another crypto victory lap. Just don’t ask what happens when the next regulatory hammer falls—this industry’s amnesia works faster than blockchain finality.

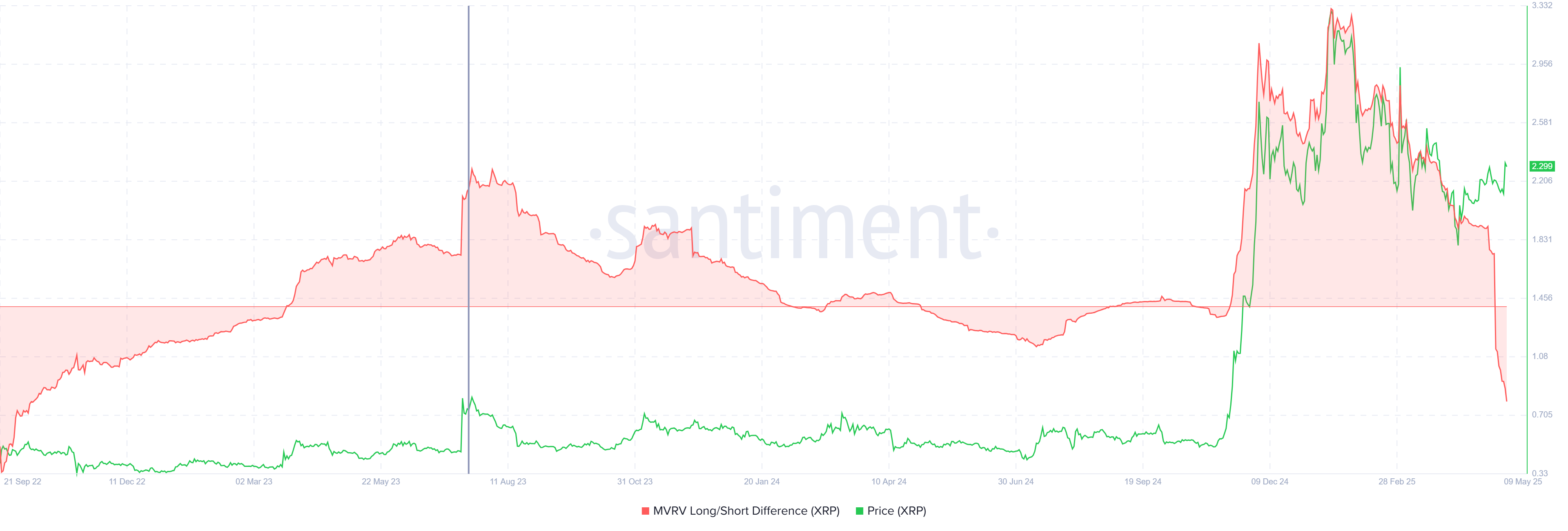

XRP Investors Are Sending Bearish Signals

The MVRV Long Short difference, currently at a 31-month low, indicates a rise in short-term holder profits. When this indicator is low, it suggests that STHs, who are typically quick to sell, might book profits. This trend is relatively bearish for the market.

These holders often sell at the first sign of profits, which could limit XRP’s ability to maintain its current upward trajectory. If many STHs decide to cash out, XRP could struggle to breach key resistance levels and face downward pressure. Additionally, the increasing profits for STHs might create an environment where speculative selling increases, especially if XRP’s price faces any short-term fluctuations.

XRP’s overall momentum shows mixed signals. On one hand, the Ichimoku Cloud, a key technical indicator, is currently exhibiting signs of bearishness. This WOULD typically suggest that the market sentiment is leaning toward a downtrend. However, the candlesticks appear to be approaching a potential breakout above the Ichimoku Cloud.

Should the candlesticks successfully break above the Ichimoku Cloud, it would mark a shift in market sentiment. The resulting confirmation of upward movement could provide a foundation for XRP to challenge higher resistance levels.

XRP Price Needs To Breakout

XRP has risen 8% in the last 24 hours, partially due to broader market bullishness and Ripple’s settlement with the SEC. As a result of the settlement, Ripple will pay $50 million of the original $125 million penalty, with the remaining $75 million being returned. This news has boosted XRP’s price, which is currently trading at $2.29.

However, XRP faces significant resistance at $2.38, a level it has struggled to breach for over seven months. If short-term holders MOVE to sell at current prices, XRP could be limited in its ability to break through this resistance. This could keep the altcoin consolidated in a range between $2.38 and $2.12, preventing a breakout.

If XRP manages to breach $2.38 and flip it into support, it could trigger a more sustained rally. A move past this level could open the door for a rise to $2.56, invalidating the current bearish-neutral outlook. Such a breakout would signal confidence in the market and potentially pave the way for further gains in the long term.