Bitcoin Smashes $100K as ETF Inflows Go Vertical—But Options Traders Get Cold Feet

Wall Street’s latest crypto love affair hits warp speed—ETF inflows surge 47% in May as Bitcoin reclaims six figures. Meanwhile, the options market flashes warning signs with put/call ratios hitting yearly highs.

Institutional FOMO meets trader skepticism: The ultimate bull-bear showdown. Cue the usual suspects—pension funds chasing yield while quant shops quietly hedge.

One hedge fund manager quipped: ’We’ll know the top’s in when Goldman starts offering BTC-collateralized yacht loans.’

Bitcoin ETFs See Another Day of Inflows

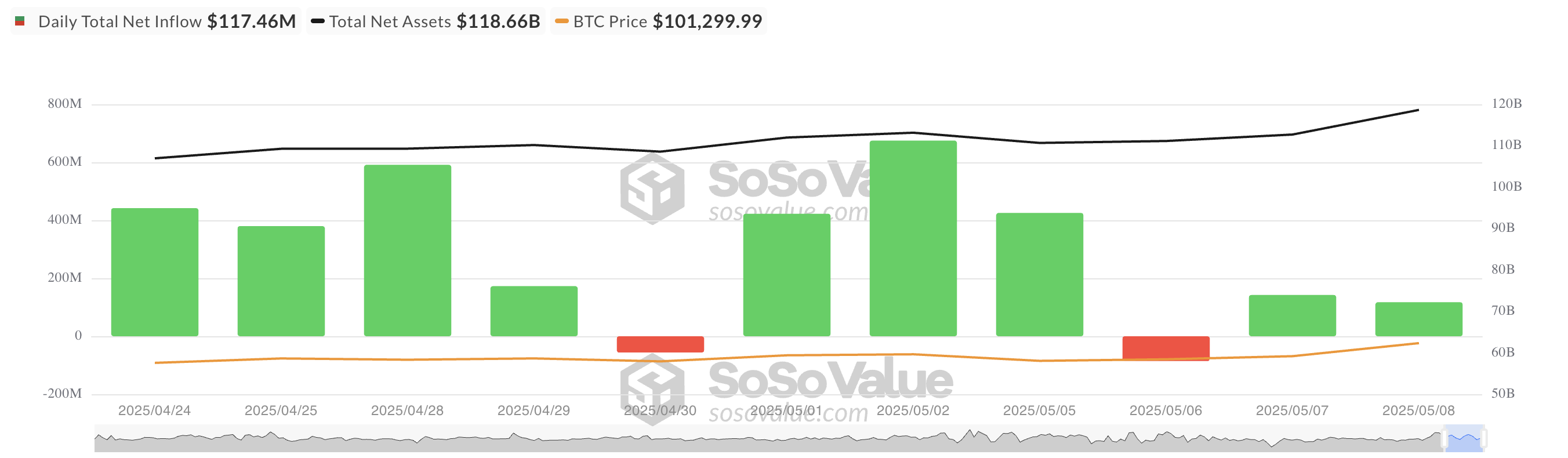

Yesterday, Bitcoin-backed ETFs recorded a net inflow of $117.46 million, down 17% from the previous day’s $142.31 million. While the slight dip may reflect profit-taking after BTC surged past the $100,000 mark, the continued inflows still signal growing investor confidence in the leading cryptocurrency.

On Thursday, BlackRock’s iShares bitcoin Trust (IBIT) led the trend, posting the highest daily inflow among all ETF issuers. The fund recorded a net inflow of $69 million for the day, pushing its total historical net inflow to $44.35 billion.

Fidelity’s ETF, FBTC, came in second with a daily net inflow of $35.34 million. Its total historical net inflow now stands at $11.67 billion.

Notably, none of the 12 ETFs logged net outflows yesterday.

BTC Rally Fuels Futures Frenzy

BTC’s break above the psychological six-figure threshold during Thursday’s trading session has reignited bullish momentum across markets.

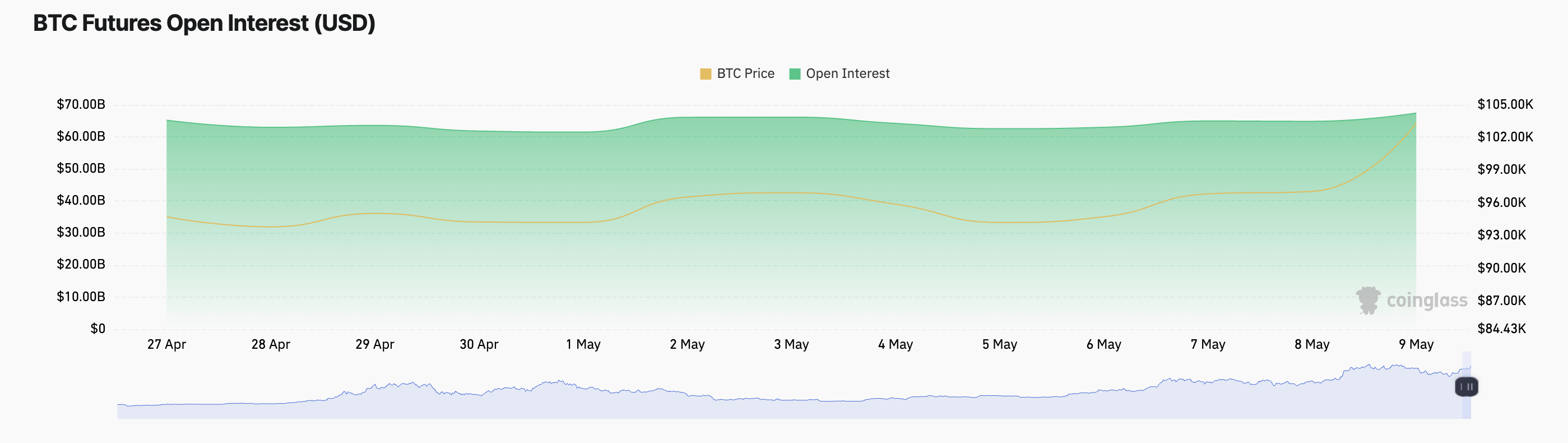

This is reflected by the coin’s futures open interest, which currently stands at $67.45 billion and has climbed 5% over the past day. When an asset’s open interest climbs alongside its price, new money is entering the market to support the trend, indicating strong bullish momentum.

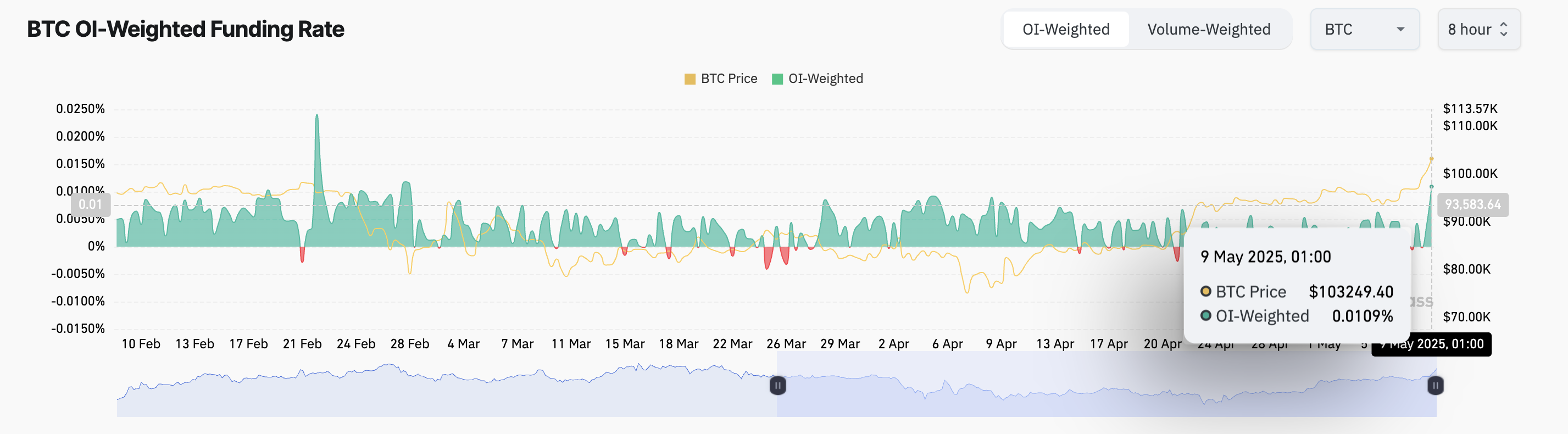

Moreover, BTC’s funding rate has soared to its highest level since February 28, reflecting a multi-month high demand for long positions among futures traders. As of this writing, the metric is at 0.0109%.

A high funding rate like this means traders holding long positions are paying a premium to remain in the trade, which can reinforce bullish sentiment in the BTC market in the short term.

However, while ETF investors and futures traders appear to be leaning bullish, the options market shows signs of caution. Data indicates a growing demand for downside protection, with increased activity around put options.

The mixed sentiment could shape short-term price action as markets digest BTC’s rally above $100,000 and assess whether it can continue.