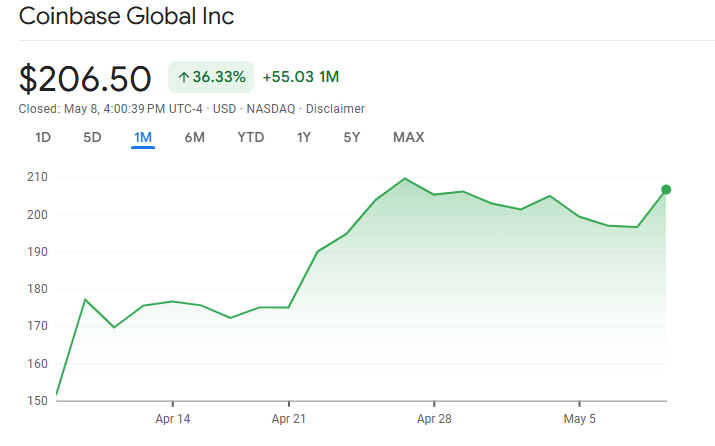

Coinbase Drops $2.9B on Deribit Acquisition—Stock Up 37% in 30 Days

Wall Street’s favorite crypto casino just doubled down. Coinbase snaps up derivatives giant Deribit in a deal that reeks of either genius or desperation—depending on which analyst you ask.

The move comes as COIN shares defy gravity with a 37% monthly surge. Traders are either pricing in regulatory leniency or just chasing the next dopamine hit.

Deribit’s options dominance gives Coinbase instant leverage in the high-stakes crypto derivatives game. Because what’s more American than turning spot ETFs into weekly expiry gambling tokens?

One hedge fund manager quipped: ’At least they didn’t blow the cash on another Super Bowl ad.’ The market’s verdict? A resounding ’meh’—COIN barely budged on the news.

Coinbase Acquires Deribit

Coinbase first opened talks with Deribit in late March, but this deal evidently took a lot of negotiation. In January, the popular derivatives exchange started publicly evaluating buyout offers, but Kraken reportedly rejected a proposal to acquire it for $4-5 billion.

Four months later, Deribit is willing to accept a much lower offer. It’s unclear what pushed Deribit to move forward with a $2.9 billion offer from Coinbase. After the Kraken deal fell through, the crypto derivatives exchange left Russia due to EU sanctions.

This may have contributed to its lower valuation, but it’s difficult to say for sure. One thing seems evident: Coinbase pursued the deal to expand its presence in the derivatives market.

“With Deribit, Coinbase becomes the #1 global platform for crypto derivatives by open interest and options volume. Deribit brings approximately $30 billion in open interest and $1 trillion+ in trading volume. This is a major step in our global expansion strategy. We’re set to offer unparalleled access to crypto derivatives,” Coinbase claimed on social media.

Coinbase, one of the world’s leading crypto exchanges, has already been a player in this market. It began offering derivatives trading almost four years ago, and recently launched CFTC-regulated XRP futures contracts.

This partnership with Deribit, however, will allow Coinbase to supercharge these operations.

Meanwhile, Coinbase’s share prices have recovered significantly since Trump’s sweeping tariffs last month. COIN surged over 36% since April, as the exchange prepares its Q1 2025 earnings report later today.

Deribit executives will receive most of their $2.9 billion asking price in Class A stock from Coinbase. The latter firm will pay $700 million in cash, but will otherwise seal the acquisition deal with 11 million shares.

According to the press release, this may delay the proceedings somewhat, but the transaction “is expected to close by year-end.”

Moving forward, Coinbase didn’t specify how it plans to leverage Deribit’s resources for its own expansion plans. Still, the firm’s public statements repeatedly stressed that Deribit is the world leader in crypto derivatives.

By simply taking over its user base and trading volumes, Coinbase has gained many opportunities to take over the spotlight.