Cardano Whales Bail as ADA’s Bull Run Hangs in the Balance

Whale wallets holding Cardano (ADA) are quietly cashing out—dropping 8% in the past quarter while retail investors cheer ’HODL’ from the bleachers. The third-gen blockchain now faces its toughest stress test: maintaining momentum without big players propping up liquidity.

On-chain data shows a troubling divergence—daily active addresses hit a 2025 high even as whale dominance erodes. Can ADA’s proof-of-stake mechanics compensate for the exodus of crypto’s 1%? Or is this just another ’decentralization’ fairytale before the hedge funds swoop back in?

Meanwhile, exchange reserves suggest accumulation at current levels. Either the smart money knows something, or they’re waiting for the next sucker to yell ’ATH incoming’ on Twitter. Place your bets.

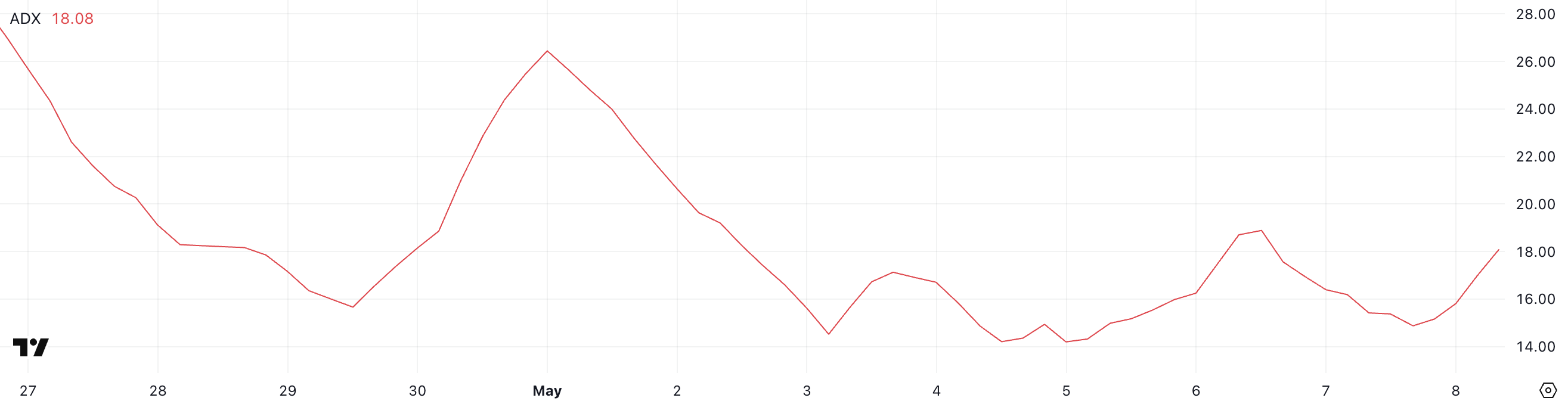

Cardano ADX Rises: Is a Stronger Move Coming?

Cardano’s ADX (Average Directional Index) has climbed to 18.08, up from 14.88 a day earlier, signaling growing trend strength.

This shift comes as ADA starts forming an early-stage uptrend, with higher lows beginning to appear on the chart. While the price hasn’t broken out decisively yet, the rising ADX suggests that underlying momentum is building.

Traders often monitor these early ADX increases as potential signals of a larger MOVE ahead, especially when paired with bullish structure.

The ADX is a widely used technical indicator that measures the strength, but not the direction, of a trend. Readings below 20 typically indicate a weak or ranging market, while values between 20 and 25 signal that a trend is forming.

A move above 25 confirms a strong, active trend. With ADA’s ADX now at 18.08 and steadily rising, the indicator is approaching the critical threshold that could validate a strengthening uptrend.

If the ADX crosses above 20 and price continues to climb, it could attract more bullish momentum and increase the chances of a sustained rally.

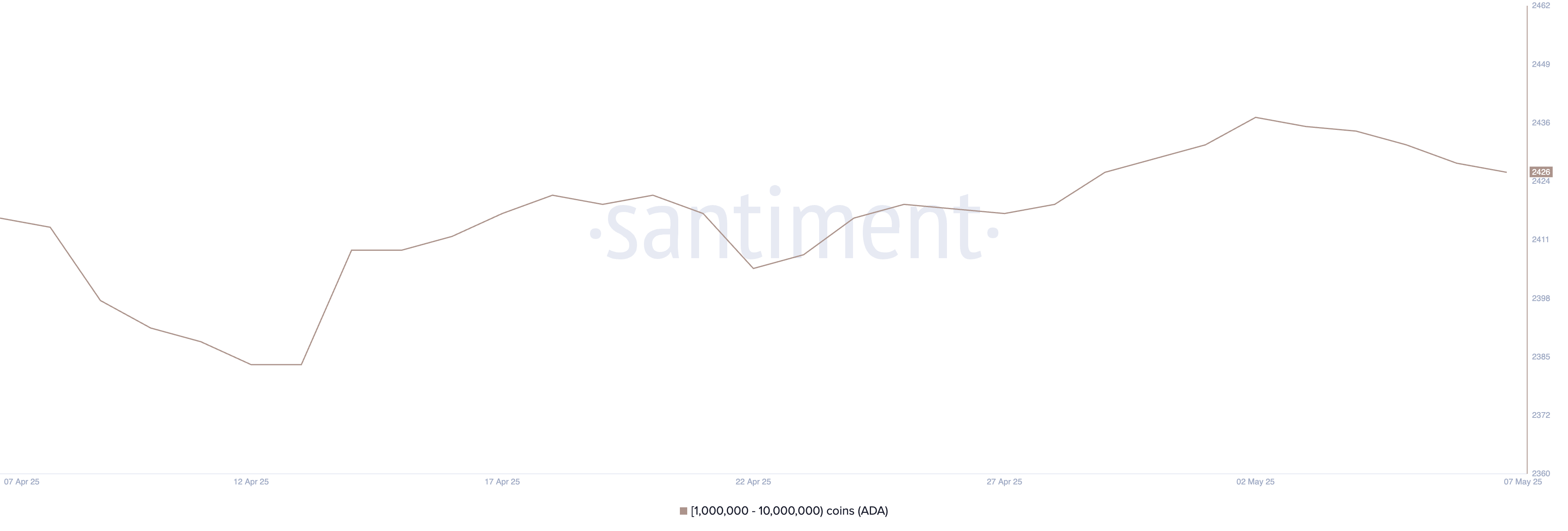

ADA Whale Wallets Drop for Sixth Day—Caution Ahead?

Despite Cardano forming an early-stage uptrend, the number of ADA whale wallets holding between 1 million and 10 million ADA has been quietly declining.

There are 2,426 such addresses, down from 2,438 just six days ago. This marks a six-day consecutive drop, following a recent peak that represented the highest whale count since mid-March.

While the price shows signs of strength, the quiet exit or redistribution among large holders could raise caution for short-term momentum.

Tracking whale wallets is crucial because large holders can significantly influence price direction through accumulation or distribution behaviors. When these addresses grow in number, it often signals confidence in the asset and a potential for sustained rallies.

Conversely, a consistent drop in whale activity—especially during a forming uptrend—may suggest profit-taking, reduced conviction, or capital rotation into other assets.

At current levels, the ongoing decline in ADA whales may be an early warning sign that not all large investors are backing this rally. If the trend continues, it could limit Cardano’s upside potential, or at least slow down the pace of gains.

Traders should watch closely whether this divergence between price action and whale behavior widens or begins to realign.

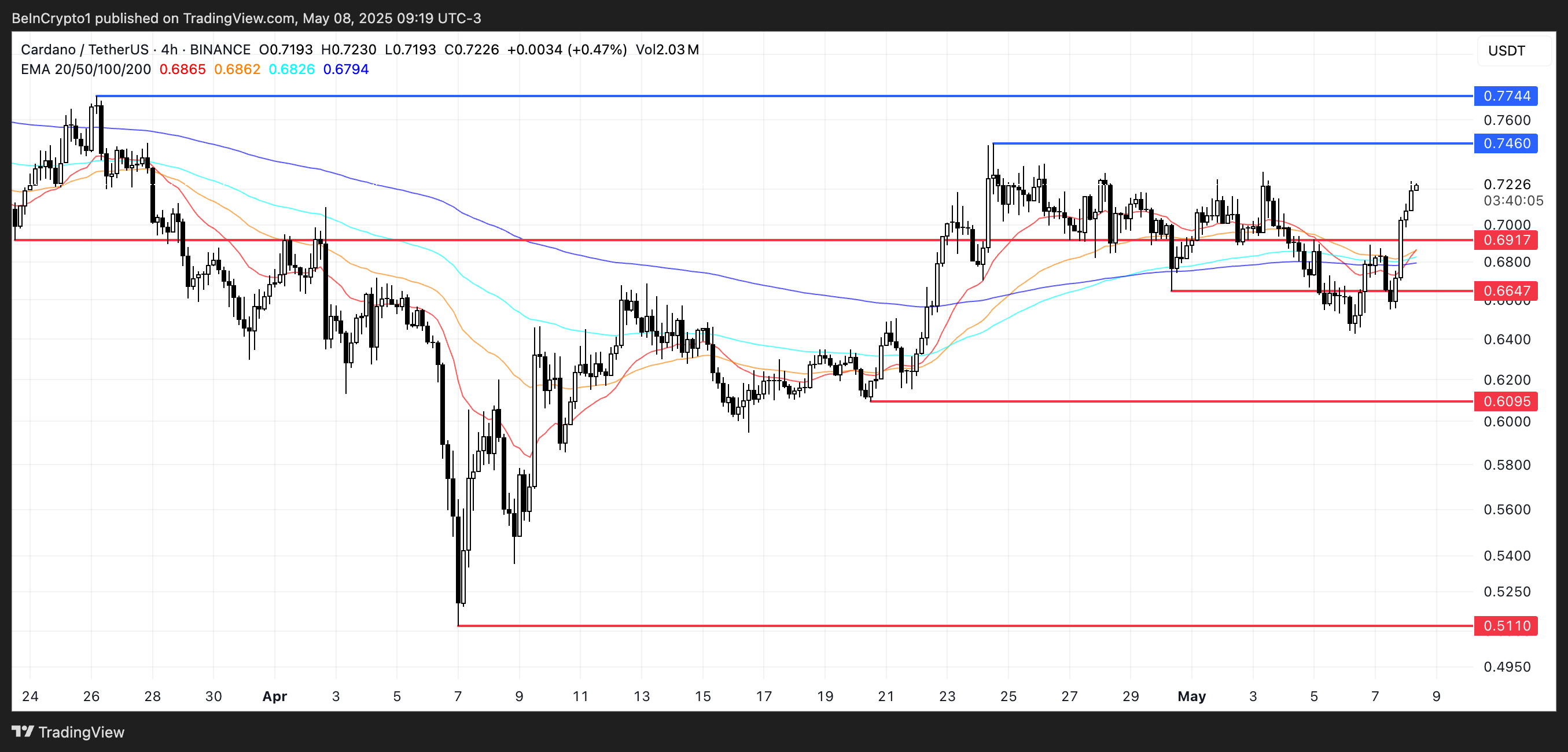

Cardano Eyes Golden Cross as Price Approaches Key Resistance

Cardano’s EMA lines are tightening, suggesting a golden cross could FORM soon—a bullish signal that occurs when the short-term EMA crosses above the long-term EMA.

If confirmed, and if Cardano price breaks above the $0.73 level, it could open the door to test the next resistances at $0.746 and $0.774.

A sustained breakout WOULD put $0.80 in play, a level not seen since March 8, potentially reigniting broader bullish momentum for ADA in the short term.

However, if the uptrend fails to gain traction, ADA could slip back toward support at $0.69.

Losing that level would expose the token to further downside, with $0.66 and $0.60 as the next key support zones.

ADA could even fall as low as $0.511 in a strong downtrend, its lowest level in over two months.