EOS Soars to 30-Day Peak as Fed’s Dovish Stance and Rebrand Hype Ignite Rally

EOS bulls are back in charge—the token just smashed through its highest price in a month, riding twin tailwinds of a softening Fed and a slick rebranding campaign.

Market Pulse: When the money printers whisper ’maybe later,’ crypto traders hear ’risk on.’ Combine that with EOS’s shiny new branding (because nothing solves blockchain scalability like a fresh logo), and you’ve got a textbook speculative bounce.

Reality Check: The 15% surge looks impressive until you realize EOS is still down 82% from its 2018 ATH. But hey, in a market where ’up only’ is both a meme and a prayer, today’s traders will take what they can get.

EOS Soars on Vaulta’s Rebrand Announcement

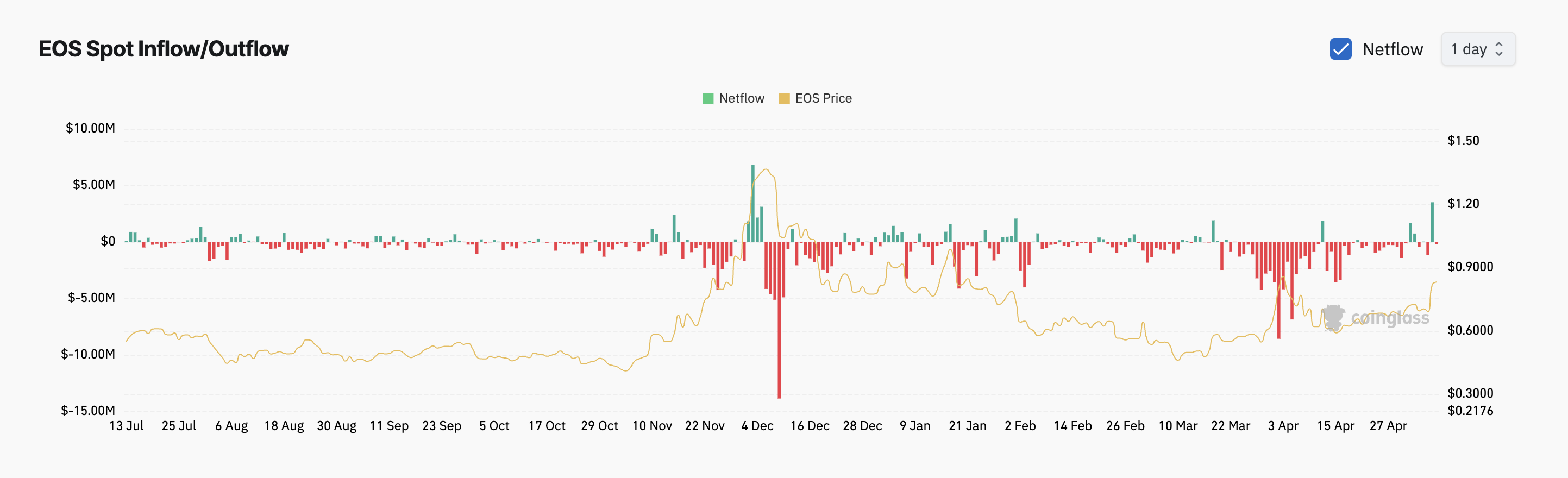

On Wednesday, Vaulta announced that EOS will officially rebrand to A, introducing a 1:1 token swap as part of the project’s transformation. The news sparked renewed investor interest, evident in the sharp spike in EOS spot inflows recorded on Wednesday.

According to Coinglass, this totaled $3.49 million and represented the coin’s single-day highest spot inflow since December 3.

A surge in spot inflows like this means more investors are buying the asset on regular (non-derivative) markets, signaling increased demand and bullish sentiment. Although the price hike has prompted a net outflow of $195,290 from the EOS spot markets today as traders lock in profits, the token’s rising daily trading volume indicates that significant buying activity is still underway.

As of this writing, EOS’s daily trading volume sits above $480 million, rocketing by 270% today.

When an asset’s price and trading volume increase simultaneously, it mirrors a strong bullish presence in the market. This trend reflects heightened investor interest in EOS and can lead to further price appreciation and increased market activity.

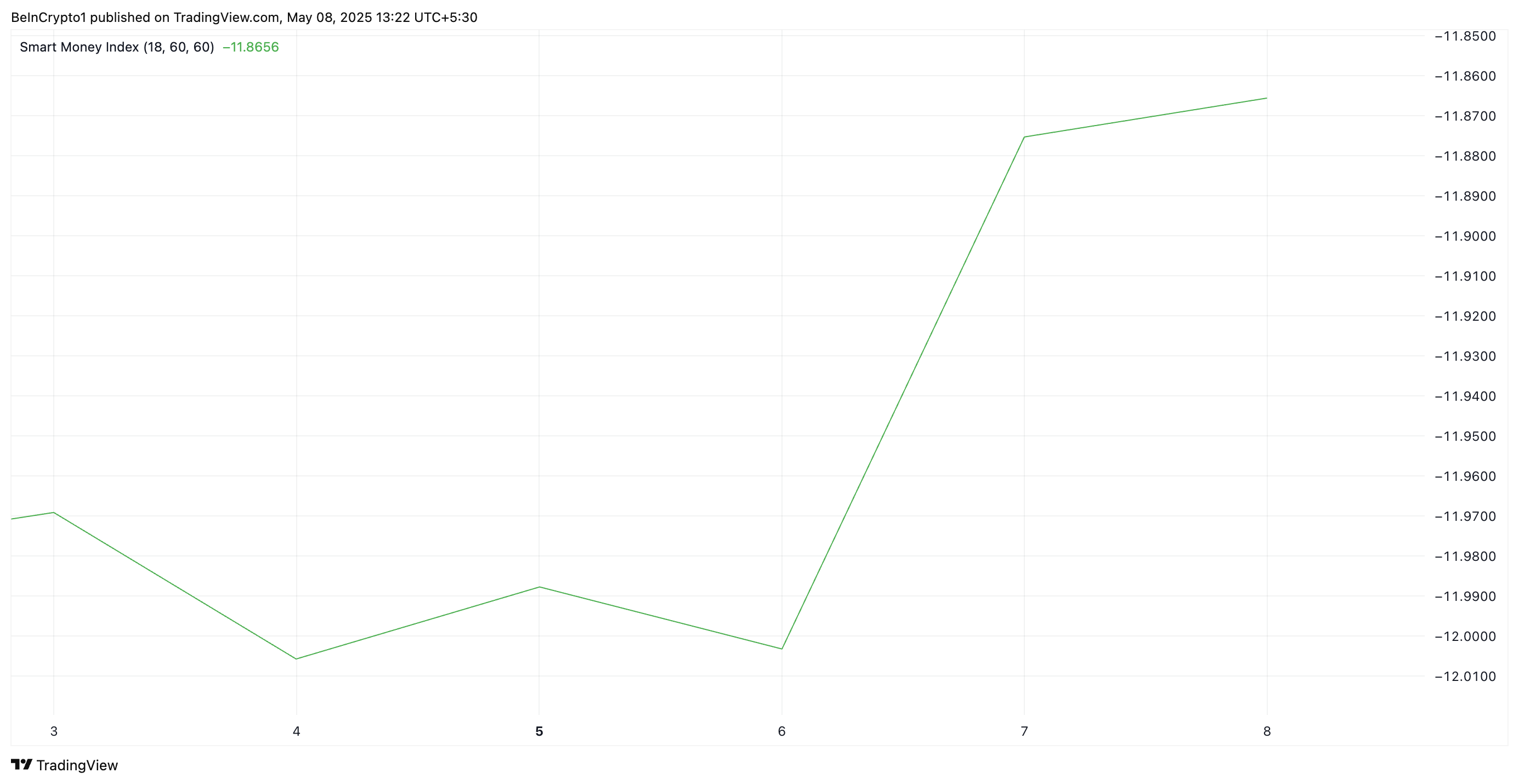

Moreover, smart money indicators reveal that institutional accumulation is on the rise. On the daily chart, EOS’ Smart Money Index (SMI) has surged to a five-month high of -11.86.

An asset’s SMI tracks the activity of institutional investors by analyzing market behavior during the first and last hours of trading. When it drops, it signals reduced confidence from these investors, pointing to expectations of price declines.

Conversely, as with EOS, when it rises, these investors increase their buying activity, signaling growing confidence in the asset. This points to the likelihood of an extended rally.

Can EOS Flip $0.85 Resistance to Fuel Surge to $0.98?

At press time, EOS trades at $0.83, resting below a key resistance level formed at $0.85. If bullish pressures persist and this zone flips into a support floor, it could propel the EOS token price to $0.98, a high it last reached on January 18.

However, an uptick in profit-taking could cause EOS to lose its recent gains and plunge to $0.67.