Fed Hits Pause—Bitcoin ETFs Explode Like a DeFi Yield Farm in Bull Market

Wall Street’s latest ’risk-on’ signal sends crypto funds into overdrive. The Fed’s rate pause—their version of ’we’re scared to break things’—has traders piling into BTC like it’s 2021 again.

Spot ETF inflows surge as institutional FOMO meets monetary policy paralysis. Guess Powell finally found something more unpredictable than his press conference gaffes.

Bonus jab: Meanwhile, gold ETFs sit gathering dust—the boomer asset nobody wanted at this party.

Bitcoin ETFs Bounce Back

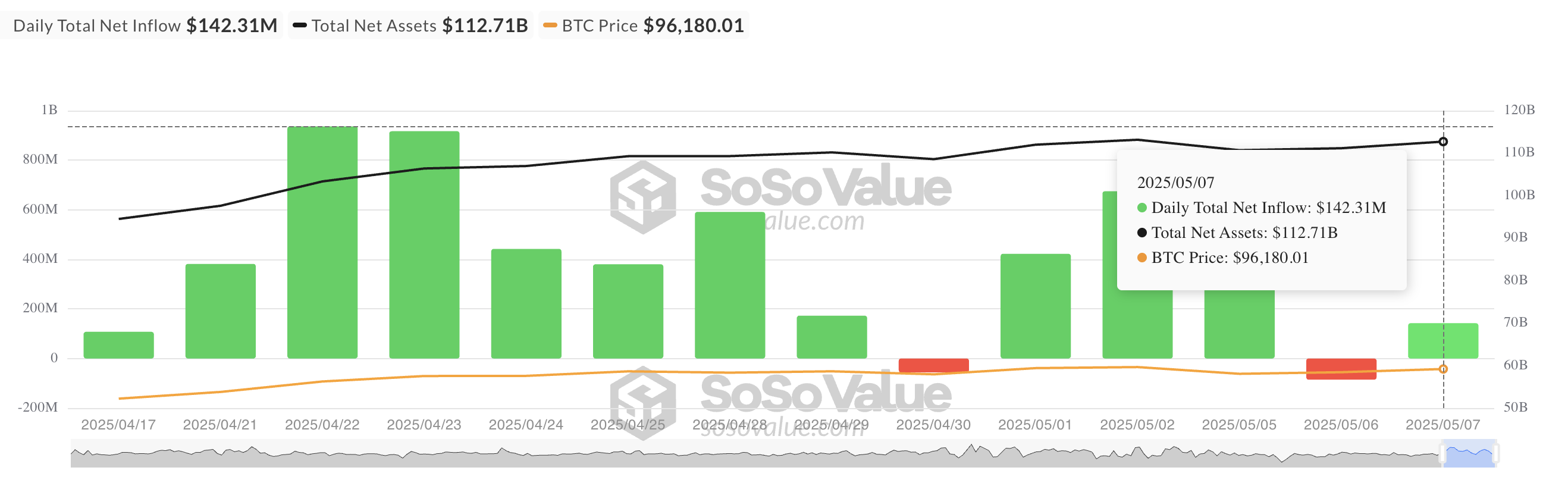

The week started strong. On Monday, inflows totaled $425.45 million across BTC spot ETFs. Yet, this bullish momentum was interrupted on Tuesday as institutional investors pulled capital from the market ahead of the Federal Open Market Committee (FOMC) meeting. The pullback resulted in net outflows of $85.64 million.

However, the trend shifted on Wednesday, thanks to the Fed’s decision to hold interest rates. The announcement triggered a sharp rebound in investor confidence, fueling fresh inflows of $142.31 million into BTC ETFs.

On May 7, Ark Invest and 21Shares’ ARKB recorded the largest single-day inflow, totaling $57.73 million, bringing its total cumulative net inflows to $2.68 billion.

The second-largest daily inflow was recorded by Fidelity’s FBTC, which saw $39.92 million enter the fund. FBTC’s total historical net inflows now stand at $11.64 billion.

According to SosoValue, no fund recorded a net outflow on Wednesday.

Options and Futures Signal Bitcoin Bulls in Control

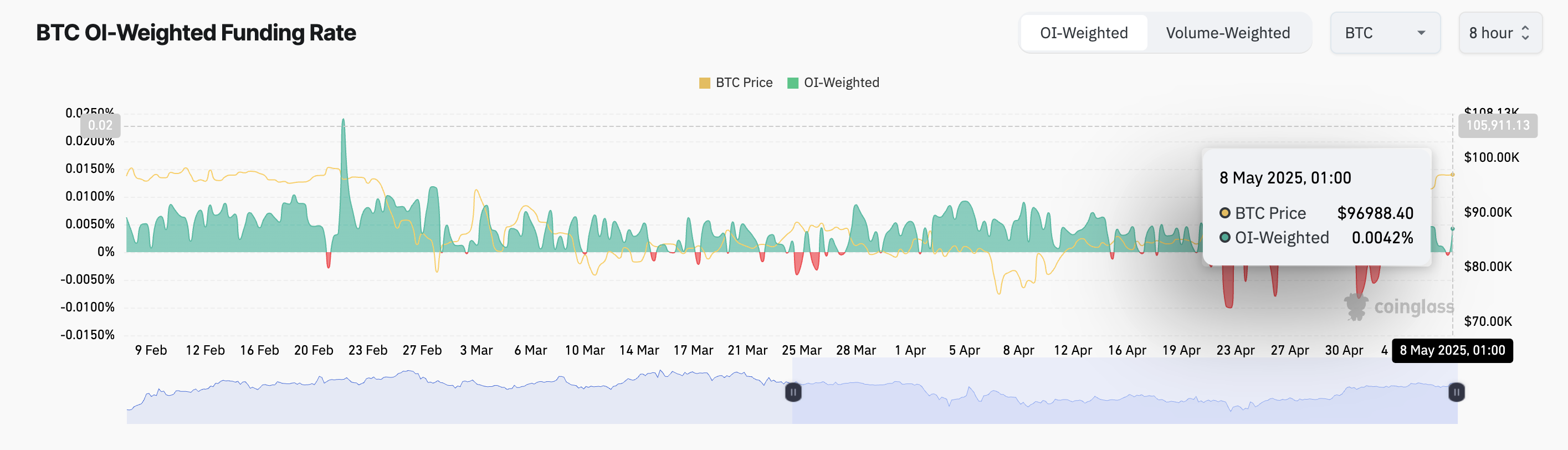

The renewed optimism extends beyond inflows into ETFs. BTC is up 2% over the past 24 hours, and currently trades at $98,888. This price surge is accompanied by a positive funding rate, indicating an increase in Leveraged long positions.

At press time, this is at 0.0042%. The funding rate is a periodic fee exchanged between long and short positions in perpetual futures contracts to keep prices aligned with the spot market. When positive like this, traders holding long positions pay shorts, indicating that bullish sentiment dominates the BTC market.

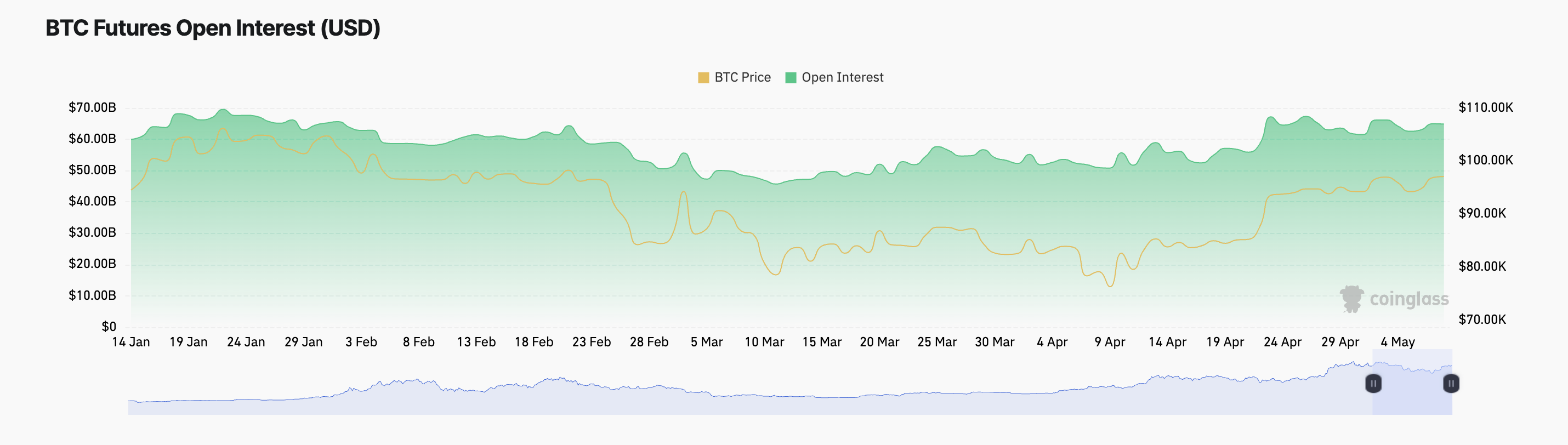

However, it is key to note that despite this, BTC’s futures open interest has fallen by a modest 0.18% over the past day. This suggests that while traders are largely optimistic, some leveraged positions may have been closed, possibly to take profit as BTC soars.

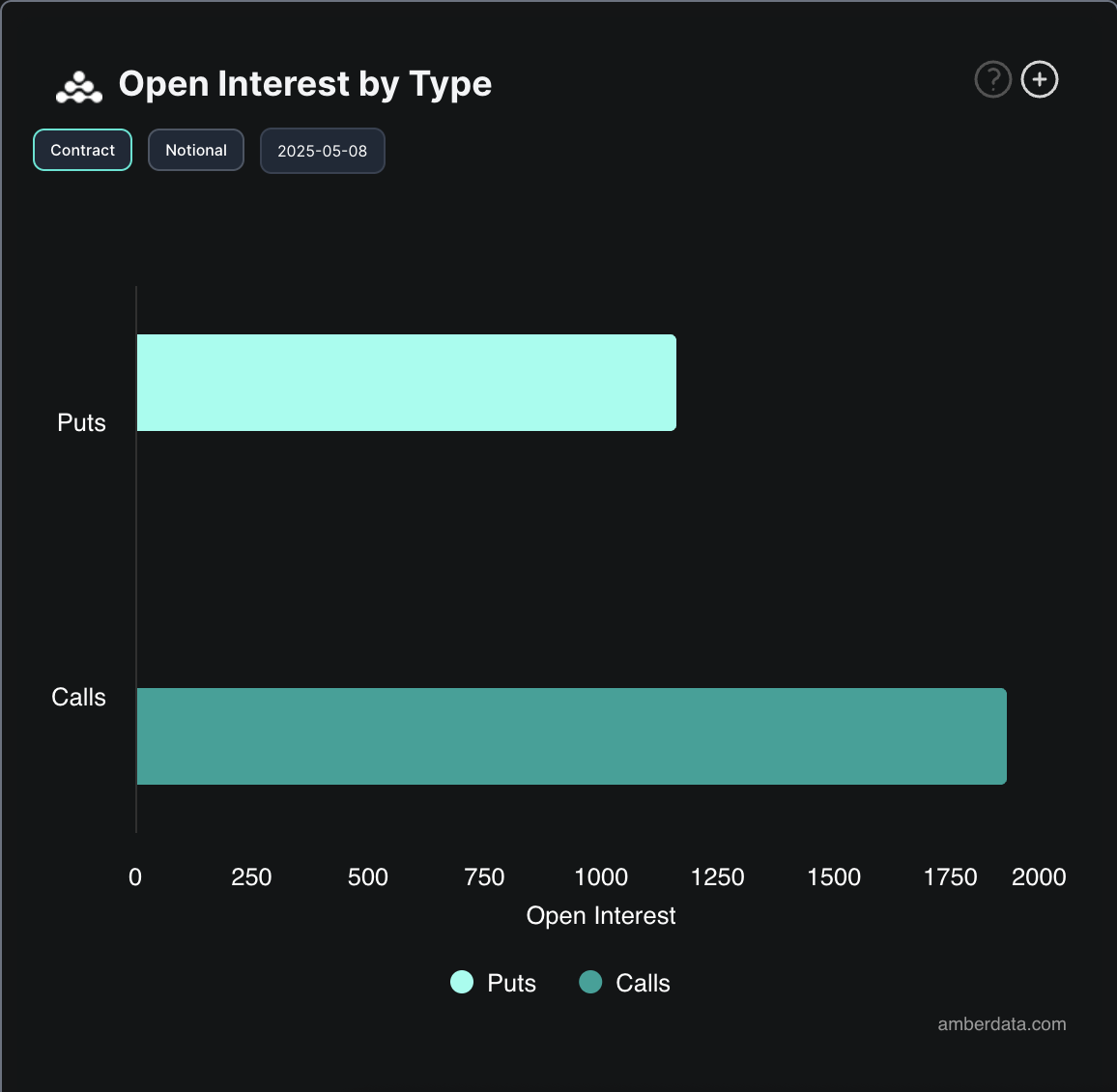

Meanwhile, traders have also caught the bullish virus in the options market. The demand for call options has surged, exceeding puts, indicating that traders are increasingly positioning for the upside.

These trends suggest a growing conviction that BTC could break higher if macro conditions remain favorable.