Ethereum’s Pectra Upgrade Just Dropped—These 5 Layer-2 Tokens Are Primed to Pump

Gas fees got you down? Ethereum’s latest upgrade is about to flip the script—and these scaling solutions are first in line to benefit.

Here’s what’s breaking out of the L2 pack post-Pectra:

1. Arbitrum (ARB): The OG rollup just got a turbocharge. Watch for DeFi blue chips migrating en masse.

2. Optimism (OP): Their ’Superchain’ vision suddenly looks less like marketing fluff and more like inevitability.

3. Starknet (STRK): Zero-knowledge proofs meet mainstream adoption. The math finally checks out.

4. Polygon (MATIC): Never count out the chain that turned ’sidechain’ from an insult to a badge of honor.

5. Mantle (MNT): The dark horse betting big on modular architecture—because why rebuild the wheel when you can rent it from Wall Street?

Let’s be real: half these tokens will underperform while VCs cash out. But the one that doesn’t? That’s your ticket to riding Ethereum’s scalability wave without the hedge fund baggage.

Arbitrum (ARB)

With expanded blob space and more efficient data availability coming from the Ethereum Pectra upgrade, Arbitrum can reduce its L1 settlement fees and scale more efficiently.

At the same time, EIP-7702 introduces smart account functionality that enables gasless transactions, batching, and simplified onboarding, all of which enhance the experience for developers and end users building on Arbitrum.

Despite these long-term tailwinds, ARB is down over 6% in the past seven days. If the correction continues, price may fall to $0.292 — a key support level — and potentially dip further to $0.27.

However, if ARB regains momentum, the first resistance to watch is $0.315.

A break above that level could open the door for further upside toward $0.345 and, in a stronger bullish scenario, $0.363.

StarkNet (STRK)

The Pectra upgrade introduces improvements in data availability and validator operations, which will benefit StarkNet in multiple ways.

Enhanced blob space directly supports cheaper and more scalable calldata posting — a major win for zk-rollups like StarkNet that rely heavily on L1 for data availability.

Additionally, EIP-7002 allows more flexible validator withdrawals, which supports future integrations of re-staking protocols and simplifies cross-chain liquidity movements.

STRK has fallen more than 13.5% in the past seven days, and its EMA lines indicate a downtrend. If this trend continues, the next key support level is around $0.116.

However, if STRK manages to reverse momentum, the first resistance to watch is $0.136. A break above that level could lead to further upside, with STRK potentially testing $0.15 and even $0.161 in a stronger bullish scenario.

Mantle (MNT)

The Pectra upgrade brings improvements that could indirectly support Mantle’s modular architecture and staking design. With EIP-7251 raising the validator staking limit, large-scale staking operations become more efficient — a potential benefit for Mantle, which integrates restaked ETH into its ecosystem.

This change simplifies validator management and enhances the economic security of protocols that rely on Ethereum as a base layer.

Additionally, the expansion of blob space contributes to lower L1 data costs, supporting cheaper and more scalable interactions for Mantle’s modular rollups and Layer 2 applications.

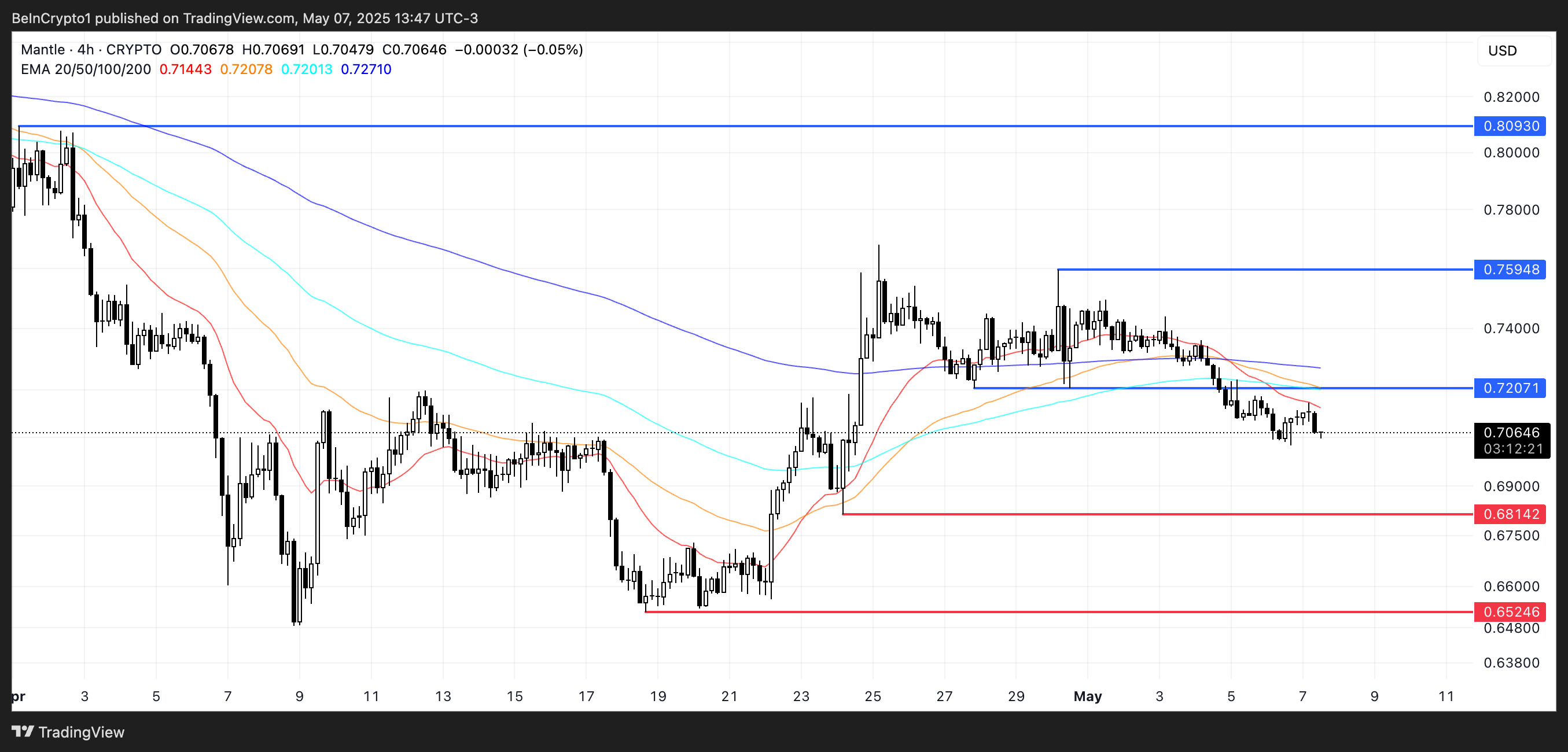

MNT formed a death cross a few days ago and is currently down 2.6% over the past seven days, signaling ongoing bearish pressure. Its next key support sits at $0.68, and if that level fails to hold, price could decline further toward $0.652.

On the upside, if MNT reverses course, the first resistance to watch is $0.72.

A successful break above that could trigger a rally toward $0.759, and in a more extended bullish move, MNT may test $0.809.

Aevo (AEVO)

Aevo, a high-performance derivatives platform built on Layer 2 infrastructure, stands to benefit from the Pectra upgrade through lower data availability costs and improved scalability.

The expansion of blob space introduced by Pectra reduces calldata fees for L2s, which is crucial for platforms like AEVO that rely on frequent state updates and high transaction throughput. This directly translates to cheaper and faster settlement for perpetuals and options.

Additionally, smart account functionality from EIP-7702 could enable features like gasless trading or streamlined account recovery, enhancing the trading experience and reducing friction for users interacting with Aevo’s contracts.

AEVO is down nearly 12% over the last seven days, with its price struggling to stay above the $0.10 mark.

If this downtrend continues, the next support is at $0.096 — and a break below that could open the door to deeper declines toward $0.082 and even $0.0756.

On the flip side, if AEVO regains momentum and breaks above the $0.107 resistance, it could rally to test $0.115. A stronger bullish push could extend gains to the next target at $0.121.

Fuel Network (FUEL)

Fuel Network, a modular execution layer focused on high throughput and developer flexibility, is well-positioned to benefit from Ethereum’s Pectra upgrade.

The expanded blob space introduced by Pectra significantly reduces the cost of posting data to Ethereum, which is crucial for Fuel’s rollup architecture. This allows Fuel to scale transaction volumes more efficiently while maintaining decentralization.

Additionally, smart account functionality from EIP-7702 aligns with Fuel’s goal of improving UX and developer tooling, enabling more advanced wallet interactions, gasless flows, and streamlined onboarding for users deploying dApps on Fuel’s stack.

FUEL’s EMA lines remain bullish, with short-term averages still holding above long-term ones, indicating underlying strength. However, the token has struggled to break through the $0.012 resistance in recent days.

If that level is tested again and cleared, FUEL could rally toward $0.0129 and $0.014, with a strong uptrend potentially pushing it back to $0.0163.

On the downside, if momentum fades and FUEL breaks below the $0.010 support, the next targets are $0.0084 and $0.0077.