Stellar’s Wealth Gap: 10 Wallets Control 80% of XLM—Centralization Alarm Bells Ring

Stellar’s egalitarian promise hits a snag as blockchain data reveals staggering concentration: just ten wallets hold the keys to nearly 80% of circulating XLM. The crypto that pitched itself as the people’s ledger now faces Wall Street-level wealth disparity.

Who’s holding the bags? While Stellar Development Foundation’s reserves account for ~30% (standard for foundational coins), the remaining whale-sized stakes belong to unidentified addresses. Exchange cold wallets? Institutional players? The blockchain doesn’t lie—but it doesn’t explain either.

Market watchers shrug: ’First time?’ Bitcoin’s top 100 addresses control 15% of supply, and Ethereum’s ICO early birds still loom large. But for a chain that branded itself as the anti-Ripple, these numbers sting like a betrayal. Maybe decentralized finance isn’t about who holds the coins—just who moves them fastest.

Closing thought: If this were a traditional bank’s balance sheet, regulators would be crawling all over it. But hey—it’s crypto, so we call it ’network security.’ How convenient.

What Does the Concentrated Supply and Rising Exchange Balances Mean?

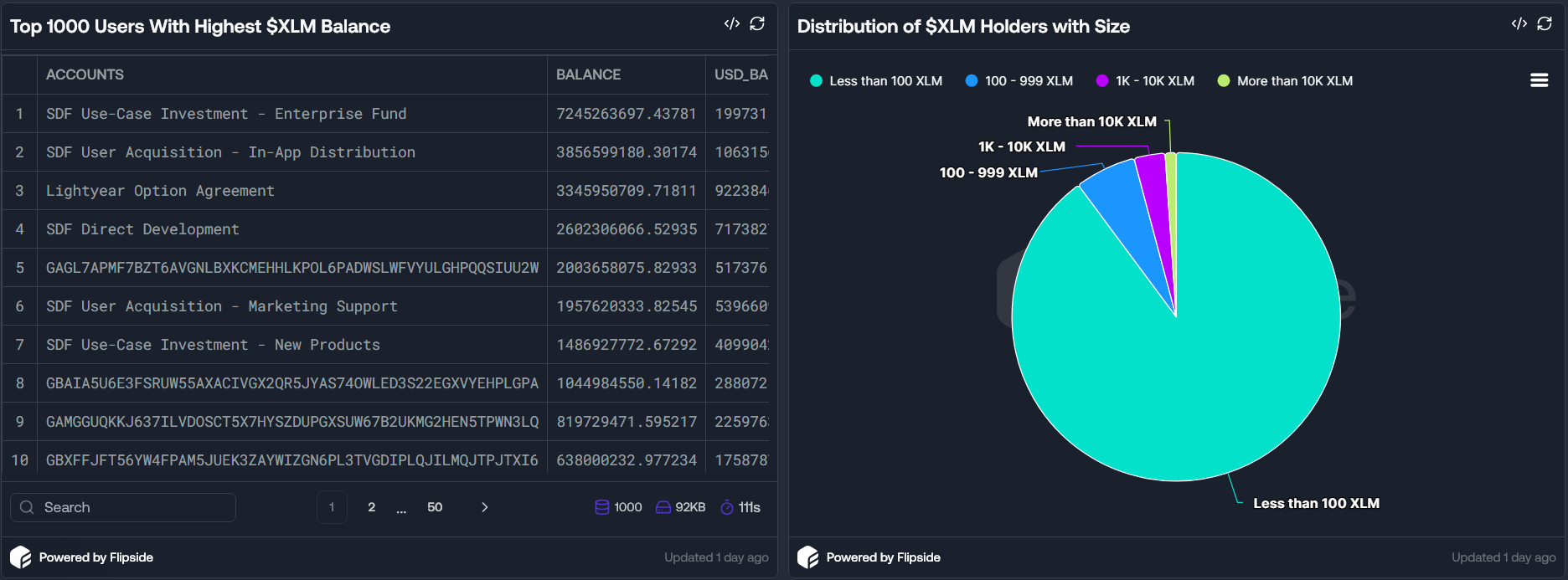

One major concern about Stellar is the concentration of XLM supply. According to Flipside Crypto, the top 10 XLM wallets hold approximately 25 billion XLM. The total circulating supply is 30.9 billion XLM, meaning nearly 80% of the supply belongs to a small group.

This raises questions about decentralization. A few entities holding large amounts of tokens could significantly influence the market. Meanwhile, about 90% of XLM holders own less than 100 XLM.

This imbalance shows that most retail investors have little impact on price. As a result, the market faces volatility risks if “whales” decide to sell.

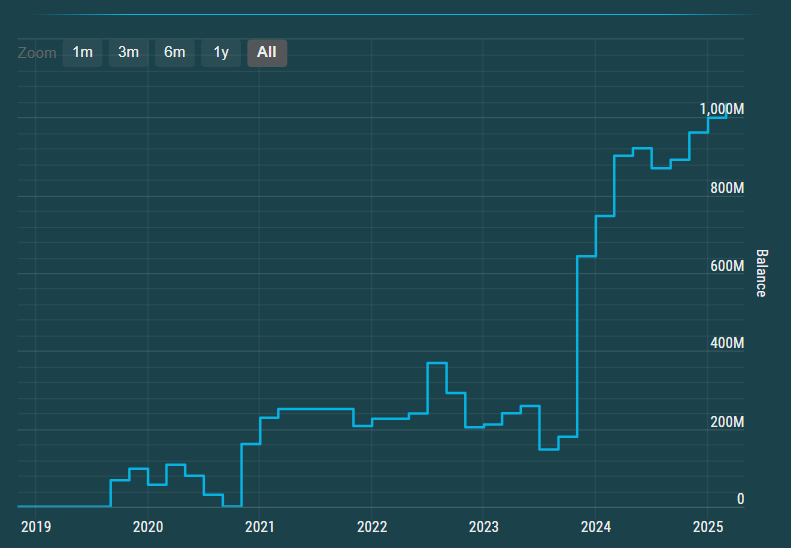

Additionally, data from stellar.expert shows that XLM balances on Binance have risen steadily since late 2023, from 180 million XLM to 1 billion XLM. This increase reflects growing demand for trading and signals potential sell pressure if negative news emerges.

At first glance, this kind of data often seems negative for a network’s outlook. However, XLM investors argue that increased circulating supply can indicate growing adoption.

“This isn’t a random distribution — it’s a deliberate strategy… Supply growth is measured and controlled while adoption skyrockets,” an XLM investor commented.

On-chain data further supports this view. Stellar’s active accounts grew from 7.2 million in 2023 to 9.5 million by May 2025. On average, the network adds about 5,000 new wallet addresses daily. This ever-increasing demand helps absorb the circulating XLM.

Signs of Rising XLM Demand in Real World Asset (RWA) Sector

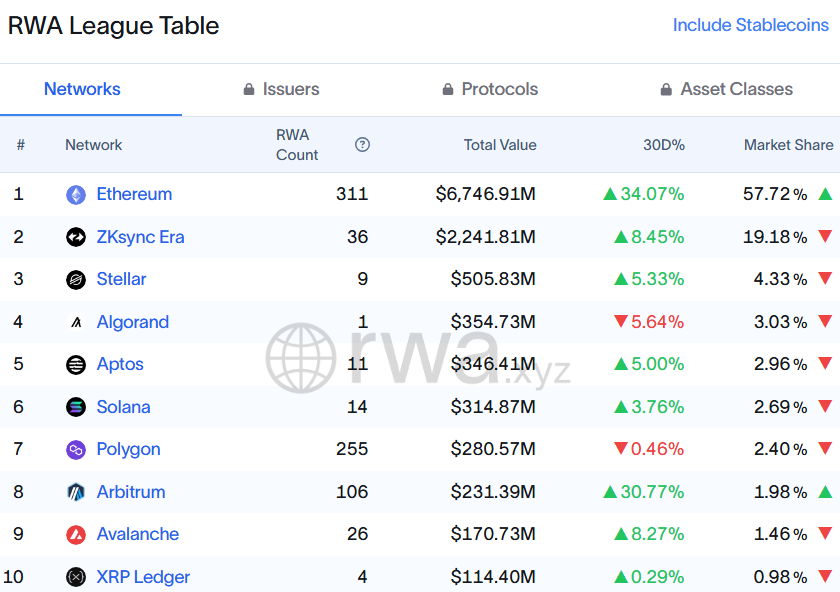

Stellar is establishing its position in the real-world asset space — one of crypto’s hottest trends.

Currently, Stellar ranks as the third-largest protocol in RWA market capitalization, behind only Ethereum and ZKsync Era. Notable players in Stellar’s RWA ecosystem include the Franklin Templeton OnChain US Government Money Fund (valued at $497 million) and Circle’s USDC stablecoin, which holds $345 million on the Stellar network.

The total value of RWAs on Stellar has grown nearly 84% in 2025. It ROSE from $275 million to over $500 million by May. This growth reflects Stellar’s increasing appeal for real-world asset tokenization.