Institutional Investors Dump Bitcoin Ahead of FOMC—ETF Bloodbath Continues

Wall Street’s crypto love affair hits a snag as big money flees BTC ahead of Fed fireworks. Spot ETFs bleed $217M in three days—because nothing says ’hedge against inflation’ like panic-selling at the first whiff of rate hike talk.

The Great Unwinding

Grayscale’s GBTC leads the exodus with $139M outflows Wednesday alone. Even BlackRock’s shiny new IBTC product saw its first-ever redemptions. Guess those ’generational buying opportunity’ memes didn’t age well.

Fed Fear Factor

Traders pricing in 60% chance Powell keeps rates higher for longer. Bitcoin’s correlation with Nasdaq hits 0.87—turns out ’digital gold’ behaves exactly like tech stocks when the punch bowl starts draining.

Bottom Line

Market makers front-running the FOMC like it’s 2022 all over again. Cue the usual suspects claiming ’this time is different’ while leveraged longs get liquidated. Bonus jab: At least someone’s making money—the SEC’s litigation department.

Institutions Pull Back from BTC ETFs as Fed Decision Looms

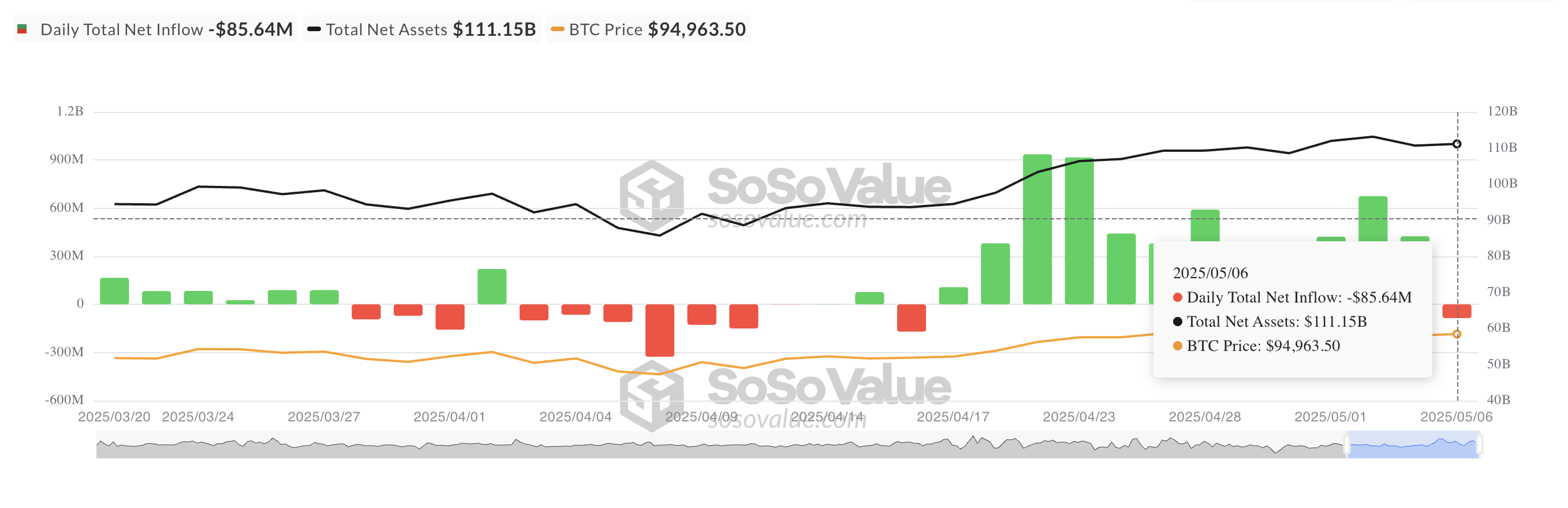

BTC spot ETFs saw net outflows of $85.64 million on Tuesday, marking a shift in sentiment among institutional investors just ahead of today’s US Federal Reserve’s latest policy meeting.

The outflows came after three consecutive days of strong inflows, totaling over $1 billion, into these BTC-backed funds. This suggests a pullback as market participants prepare for potential volatility surrounding today’s FOMC announcement.

It can also be seen as a strategic step to avoid short-term losses in the event of an unfavorable policy signal or unexpected market reaction.

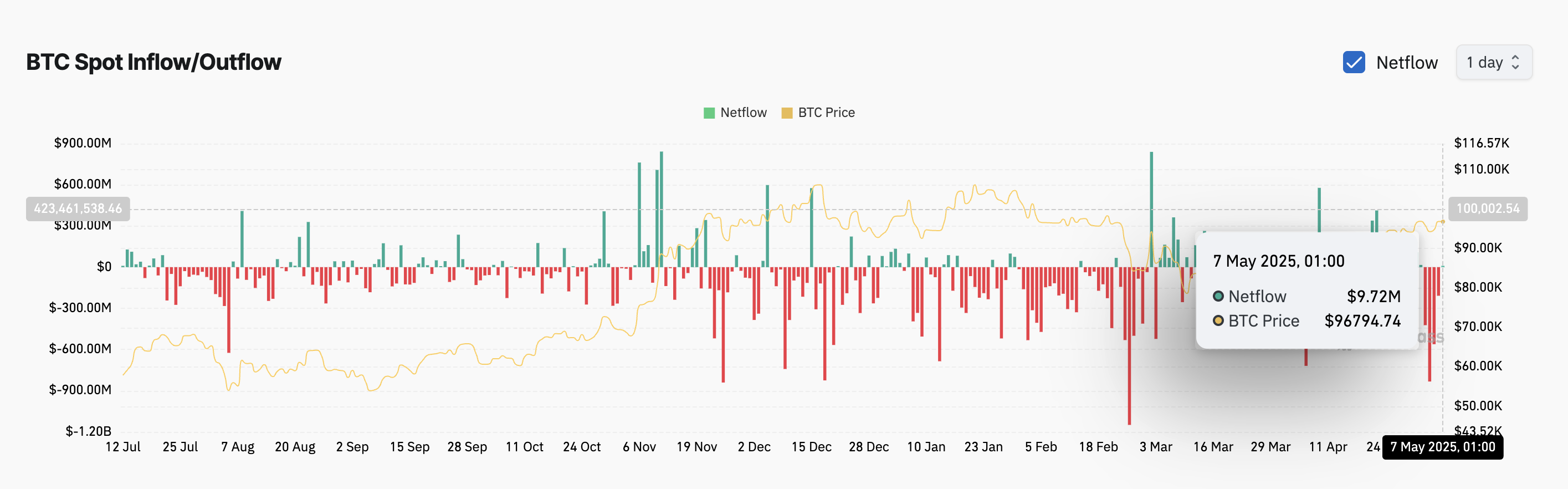

Despite the ETF outflows, on-chain data reveals a spike in spot net inflows today. This indicates that while institutional players may be reducing their ETF exposure, they could be rotating capital into direct spot positions, possibly to capitalize on short-term price swings both before and after the Fed’s announcement.

According to Coinglass, BTC’s spot net inflows sit at $9.72 million. When an asset sees spot inflows, the number of its coin or tokens purchased and moved into spot markets has increased, indicating rising demand.

This points to surging accumulation among BTC spot market participants, a trend which can drive price appreciation if buying pressure remains.

Bitcoin Rises on Buyer Strength

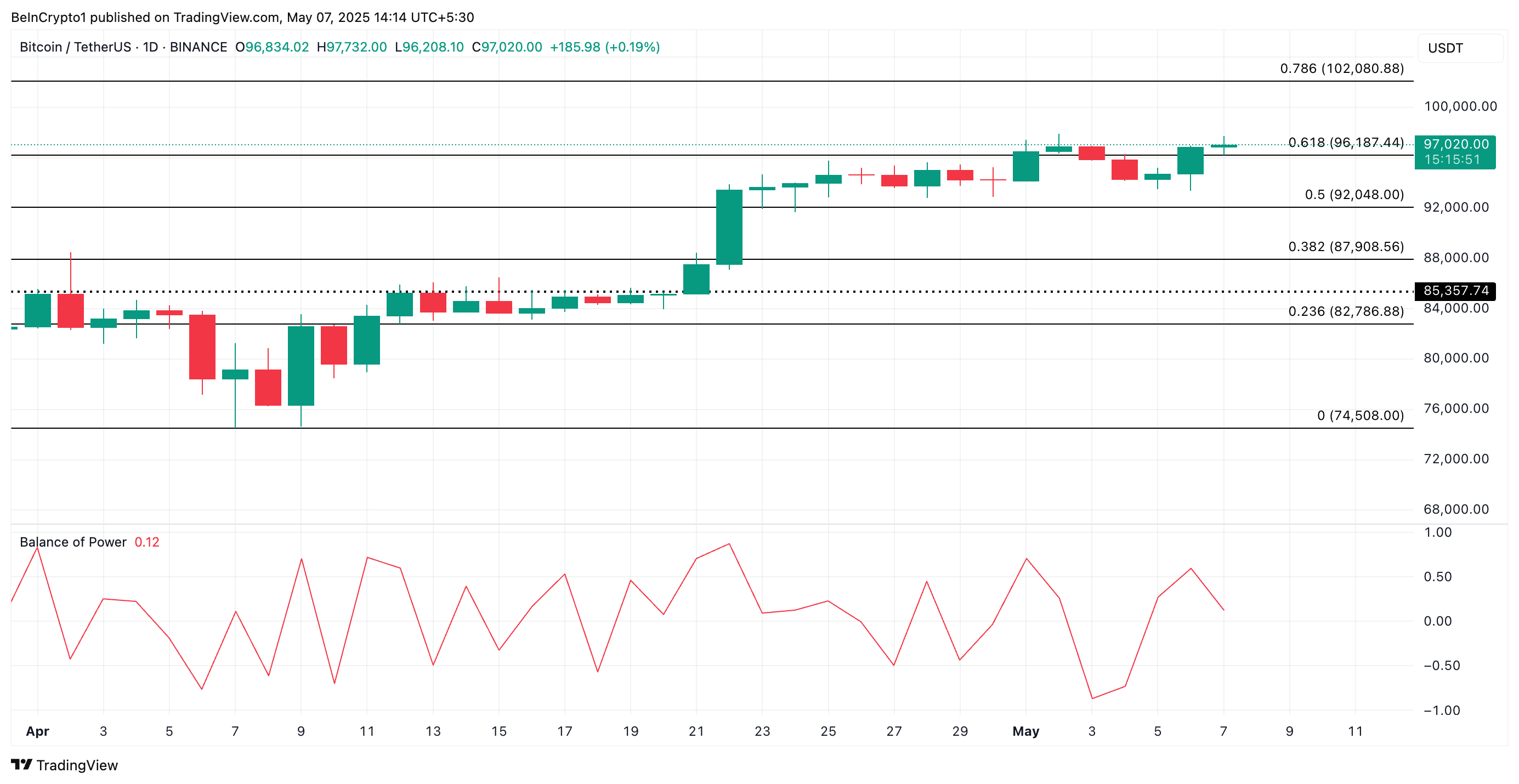

BTC trades at $96,679 at press time, noting a 2% surge over the past day. The coin’s positive Balance of Power (BoP) reflects the steady rise in spot buying activity ahead of the FOMC meeting. As of this writing, this is at 0.10.

This indicator measures the strength of buyers versus sellers by comparing the closing price to the trading range over a specific period. When its value is positive, buyers dominate the market, suggesting bullish momentum and upward pressure on an asset’s price.

If BTC demand rockets and market conditions remain favorable post-FOMC meeting, it could climb toward $102,080.

However, if market volatility triggers a move to the downside, BTC could shed recent gains, breach support at $96,187, and fall to $92,048.