Litecoin (LTC) Surges 10% Despite SEC ETF Roadblock—Traders Shrug Off Regulatory Gridlock

Litecoin bulls just don’t care. While the SEC’s latest ETF delay sent shockwaves through crypto markets, LTC ripped higher—defying gravity with a 10% rally. Here’s how the ‘digital silver’ played its own game.

SEC stalls, Litecoin strolls. The agency’s decision to punt on spot ETF approvals tanked Bitcoin’s momentum, but LTC traders flipped the script. Volume spiked 40% as buyers piled in, turning regulatory uncertainty into pure fuel.

Cheap, fast, and now defiant? Litecoin’s no-frills blockchain has long been the workhorse of payments. But today’s move hints at something sharper—a market calling the SEC’s bluff. (Wall Street’s still waiting for that ‘investor protection’ payoff, by the way.)

What’s next? If this rally holds, LTC could retest its 2024 highs. Or it’s just another crypto fakeout. Either way, today proved one thing: when traditional finance hits the brakes, altcoins still find a way to gun it.

LTC Bounces Back, Yet Profit-Taking Threatens Upside

On Tuesday, after the SEC called for public comments on Canary Capital’s application for a spot Litecoin ETF, LTC plunged to a two-week low of $81.03.

However, the resurgence in trading activity across the broader crypto market over the past day has helped LTC rebound from this dip. It now trades at $91.68, with daily trading volume exceeding $850 million.

But, there is a catch. Key technical and on-chain indicators suggest a potential bearish reversal in the short term, as buyer exhaustion appears on the horizon.

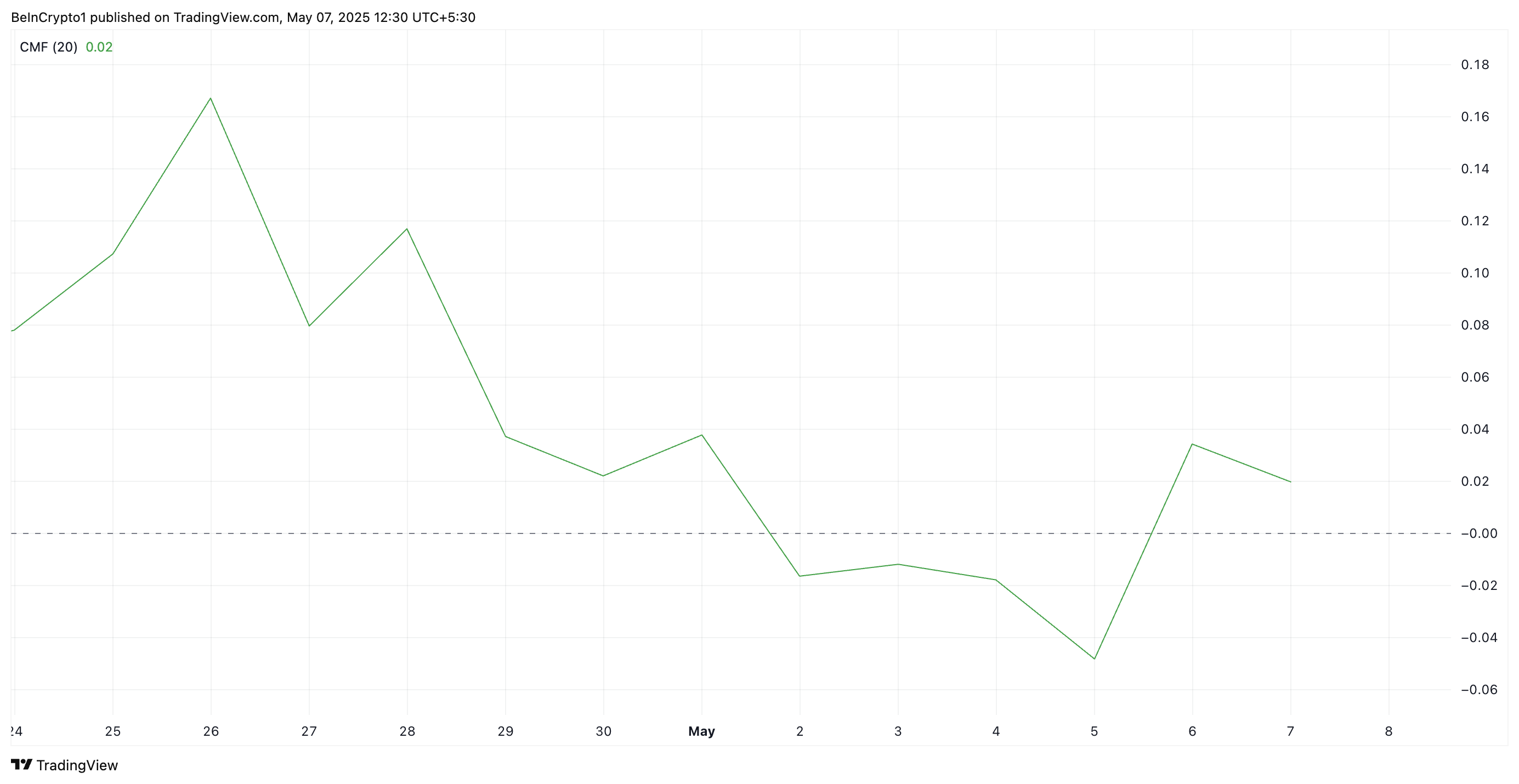

For example, despite LTC’s rally, its Chaikin Money Flow (CMF), which measures buying and selling pressure, has declined, forming a bearish divergence. Readings from the daily chart show that this momentum indicator is declining and poised to breach the center line.

A CMF bearish divergence occurs when the price of an asset makes higher highs while the indicator makes lower highs. This suggests that buying pressure is weakening despite rising prices. The trend indicates a potential reversal or loss of upward momentum in the LTC market.

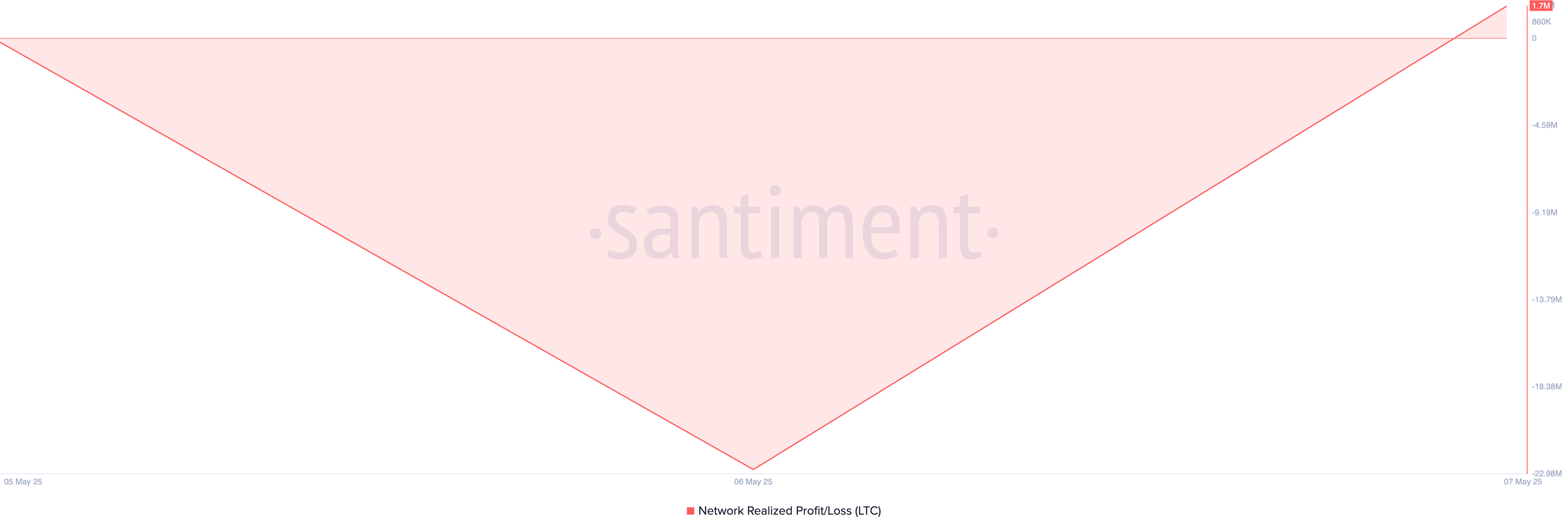

Moreover, on-chain readings show that LTC’s Network Realized Profit/Loss (NPL) is rising, indicating that coin holders are sitting on unrealized gains and may be tempted to sell. At press time, the NPL sits at 1.7 million.

This metric reflects the net profit or loss of all coins moved on-chain, based on the price at which they were last moved. A rising NPL suggests increasing profitability across the network.

This, in combination with LTC’s weakening buy pressure as reflected by its CMF, heightens the risk of short-term selling pressure as traders look to lock in profits.

Can Litecoin Hold Its Gains?

With strengthening bearish pressure, LTC buyers risk facing exhaustion soon. If new demand fails to come into the spot markets to support the LTC token rally, it could lose its current gains and fall to $82.88.

However, a bullish shift in market sentiment could prevent this. If buying activity soars, it could drive LTC’s price to $95.13. A breach of this resistance could catapult the altcoin toward $105.04.