XRP Plunges to 7-Day Low as Bears Pile On—’Smart Money’ Still Loading Bags

XRP gets hammered down to its worst price in a week as derivatives traders short the hell out of it. Classic crypto volatility—or the start of another ’correction’ engineered to shake out retail?

Why this matters: Liquidation cascades love company. With open interest swelling in perpetual swaps, the stage is set for a classic crypto squeeze play. Watch those leverage ratios.

Bonus cynicism: Wall Street would charge you 2-and-20 for this level of predictable price action. In crypto, we call it Tuesday.

XRP Faces Prolonged Sell Pressure

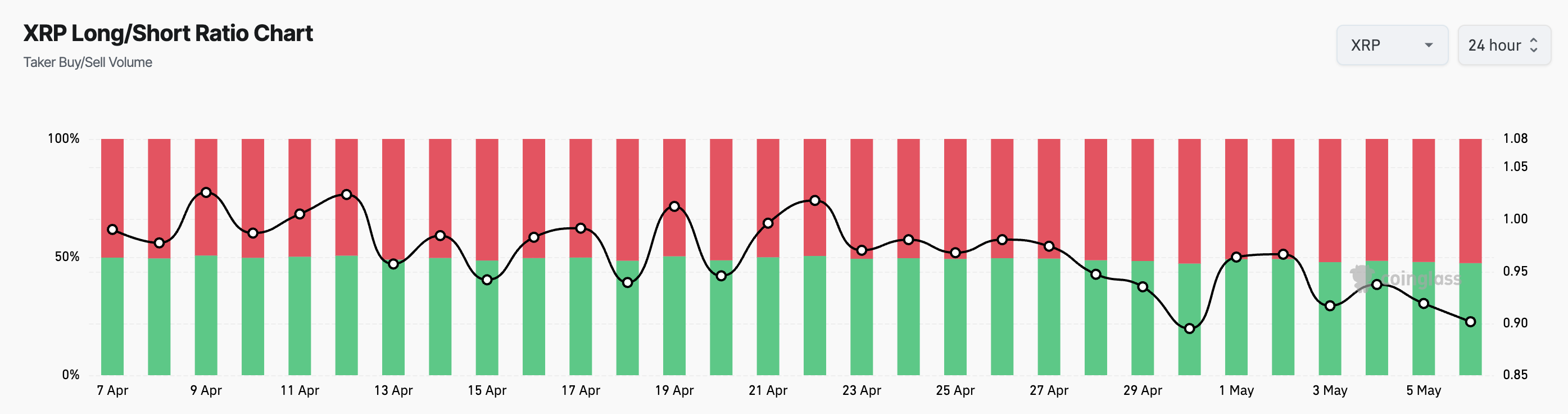

XRP’s long/short ratio reflects the bearish bias dominating its futures market. At press time, the ratio stands at 0.98, indicating more traders are betting against the altcoin.

This ratio compares the number of long and short positions in a market. When an asset’s long/short ratio is above 1, there are more long than short positions, indicating that traders are predominantly betting on a price increase.

Conversely, as seen with XRP, a ratio below one indicates that most traders are positioning for a price drop. This reflects heightened bearish sentiment and growing expectations of continued downside movements.

According to Coinglass, XRP last recorded a long/short ratio above one on April 22. This means it has been over two weeks since bullish positions outnumbered bearish ones in the XRP futures market. The extended period of bearish dominance suggests that market participants have grown increasingly pessimistic about XRP’s short-term prospects.

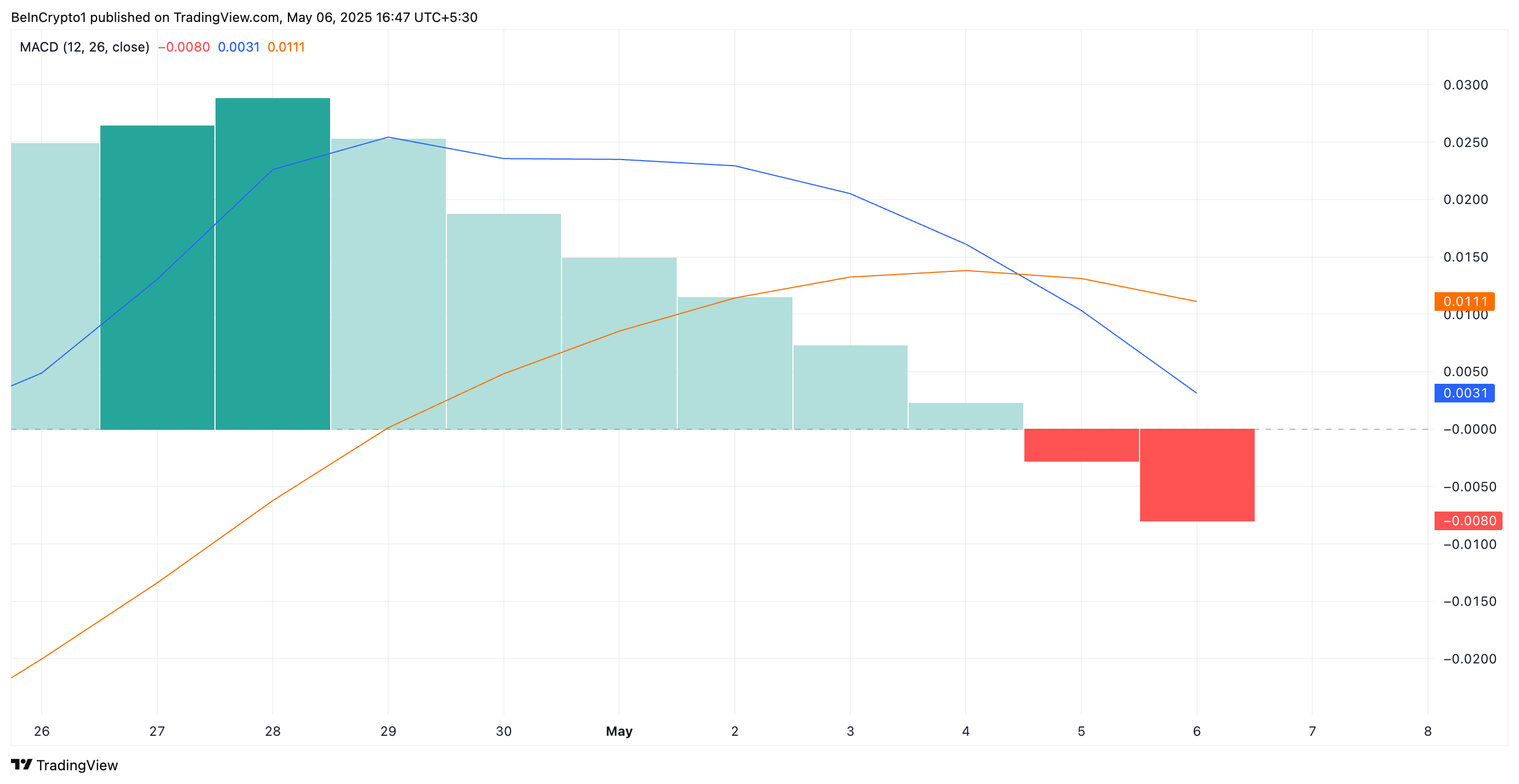

On the daily chart, the newly formed “death cross” by XRP’s Moving Average Convergence Divergence (MACD) indicator supports this bearish outlook. Readings from the XRP/USD one-day chart have revealed that XRP’s MACD line (blue) closed below its signal line (orange) on Monday, forming a death cross.

This pattern is a notable marker of a sustained downtrend and is widely viewed by traders as a sign of weakening price strength. Hence, XRP risks plummeting further.

XRP Holds Key Support at $2.09 — But for How Long?

XRP currently trades at $2.10, resting above the support formed at $2.03. If selloffs strengthen, the support floor could weaken, making way for a price decline toward $1.61.

On the other hand, if the XRP token altcoin sees a spike in new demand, it could reverse the downtrend and climb to $2.29.