Ethereum Validators Dig In as Pectra Looms – Will ETH Price Hold or Fold?

Staking pools aren’t budging—despite the upgrade’s promise of turbocharged efficiency. Why lock up ETH now when you could chase memecoins like the rest of the degenerates?

Pectra’s two-phase rollout aims to slash gas fees and boost scalability. But validators seem skeptical, with staking yields hovering near 3.2% (barely beating Treasury bills).

The real test comes post-upgrade: if institutional money actually shows up this time, we might finally break that pesky $4K resistance. Or watch another ’buy the rumor, sell the news’ bloodbath.

Ethereum Validators Hold Firm Ahead of Pectra

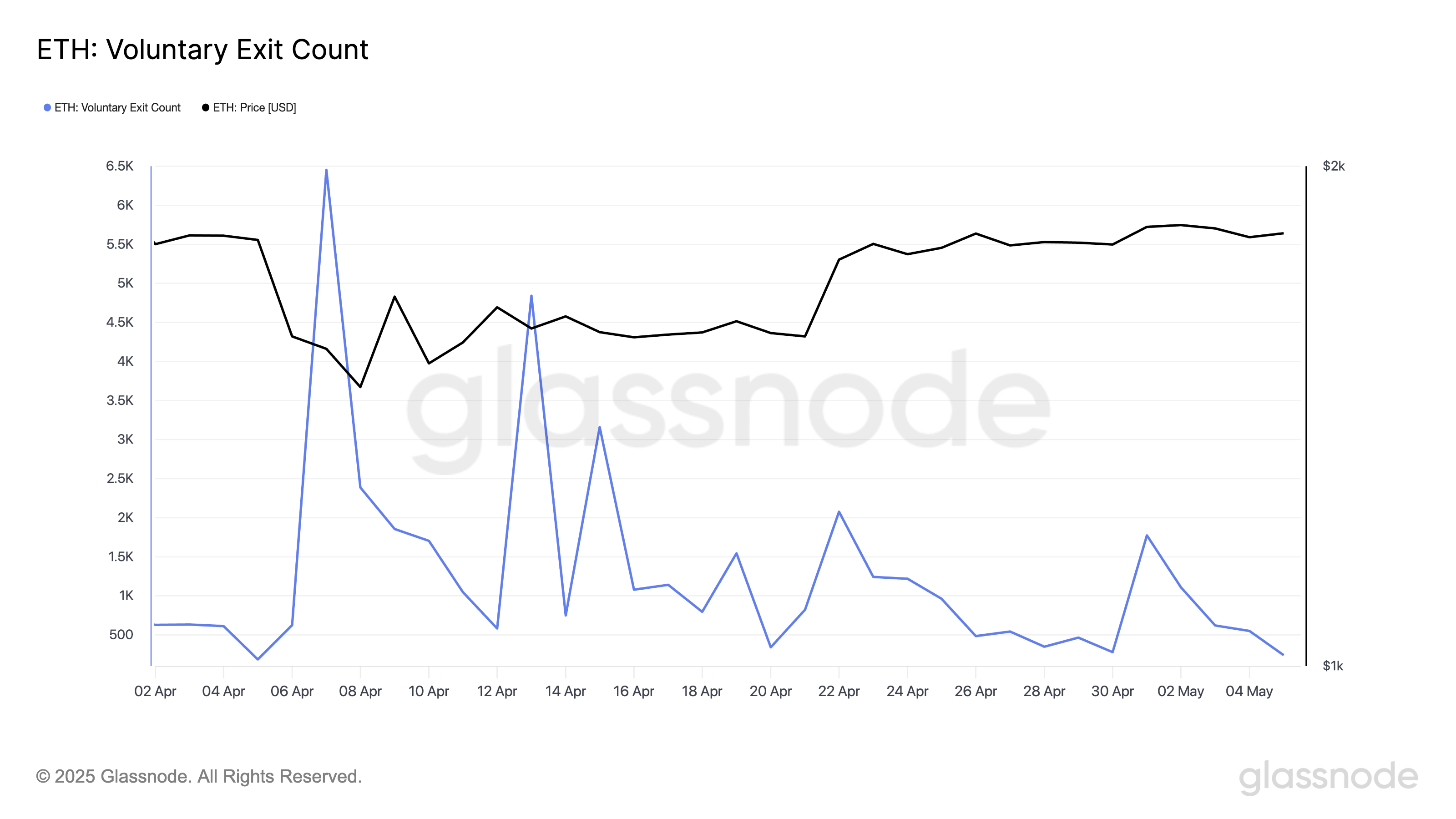

According to Glassnode, Ethereum’s validator voluntary exit count has declined noticeably since May 1, signaling a drop in the number of validators choosing to leave the network. On May 5, only 238 validators exited the network — the lowest daily count of validator exits from Ethereum since April 5.

This trend indicates that more validators are opting to stay put rather than liquidate their staked ETH, a sign of long-term confidence in the network and its coin.

With fewer exits, Ethereum validators appear optimistic about the network’s near-term outlook and the potential impact of the Pectra upgrade. Such sentiment, if sustained, could help lay the foundation for a post-upgrade ETH rally.

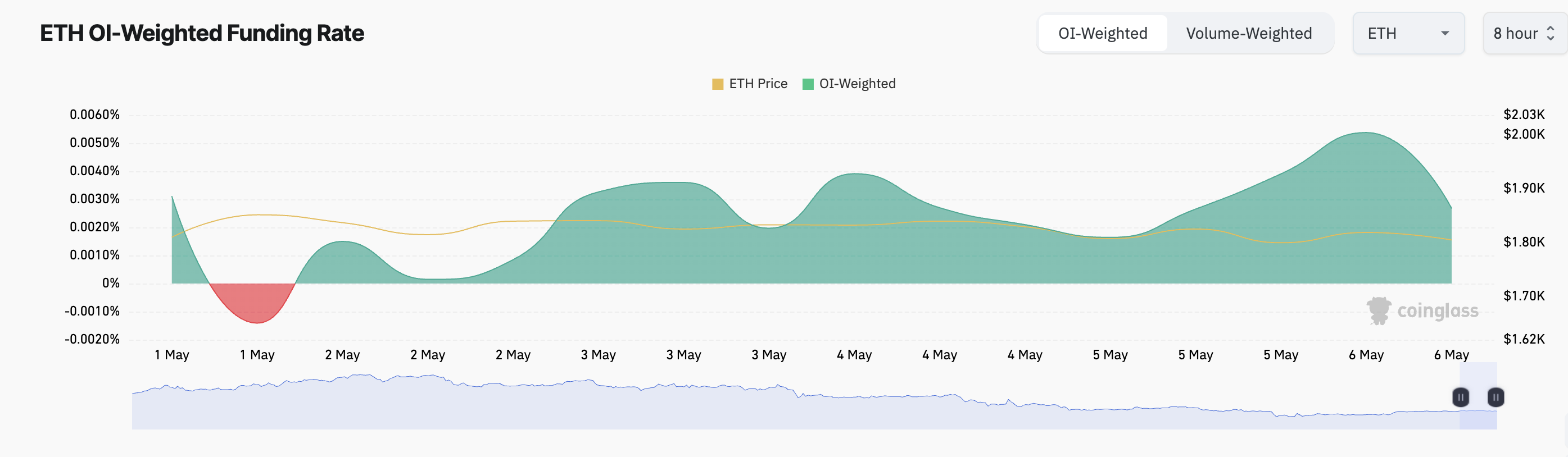

Moreover, the coin’s persistently positive funding rate reinforces the bullish sentiment surrounding ETH. At press time, ETH’s funding rate is 0.0027%, indicating that traders are still willing to pay a premium to maintain long positions.

A positive funding rate suggests bullish sentiment dominates the futures market, as long-position holders pay short sellers to keep their trades open. This dynamic reflects traders’ expectations of upward price movement.

Despite ETH’s continued struggle to break decisively above the $2,000 level, futures traders remain optimistic, consistently placing Leveraged bets in anticipation of a price surge.

Bullish Setup Meets “Sell-the-News” Fears

As the countdown to Pectra ticks down, the fall in validator exit from Ethereum could tighten ETH’s circulating supply, contributing to a bullish breakout post-upgrade. If bullish sentiment persists, ETH’s price could rally to $2,027.

However, the risk of a “sell-the-news” event remains.

If the upgrade fails to meet market expectations or triggers profit-taking, ETH could experience downside pressure despite the optimistic signals from validator behavior. In this scenario, its price could fall to $1,744.