Crypto Whales Gobble Up These 3 Altcoins as May 2025 Trading Kicks Off

Big money moves fast—while retail traders were still nursing their coffee, crypto whales dumped millions into three altcoins this week. Here’s where the smart money parked its bags.

1. BNB: The Exchange Coin That Refuses to Die

Binance’s native token saw surprising accumulation despite regulators’ best efforts—proving once again that in crypto, compliance is optional until it isn’t.

2. Solana: The ’Ethereum Killer’ That Learned to Swim

SOL whales doubled down after last month’s network upgrade, betting that ’web3 scale’ isn’t just another VC buzzword.

3. Arbitrum: The Layer-2 That Ate Wall Street’s Lunch

Institutional inflows spiked as TradFi finally realized—three years too late—that sub-dollar gas fees matter more than golf course handshakes.

Watch these charts. When whales feed, the market usually follows—until the next ’unforeseen’ black swan event wipes out your leveraged long, of course.

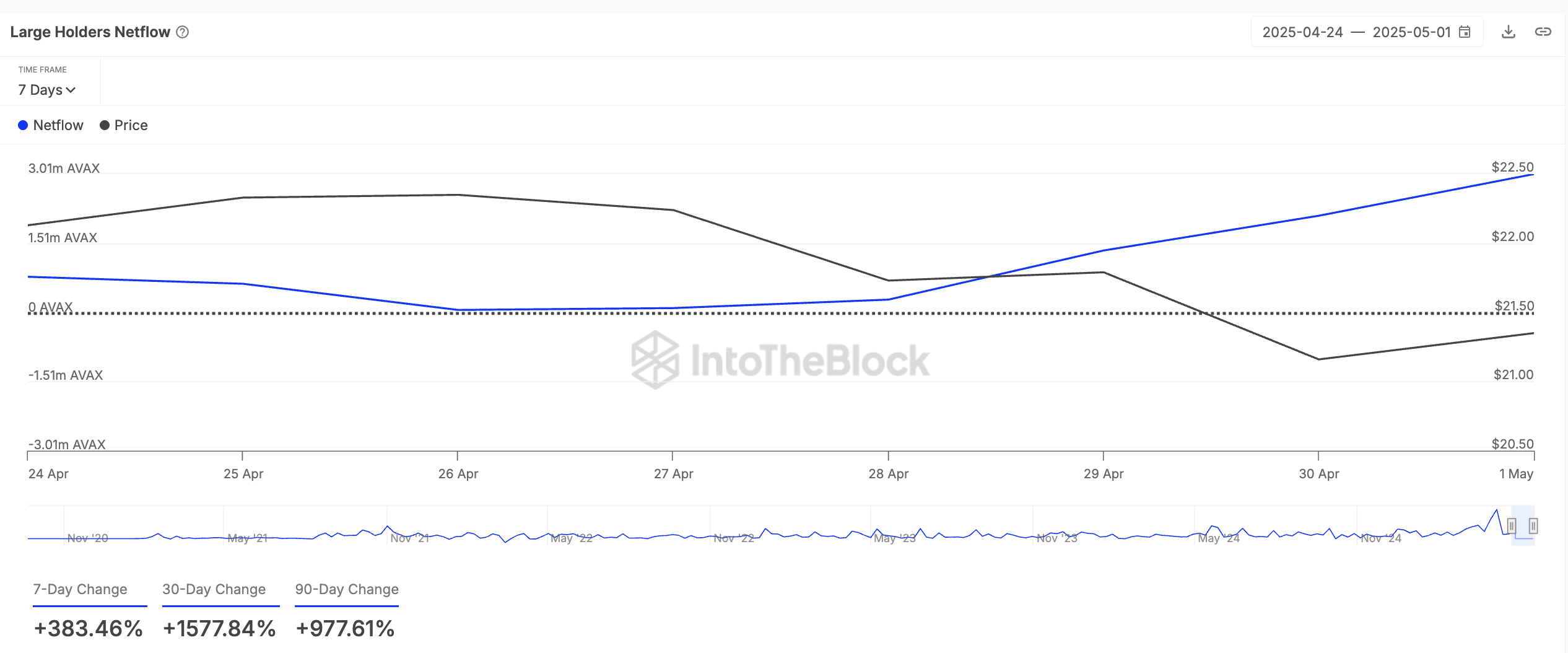

Avalanche (AVAX)

Layer-1 (L1) coin AVAX has seen increased whale attention this week, reflected by the spike in its large holders’ netflow. According to IntoTheBlock, this has rocketed over 380% in the past seven days.

A large holder is a wallet address holding over 0.1% of an asset’s circulating supply. The large holders’ netflow tracks these investors’ buying and selling activity.

When it rises, crypto whales buy more tokens. This bullish signal often prompts retail investors to increase their holdings.

If AVAX’s accumulation trend persists, its price could breach the resistance at $24.28 and rally toward $30.23.

Conversely, if demand wanes, AVAX could fall to $14.66.

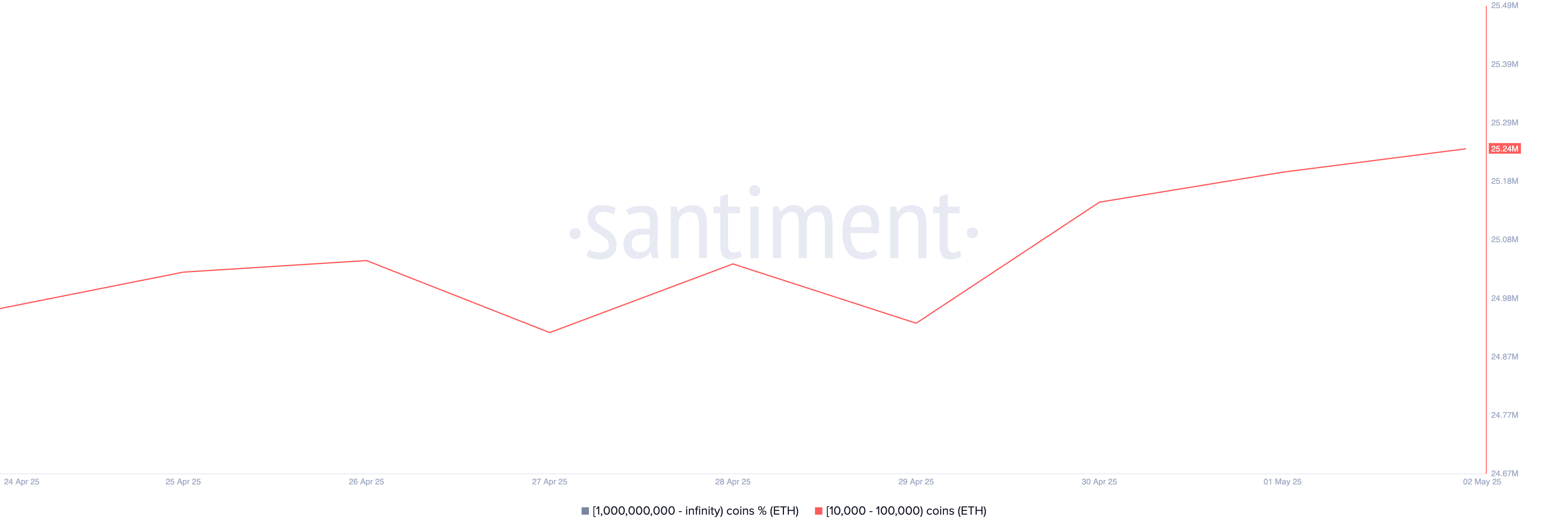

Ethereum (ETH)

Amid the recent broader market rally, ETH has recorded a modest 3% price uptick in the past seven days, buoyed by steady whale accumulation.

According to Santiment, during that period, whale addresses holding between 10,000 and 100,000 coins have acquired 280,000 ETH valued at over $510 million at current market prices.

As of this writing, this cohort of ETH whales controls 25.24 million ETH, their highest holding in the past month. ETH’s price could be driven above the psychological $2,000 mark if whale accumulation persists.

However, if the bears regain dominance, they could push the coin’s price to $1,733.

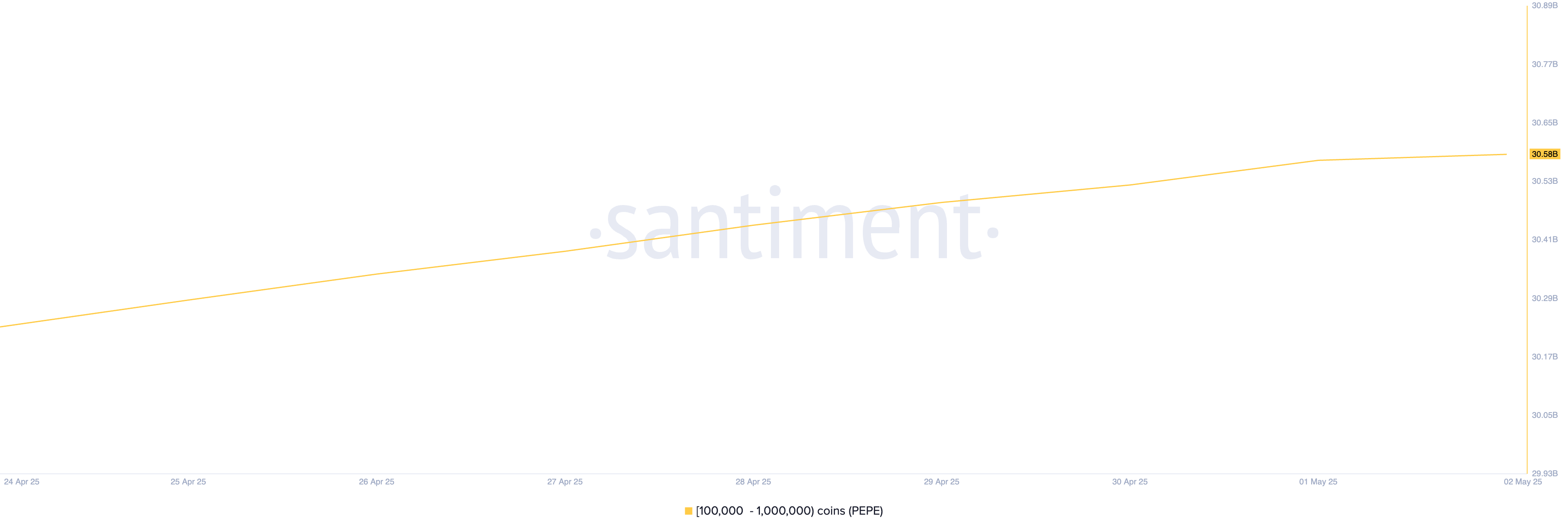

Pepe (PEPE)

Popular meme coin PEPE is another asset that has seen a surge in crypto whale accumulation this week. Per Santiment, wallet addresses that hold between 100,000 and 1 million tokens have bought 350 million PEPE in the past seven days.

At press time, the meme coin trades at $0.0000086. If whale accumulation persists, PEPE could reverse its current downtrend and break above the resistance at $0.0000010.

On the other hand, if sellofs continue, the token’s price could drop to $0.0000052.