Kraken Rakes in $472M Amid Political Chaos—Trump-Era Volatility Pumps Crypto Revenue 19%

Political turbulence becomes Kraken’s profit engine as traders scramble for crypto safe havens. The exchange’s $472 million haul proves once again that when traditional markets tremble, digital assets clean up.

Wall Street’s loss is crypto’s gain—another quarter where ’uncorrelated assets’ magically correlate with brokerage fees. Kraken’s 19% revenue surge reads like a middle finger to legacy finance, with volatility doing the heavy lifting.

Who needs fundamentals when you’ve got former presidents rattling markets? The numbers don’t lie: chaos breeds opportunity, and exchanges always take their cut.

Overview of Kraken’s Q1 2025 Financial Performance

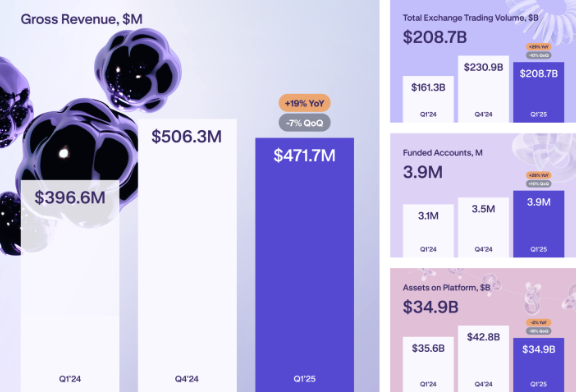

Data from Kraken reveals that its gross revenue reached $472 million, marking a 19% year-on-year growth from 2024. The company’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) stood at $187.4 million. This reflects a 17% increase over the same period.

This growth occurred amid significant volatility in the cryptocurrency market, particularly during the first 100 days of President Donald Trump’s second term, as pro-crypto policies spurred heightened trading activity. Several factors contributed to this performance.

First, the price volatility of Bitcoin and other major cryptocurrencies drove a surge in trading volumes across the industry. According to BeInCrypto data, Bitcoin’s price rose from $69,000 at the start of 2025 to over $94,000 by the end of March, representing a 35% increase.

This growth was bolstered by positive community sentiment following the Trump administration’s plans to establish a national Bitcoin reserve. Against this backdrop, Kraken capitalized on the increased trading wave, with its platform’s trading volume rising by 29%, directly contributing to its revenue growth.

Additionally, Kraken made strategic moves to expand its operations. The company’s official blog on May 1, 2025, revealed the launch of an institutional-grade FIX API for futures trading, boosting monthly trading volumes by 250%.

Furthermore, Kraken’s $1.5 billion acquisition of NinjaTrader in March 2025 enabled the exchange to onboard nearly 2 million new traders and expand into asset classes beyond cryptocurrencies. These initiatives demonstrate Kraken’s efforts to diversify its services and seize market opportunities.

Challenges and Future Outlook

Despite the positive results, Kraken faces several challenges moving forward.

First, competition within the industry is intensifying as major exchanges like Coinbase and Binance continue to expand their market share. This competitive pressure requires Kraken to innovate and enhance its services to continually retain customers.

Second, the reliance on market volatility to drive revenue poses a significant risk, particularly if the crypto market enters a phase of consolidation or decline. Finally, regulatory pressures in the US and globally remain critical to monitor, as any policy changes could impact Kraken’s operations.

On the outlook front, Kraken plans to expand into the Asian market, where crypto user growth is accelerating. The launch of Kraken Pay and the expansion of on-chain staking in Q1 2025 also indicate the company’s efforts to diversify revenue streams. However, to sustain its growth momentum, Kraken must develop a long-term strategy to reduce its dependence on market volatility and strengthen its competitive edge against rivals.