World Liberty Financial’s $1 Stablecoin Smashes $2B Market Cap—Bankers Reach for Alka-Seltzer

Another day, another stablecoin milestone—this time it’s the institutional darling from World Liberty Financial notching a $2 billion valuation while traditional banks still struggle with Zelle outages.

The USD-pegged token now joins the big leagues, proving that even in 2025, Wall Street would rather rebrand blockchain than rebuild its own creaking infrastructure.

Fun fact: That $2B market cap could buy you 400 million fractional shares of their own overpriced stock.

USD1 Stablecoin’s Growth: From $128 Million to $2 Billion

WLFI co-founder Zach Witkoff shared the development in the latest X (formerly Twitter) post.

“Proud to announce that @worldlibertyfi USD1 stablecoin has officially crossed $2 billion in market cap. Proud of the team, onwards!” Witkoff posted.

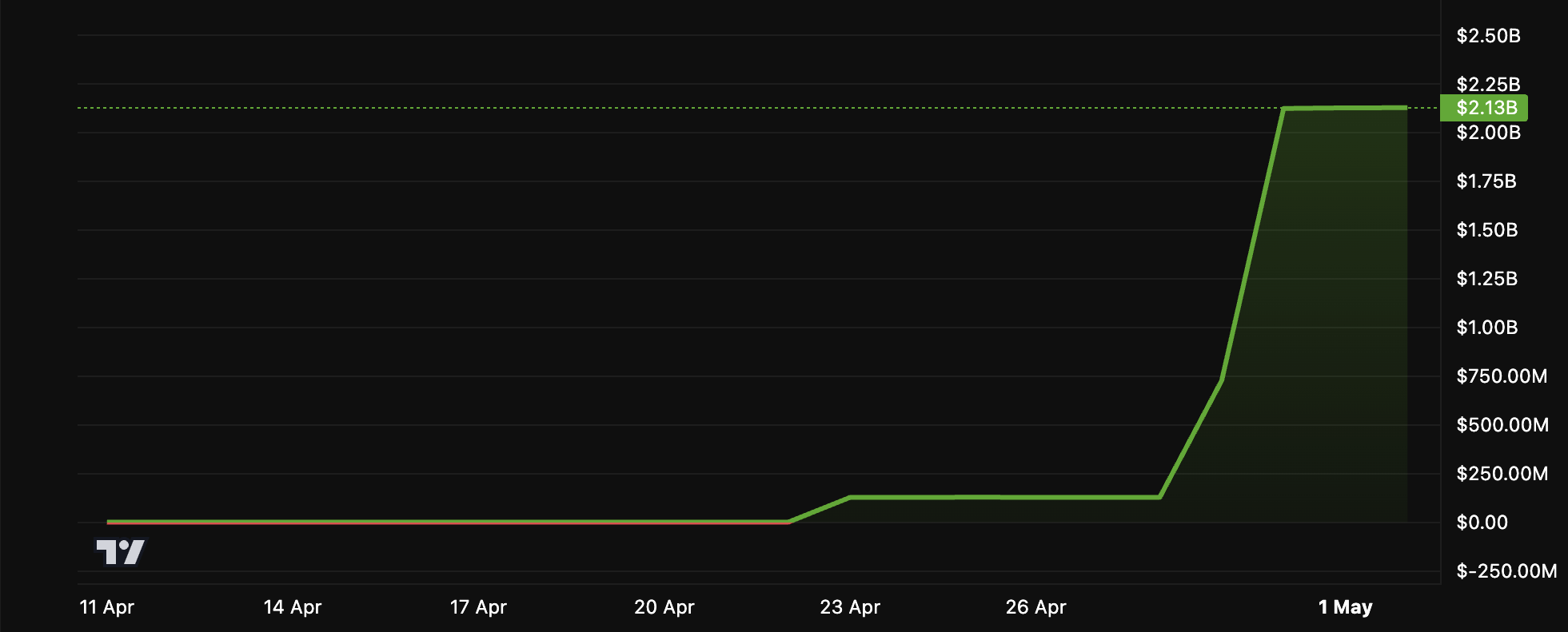

Data from BeInCrypto shows that USD1 experienced significant growth over a short period. On April 28, its market cap was $128 million. However, by the next day, it surged to $1 billion.

“Congratulations to the @worldlibertyfi team on USD1 reaching a $1 billion market cap,” BitGo wrote on X.

That’s not all. By April 30, the market cap doubled to $2.1 billion, ranking USD1 57th among all cryptocurrencies and 7th among stablecoins. It overtook established players like PayPal USD (PYUSD) and First Digital USD (FDUSD).

In fact, the surge has also solidified USD1’s standing on the Binance Smart Chain, where it now ranks as the second-largest stablecoin.

This highlights the increasing adoption and trust in USD1. The ascent positions it as one of the fastest-growing decentralized stablecoins in the market since its launch in late March.

Data from Dune’s blockchain analytics platform provides further insight into the factors driving this expansion. A series of minting events in the last week of April catalyzed the stablecoin’s market cap increase to over $2 billion.

These minting activities align with WLFI’s strategic efforts to expand the token’s circulation. Earlier this month, the DeFi project proposed a USD1 airdrop to early supporters. As BeInCrypto reported, the airdrop is intended to test the on-chain distribution system, reward adopters, and enhance visibility ahead of a full-scale deployment.

USD1’s rise, however, has not been without scrutiny. The project has drawn attention due to President Donald Trump’s involvement, raising concerns among lawmakers about potential conflicts of interest.

Despite this, USD1’s market performance indicates strong investor confidence. The stablecoin’s rapid growth suggests it may continue to play a significant role in the digital asset market. However, its future will likely depend on both market dynamics and regulatory developments.