Trump’s ’Made in USA’ Crypto Experiment: A 100-Day Postmortem

When the 45th president slapped ’America First’ on everything from steel tariffs to meme coins, the crypto world braced for impact. Here’s how the gambit played out—and why Wall Street barely blinked.

The Patriot Pump (And Subsequent Dump)

Flagship ’USA Token’ surged 320% on inauguration hype—then cratered faster than a Trump casino stock when traders realized patriotism doesn’t mint liquidity. By day 100, it was trading below pre-launch levels, proving once again that nationalistic branding can’t override tokenomics.

Regulatory Roulette

The administration’s simultaneous embrace of ’digital dollar’ talks and crackdown on non-KYC coins created whiplash. Mining operations fled to cheaper jurisdictions, because apparently ’Made in America’ doesn’t extend to subsidizing energy bills.

The Legacy

Eight years later, the experiment serves as a cautionary tale: mixing populism with DeFi yields predictable results—a lot of hype, volatile charts, and hedge funds quietly shorting the whole narrative from their offshore accounts.

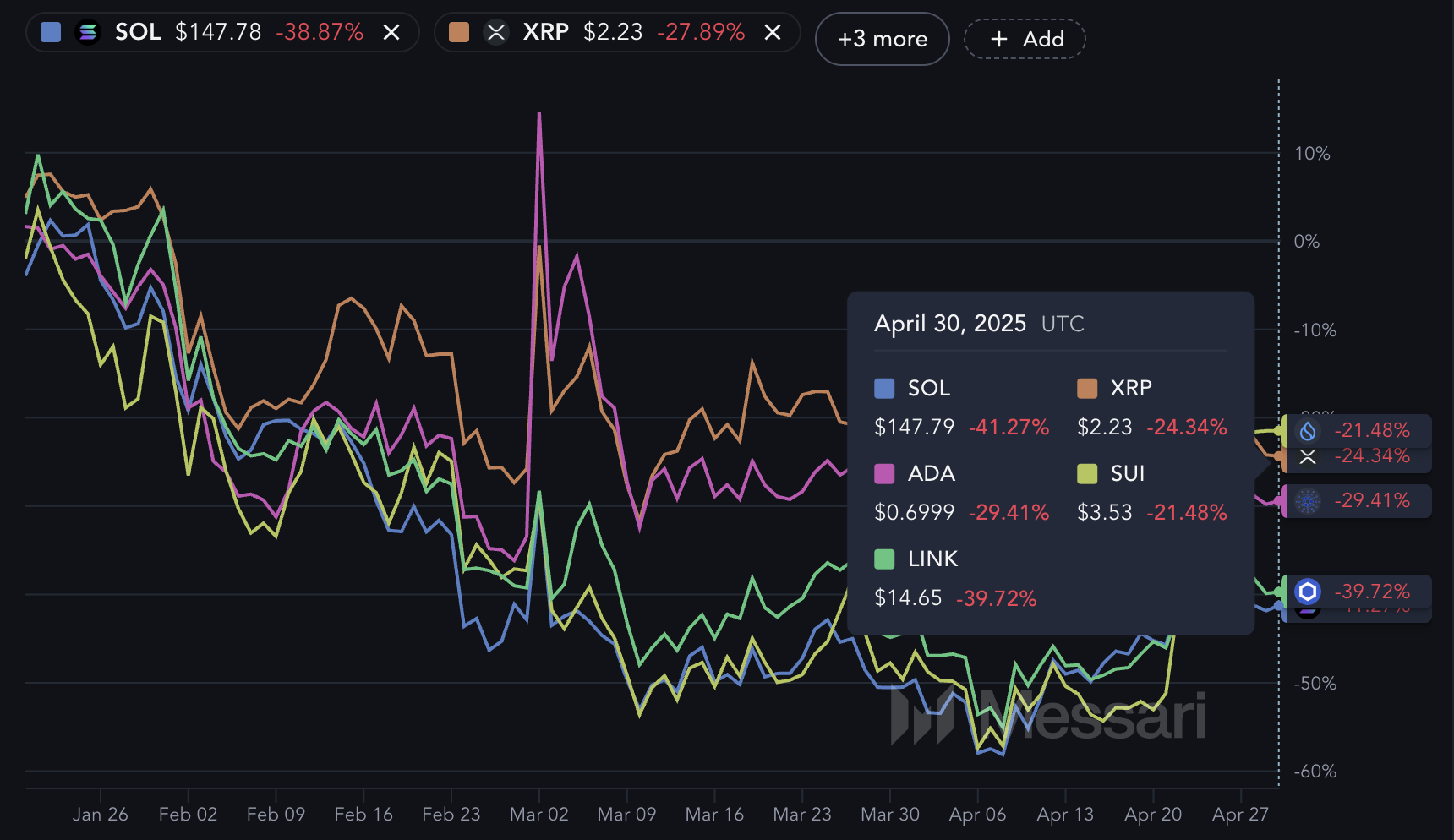

Made in USA Coins Struggle Under the Trump Era

All five leading “Made in USA” coins have declined by at least 20% since January 20, the day of Trump’s inauguration. While recent short-term gains have helped improve sentiment, the broader 100-day trend remains negative for these U.S.-linked assets.

This performance comes despite expectations of a more favorable environment for crypto under the current administration.

Solana (SOL) is the weakest performer in this group, down over 41% since Trump took office, even after gaining more than 18% in the past 30 days.

On the other hand, SUI has rallied 58% in the same period, supported by strong growth in meme coin trading and decentralized exchange (DEX) volume. Recently, it became the fifth-largest chain by DEX activity.

ADA, LINK, and XRP have all posted modest gains between 7% and 10% over the past month, but remain down more than 24% in the first 100 days of the administration.

The overall performance of Made in USA coins has diverged from initial expectations following Trump’s return, which included promises of a more crypto-friendly stance.

While the SEC, now under Paul Atkins, has dropped several cases against crypto firms, removing regulatory overhang, other policy developments may limit the upside.

In particular, ongoing trade pressures tied to Trump’s tariff strategy may create additional headwinds for U.S.-linked crypto assets.

Despite ETH and DOGE Losses, Non–USA Coins Hold Up Better

Among the five largest non–USA coins, only two have posted significant losses over the last 100 days. Ethereum (ETH) has fallen by more than 43%, and Dogecoin (DOGE) has fallen by nearly 51%.

These declines stand out sharply, especially given the more stable performance of other top assets. Bitcoin (BTC) is down just 6% in the same period, while BNB has slipped by nearly 12%.

Short-term trends offer a more balanced view. Bitcoin has gained nearly 16% over the past 30 days, reflecting stronger momentum than its peers.

DOGE is up more than 7% in the same window, while BNB and ETH have remained largely flat. TRON (TRX) is the only top coin outside the US-linked group to post gains over both timeframes, up 7.5% over the last 100 days.

The broader group of global assets has fared relatively better than Made in USA coins. Despite steep losses in ETH and DOGE, the group has outperformed Made in USA coins like SOL and ADA, many of which have dropped more than 20–40% in the same timeframe.

This divergence suggests that while regulatory sentiment in the US may improve, macro and policy-specific headwinds could weigh more heavily on domestic crypto assets.