Celsius Founder Faces Prison as CEL Token Defies Logic With 70% Surge

Alex Mashinsky could serve two decades behind bars for his role in Celsius Network’s collapse—but the platform’s token just mooned harder than a DeFi degens’ portfolio during a bull run.

Justice moves slow, but crypto moves faster: While prosecutors build their case, CEL ripped past resistance levels like a trader ignoring stop-losses. The ultimate ’buy the rumor, sell the news’ play—except the news is potential federal prison time.

Wall Street would call this ’irrational exuberance.’ Crypto calls it Tuesday. Maybe the market’s betting on jailhouse innovation—Mashinsky coding the next Ponzi from a prison laptop?

CEL Token Soars 70% Amid Mashinsky’s 20-Year Sentence Risk

The US DoJ issued the request in a sentencing memo filed on Monday, April 28, asking the court for a 20-year jail term for Alex Mashinsky.

The prosecution calls Mashinsky out for “deliberate, calculated” fraud, which resulted in the loss of almost $7 billion in customer funds.

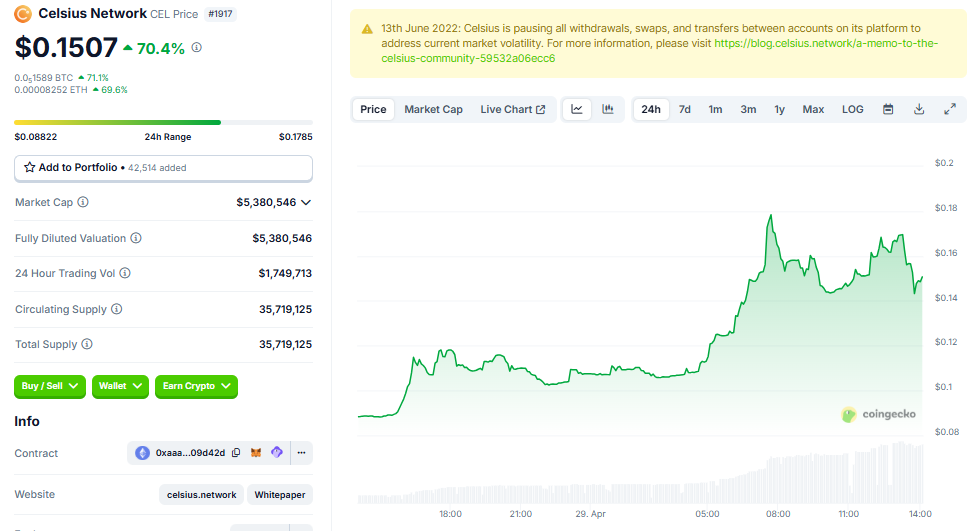

Despite this report, CEL, the powering token for the Celsius Network, is up by over 70%. As of this writing, data on CoinGecko shows CEL was trading for $0.1507.

This request comes five months after Mashinsky’s guilty plea, following fraud charges, including CEL token market manipulation, and avoiding a January trial. Commodities fraud and price manipulation were among the schemes linked to Celsius’s collapse.

According to the DoJ, while Mashinsky pled guilty, he still refuses to accept responsibility. Instead, he is reportedly shifting blame to regulators, market conditions, and even his victims.

“Mashinsky’s crimes were not the product of negligence, naivete, or bad luck. They were the result of deliberate, calculated decisions to lie, deceive, and steal in pursuit of personal fortune,” the DoJ contends.

Meanwhile, this case traces back to July 2023 when the US SEC (Securities and Exchange Commission) sued Celsius and Mashinsky. The securities regulator cited the two defendants for:

- Misrepresentation of the central business model and risks to investors.

- Misrepresentation of financial success.

- Misrepresentation of the safety of customers’ assets on the Celsius platform.

- Market manipulation of Celsius (CEL) tokens

Beyond the DoJ and SEC, other agencies, including the CFTC (Commodities Futures Trading Commission), FTC (Federal Trade Commission), and the US Government, had also filed similar charges against Celsius and Mashinsky.

“SEC, DOJ, CFTC, and FTC all sued/charged Celsius and Mashinsky in the past hour. Rough day,” db reported at the time.

Notably, this happened a year after Mashinsky stepped down as CEO of Celsius. Over the years, a key highlight in the case includes Mashinsky claiming to have withdrawn $10 million ahead of the platform’s bankruptcy.

Notwithstanding, the judge froze his assets and recently turned down his request to dismiss fraud charges.

Meanwhile, efforts to make victims whole have included unstaking the platform’s Ethereum (ETH) holdings. In January 2024, Celsius informed its followers on social media that it was working to compensate victims.

“The significant unstaking activity in the next few days will unlock ETH to ensure timely distributions to creditors,” read the post.

More recently, Celsius announced the second payout to creditors, citing $127 million in Bitcoin (BTC) and US dollars based on eligibility.

Mashinsky’s sentencing is set for Thursday, May 8. If the court agrees to the US DoJ’s push for a 20-year sentence, Alex Mashinsky would have received a lesser sentence than FTX’s Sam Bankman-Fried (SBF) 25-year jail term.