Bitcoin Nears Euphoria Zone as 85% of Circulating Supply Turns Profitable

BTC holders are swimming in unrealized gains—classic ’number go up’ psychology at work. When this much supply flips green, history suggests two outcomes: a blow-off top or a brutal reckoning for latecomers.

Key metric flashing: The MVRV ratio (market-value-to-realized-value) now mirrors pre-bull-run peaks. Translation? Traders are either early...or about to become exit liquidity for whales.

Wall Street’s reaction? Suddenly remembering blockchain exists—just in time to sell the ’digital gold’ narrative at a 300% markup. Meanwhile, Bitcoin’s actual utility—censorship-resistant transactions—gets lost in the speculative frenzy.

BTC Enters Bullish Territory, but Analysts Warn of Possible Pullback

BTC’s supply in profit measures the percentage of coin holders who acquired their assets at prices lower than the current market value. When this number rises, it indicates broad investor confidence and strong capital inflows into the asset.

In a new report, pseudonymous CryptoQuant analyst Darkfost found that more than 85% of BTC’s circulating supply is currently held in profit. Although this trend represents a bullish signal, it comes with a catch.

“Having a large portion of the supply in profit is not a bad thing, quite the opposite. Of course, there are certain levels that are more “comfortable” than others, but generally, an increase in the supply in profit tends to fuel bullish phases,” Darkfost wrote.

According to the analyst’s note, the market is now entering the euphoric zone, a phase that emerges when the profit supply approaches or exceeds 90%. These levels, while bullish, have often coincided with local market tops as traders begin to lock in profits, triggering short- to medium-term corrections.

“Historically, when the supply in profit surpassed the 90% threshold, it consistently triggered euphoric phases, and we are now approaching that level. However, these euphoric phases can be short-lived and are often followed by short- to medium-term corrections.”

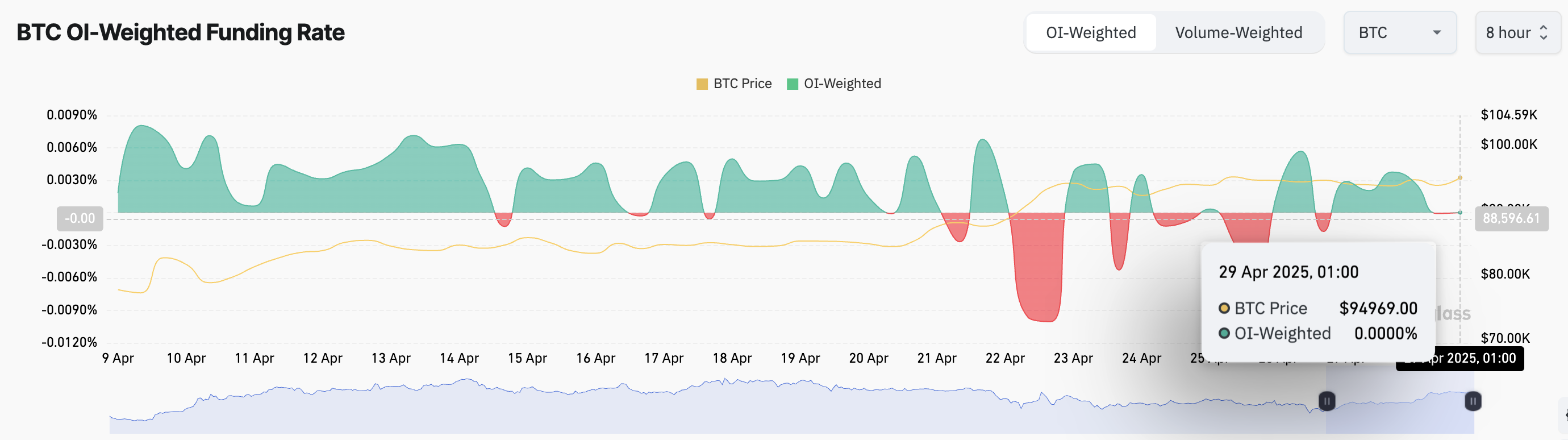

Funding Rate Signals Market in Wait-and-See Mode

Interestingly, BTC’s funding rate remains relatively balanced, indicating that the market is in a state of anticipation. At press time, the coin’s funding rate is 0%.

The funding rate is a periodic payment between traders in perpetual futures markets, used to keep contract prices aligned with the spot market. As with BTC, when an asset’s funding rate is 0%, it indicates a neutral market sentiment, where neither long nor short positions dominate.

This signals that BTC investors are waiting for a catalyst to provide clearer direction. This neutral market sentiment and rising profit supply set the stage for potential price volatility in the NEAR term.

Bitcoin Holds Firm Below Resistance

At press time, the king coin trades at $95,125, resting below a major resistance level of $95,971. Despite recent market volatility, BTC demand among spot market participants remains significant, as reflected by its Relative Strength Index (RSI), which currently stands at 68.21.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a price decline. Converesly, values under 30 indicate that the asset is oversold and may witness a rebound.

BTC’s RSI reading indicates room for further price growth before the coin becomes overbought. If demand strengthens, the coin could break above the $95,971 resistance and rally to $98,983.

However, if bearish sentiment grows, BTC could resume its downtrend and fall to $91,851.