Ethereum Whales Return as ETF Inflows Break 8-Week Drought

Big money is circling back to ETH—just as Wall Street’s latest crypto ETF flavor-of-the-month starts showing green shoots.

After two months of bleeding out, Ethereum ETFs posted net inflows this week. The sudden reversal suggests institutional players might be positioning for the next leg up.

Whale activity spiked simultaneously, with several nine-figure wallets waking from dormancy. Coincidence? The blockchain never lies—but hedge fund prospectuses often do.

ETH Whale Accumulation and ETF Inflows Hint at Imminent Price Surge

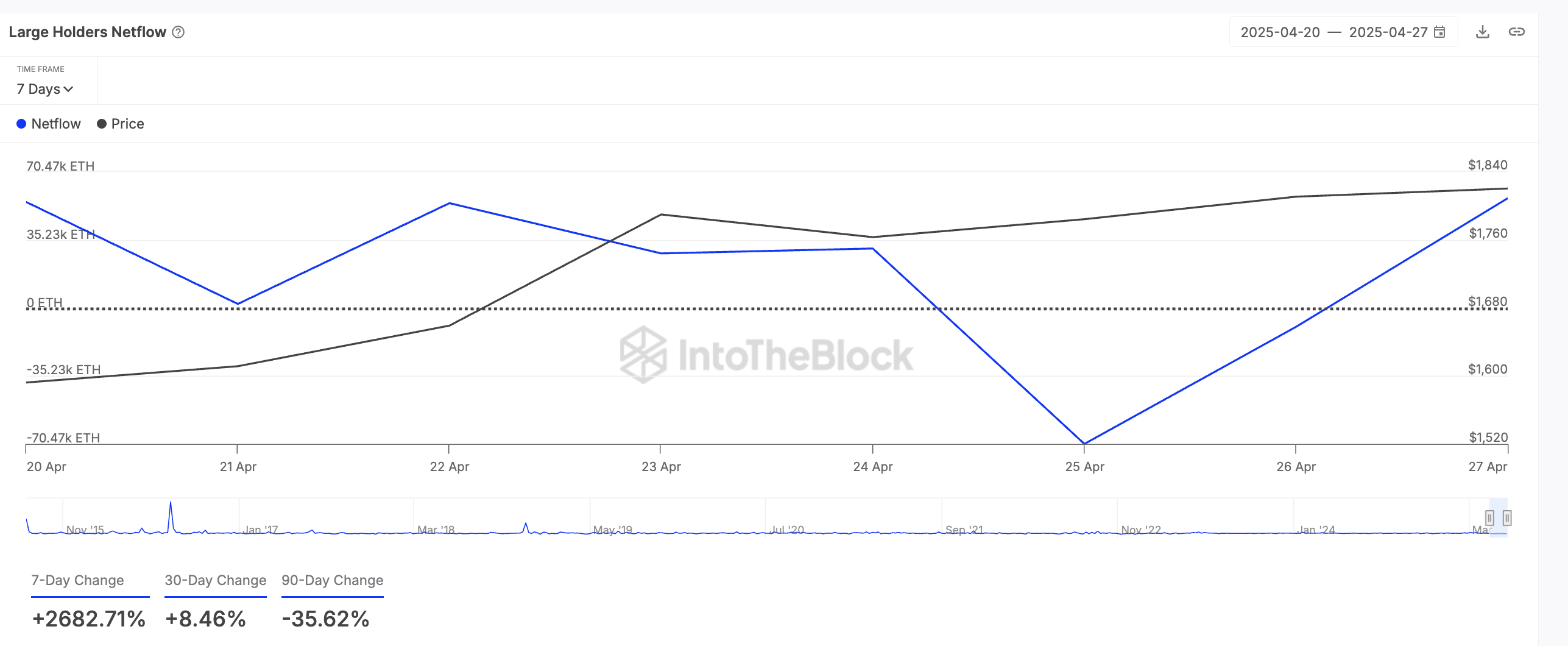

According to on-chain data, leading altcoin ETH has noted a significant spike in its large holders’ netflow over the past week. According to the on-chain data provider, this has rocketed 2682% in the past seven days.

Large holders of an asset refer to whale addresses holding more than 0.1% of its circulating supply. The large holders’ netflow metric tracks the difference between the coins these investors buy and the amount they sell over a specific period.

When an asset’s large holders’ netflow surges, its whale investors are ramping up their coin accumulation. This accumulation trend suggests a belief in ETH’s future upside, as major holders tend to act when they see value at current price levels.

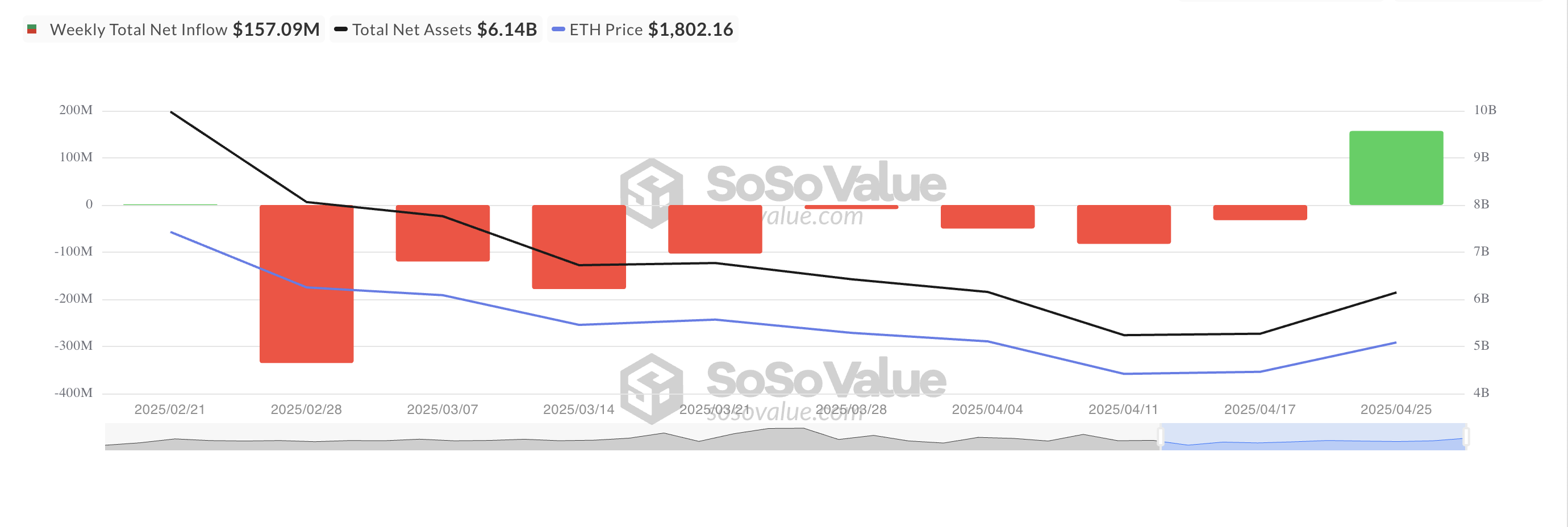

Adding to the bullish narrative, ETH-backed ETFs recorded their first weekly net inflow in eight weeks. According to SosoValue, net inflows into ETH-backed ETFs reached $157.09 million between April 21 and April 25, reversing an eight-week streak of outflows totaling over $700 million.

With major players re-entering the market, ETH could be poised for further upside in the NEAR term.

Ethereum Sees Bullish Momentum

On the technical side, ETH’s positive Balance of Power (BoP) highlights the resurgence in demand for the leading altcoin. This is currently at 0.31.

This indicator measures the buying and selling pressure of an asset. When its value is positive, pressure outweighs selling pressure. This indicates strength in the ETH’s price movement and signals further potential upward momentum. If this happens, ETH could rally back above $2,000 to exchange hands at $2,027.

However, if market sentiment worsens, ETH could shed recent gains and plummet to $1,385.