Tether Prints $1B USDT Overnight—Bull Market Rocket Fuel or Just Printer Go Brrr?

Tether’s minting press fires up again—another billion USDT hits the crypto ecosystem overnight. Market watchers split: bullish signal or just stablecoin shenanigans?

Liquidity tsunami incoming? The sudden injection sparks speculation of institutional accumulation. Exchanges’ USDT reserves already swelling—Binance’s war chest up 18% this month alone.

But let’s be real—when has Tether ever needed actual dollars to back these moves? The ’full reserves’ claim gets its quarterly stress test from skeptical traders rolling their eyes.

One thing’s certain: when the stablecoin printer hums, crypto traders start reaching for their moon helmets. Whether this fuels a legitimate rally or just another paper paradise remains to be seen.

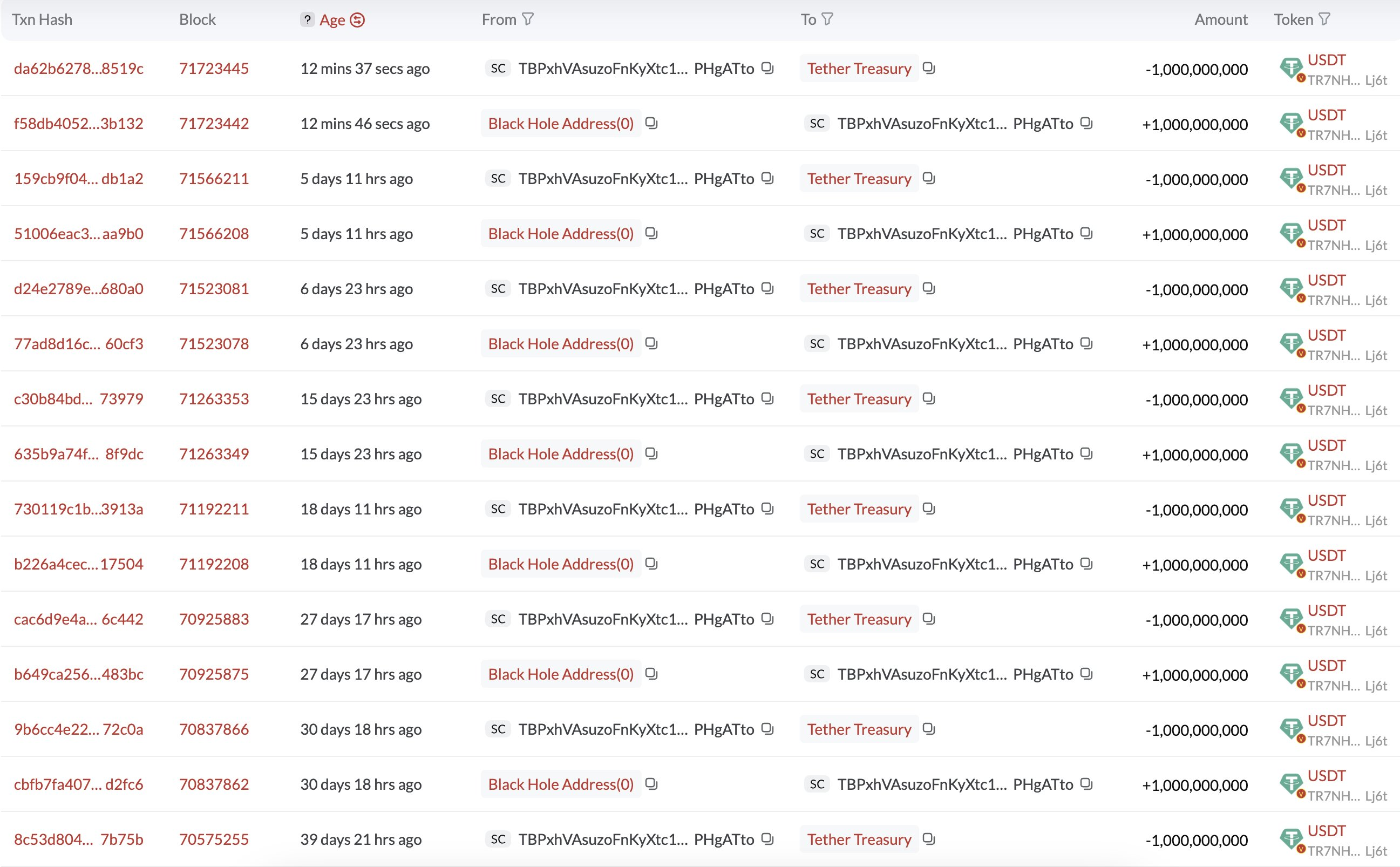

Tether’s Major USDT Minting

Tether, the world’s largest stablecoin network, has been steadily minting USDT tokens for the past few months. It minted 19 billion in a spree between November and December last year and added another billion less than a week later.

Today, Tether’s new action on TRON could have a powerful impact on the market.

This new USDT minting could have broad market implications for a few reasons. Major net issuances often reflect growing demand from institutions and OTC desks that need large blocks of stablecoins for cross-border settlements or build-up before buying digital assets.

For example, when it issued 1 billion USDT a little over a year ago, this caused Bitcoin’s price to spike.

In isolation, this single issuance could push the needle in a bullish direction. However, since Lookonchain data shows a pattern of major mintings, Tether could spur a lot of optimism.

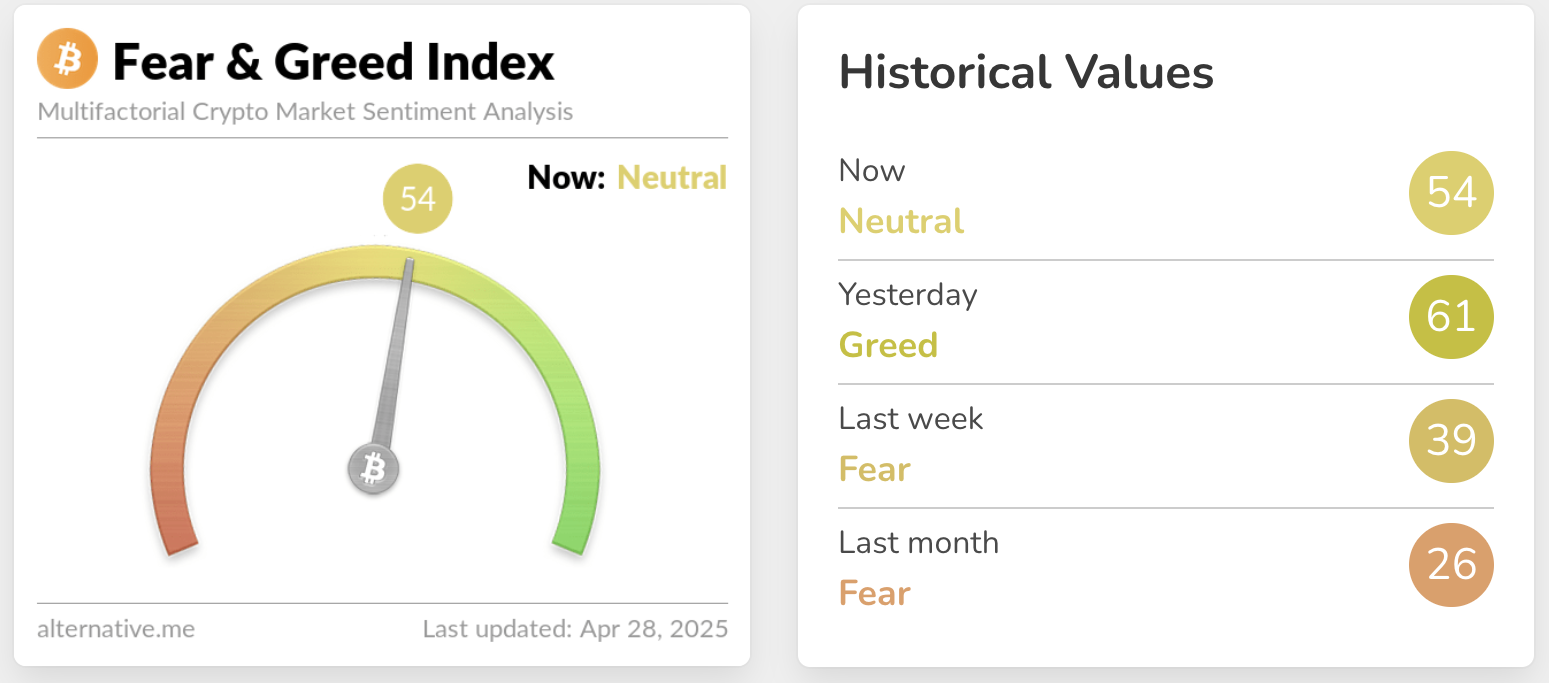

Despite recently hitting a three-year low, the Crypto Fear and Greed Index has been trending upward. It’s currently in Neutral but briefly exhibited Greed yesterday.

In other words, the market is primed to accept a bullish signal, and Tether’s major minting may provide it.

Still, not every mint equates to immediate market deployment. True bullish pressure arrives only when those new USDT hit exchange wallets. Luckily, that seems like a very achievable goal.

Tether has a long history of using Tron’s blockchain for USDT mintings, and the two firms enjoy active cooperation today. Hopefully, this will help ensure these new tokens quickly reach exchanges and the broader market.

If so, Tether could aid a preexisting trend of fresh inflows to the crypto sector.