Monero (XMR) Surges 40% Following $330M ’Privacy-Preserving’ Transaction—Regulators Fume

Privacy coin Monero (XMR) rockets upward as a shadowy nine-figure transfer sparks debate—and predictable pearl-clutching from legacy finance.

The Pump No One Wants to Explain

A single $330M XMR transaction—untraceable by design—triggered the rally. Chainalysis analysts mutter about ’laundering red flags’ while crypto traders shrug and buy the dip.

Privacy vs. Paper Trails

The surge highlights crypto’s eternal tension: Monero’s bulletproof anonymity attracts both libertarians and, well, folks who really need bulletproof anonymity. Meanwhile, SEC lawyers reportedly started drafting subpoenas mid-eye-roll.

The Ironic Footnote

Funny how ’suspicious activity’ always seems to pump the price. Almost like... nah, couldn’t be that exchanges profit from volatility. (Cue gasps from Wall Street’s ’clean money’ brigade—you know, the guys still paying billions in LIBOR fines.)

What’s Behind Monero’s (XMR) 40% Surge?

According to a post by ZachXBT on X today, a theft involving 3,520 Bitcoin (BTC), equivalent to $330.7 million, occurred. The stolen funds were quickly converted into XMR through several instant exchanges.

“Nine hours ago a suspicious transfer was made from a potential victim for 3520 BTC ($330.7M). Theft address: bc1qcrypchnrdx87jnal5e5m849fw460t4gk7vz55g. Shortly after, the funds began to be laundered via 6+ instant exchanges and were swapped for XMR, causing the XMR price to spike 50%,” ZachXBT reported.

However, ZachXBT did not reveal any clues about the entity behind the suspicious wallet address. Smokey, Polygon’s Community Lead, raised questions about whether this could be a new hack involving North Korea. Yet, ZachXBT believed that it was unlikely.

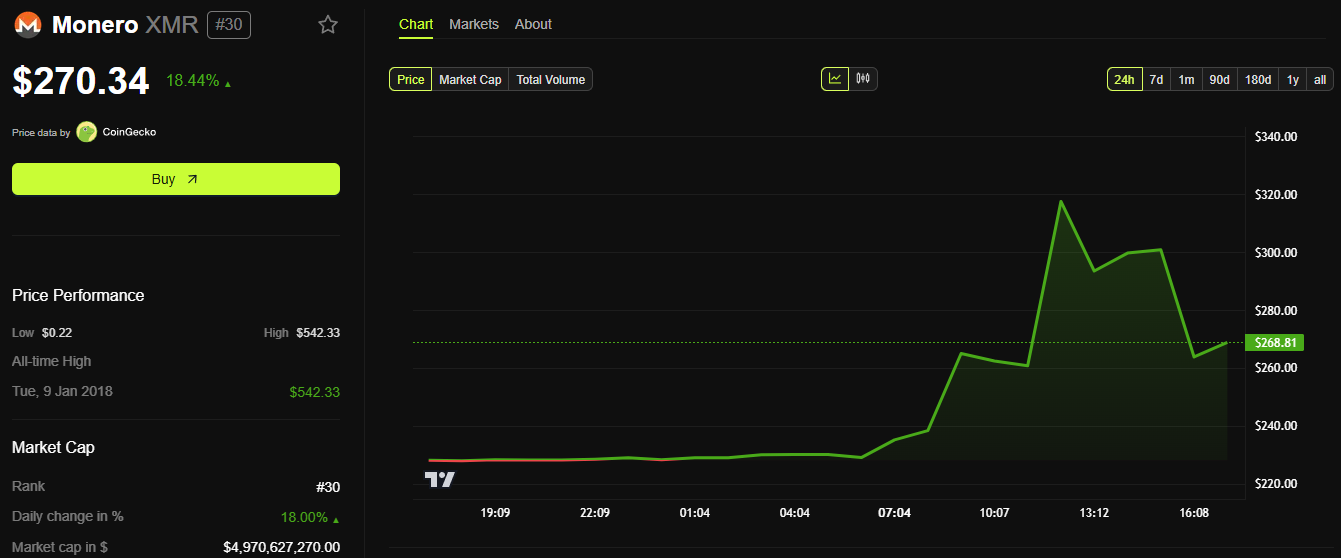

Data from BeInCrypto shows that today, the price of XMR ROSE from $229 to $317, marking a 40% increase before correcting to the current level of $270. On certain exchanges like Bitfinex, XMR peaked at $328, achieving nearly a 50% gain in April, as ZachXBT had mentioned.

In addition, CoinMarketCap data revealed that XMR’s trading volume today exceeded $250 million. This marked a 360% increase compared to the previous day and set a new daily volume record for the year.

Monero, with its strong privacy features such as concealing the sender, recipient, and transaction amount, has become an ideal tool for money laundering activities.

The 2025 Crypto Crime Report by Chainalysis noted that as law enforcement agencies improve their tracking of Bitcoin transactions, operators and darknet market providers have increasingly turned to Monero as their cryptocurrency.

Additionally, research from ScienceDirect highlighted that privacy coins are closely linked with Dark Web traffic. This connection has further boosted their popularity in illegal markets.

Privacy Coins Retain Their Appeal Amid Changing Market Conditions

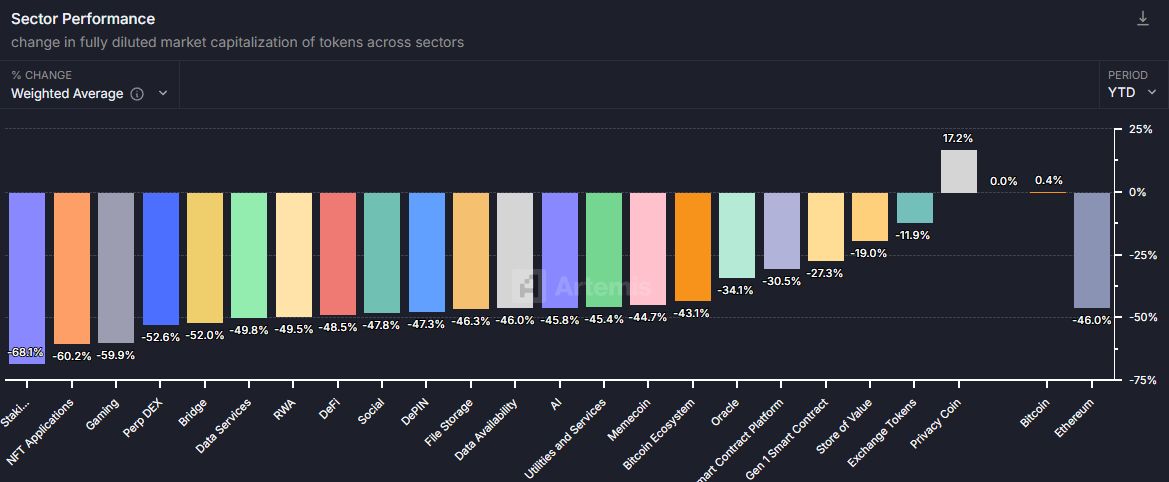

Data from Artemis, a cryptocurrency analytics platform, also pointed to a notable trend. Since early 2025, privacy-focused coins like Monero have been the only sector showing positive growth, achieving over a 17% increase.

Moreover, a recent study by Swan found that Monero holds the record for the longest downward resistance among the top 300 altcoins. This study emphasized XMR’s ability to maintain value despite constantly changing market conditions.

CR1337, a CORE Team member at Navio, a privacy finance project, suggested that XMR’s recent price rally would spark more investor interest in privacy coins.

“Whatever the reason for XMR’s recent price rise, it doesn’t really matter. It’s guaranteed to make more people aware of the privacy coin #1,” CR1337 said.

The data above demonstrates that the demand for Monero remains solid as the need for anonymity continues to exist and grow.

This demand comes from both financial privacy advocates and money laundering criminals. As a result, the conflict between personal finance freedom and government regulation grows stronger.