Crypto Whales Gobble Up These 5 Altcoins in Late April 2025—Here’s What They Know That You Don’t

While retail investors were busy staring at Bitcoin’s price charts, the big players made their move. These are the altcoins that saw massive whale accumulation last week—and why it matters.

Ethereum (ETH): The OG smart contract platform saw its largest single-week inflow since the Shanghai upgrade. Whales are betting hard on the upcoming Pectra fork.

Solana (SOL): Despite the memecoin circus, institutional-sized SOL purchases hit a 90-day high. Somebody knows something about that mysterious Firedancer update delay.

Toncoin (TON): Telegram’s darling surged 28% post-whale accumulation. Nothing boosts confidence like seeing Pavel Durov’s pet project finally deliver.

Avalanche (AVAX): Institutional wallets quietly stacked AVAX ahead of the Vryx upgrade. The ’ETH killer’ narrative might be tired, but the money flow doesn’t lie.

BNB: Binance’s token saw bizarre accumulation patterns—whales bought while retail sold. Either they know about an unannounced burn mechanism, or they’ve got faith in that pesky SEC lawsuit magically disappearing.

Remember: In crypto, the ’smart money’ is usually just the money that moves first—before dumping their bags on the overleveraged degens.

Uniswap (UNI)

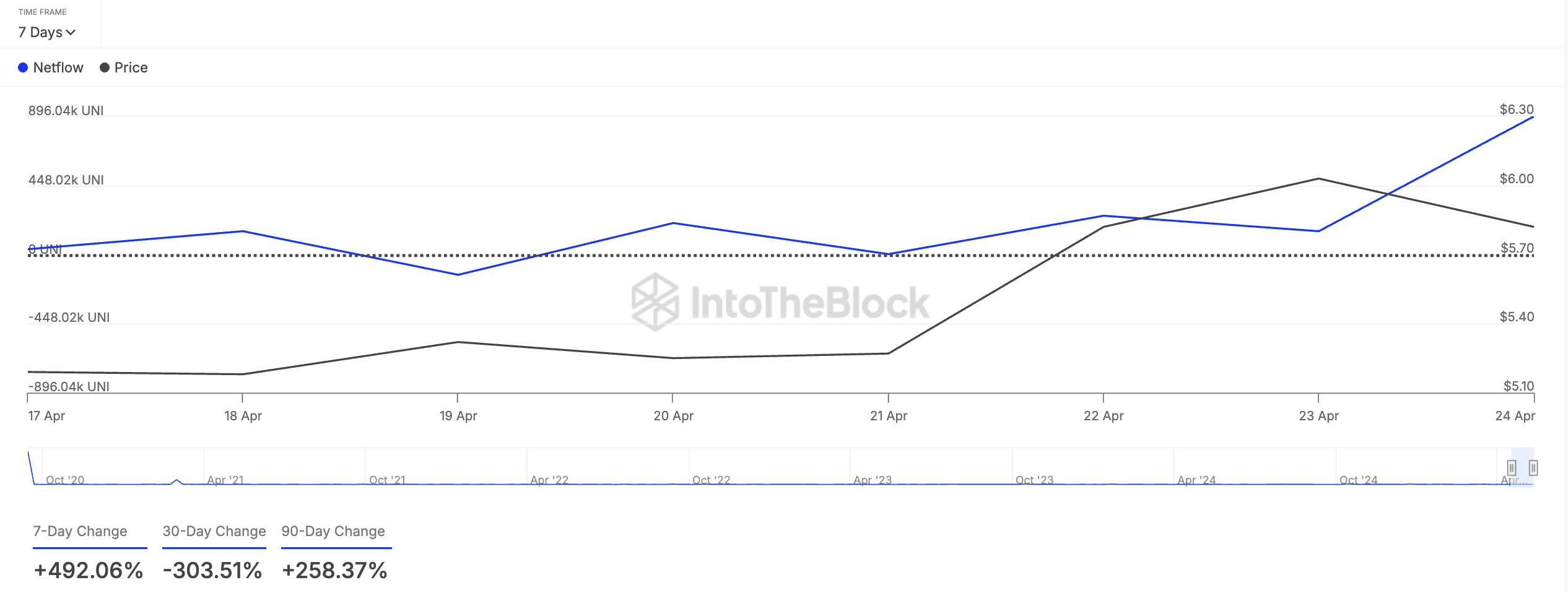

Uniswap’s governance token UNI is one of the tokens crypto whales bought this week. This is evidenced by its large holders’ netflow, up 492% over the past seven days.

The large holders’ netflow measures the difference between the amount of tokens that whales buy and sell over a specified period. When it surges like this, it signals strong accumulation by whales, suggesting growing confidence or a bullish outlook on the asset.

If whale accumulation persists, UNI could extend its rally to $7.10. On the other hand, if demand leans, UNI could shed recent gains and fall to $4.60.

MANTRA (OM)

OM’s recent price downturn has opened the door for strategic accumulation by some of its largest holders. According to on-chain data from Santiment, whale addresses holding between 10 million and 100 million OM tokens scooped up 26 million OM during the week under review.

This accumulation trend follows a dramatic collapse in OM’s price on April 13. The token suffered a flash crash that erased over 90% of its value in less than an hour, wiping out more than $5.5 billion in market capitalization.

The price plunge shook retail sentiment, but whales appear to have viewed it as a discounted entry point, positioning themselves for a potential recovery.

If this trend continues, OM could rally above $1. However, once selloffs resume, its price could fall to $0.022.

Worldcoin (WLD)

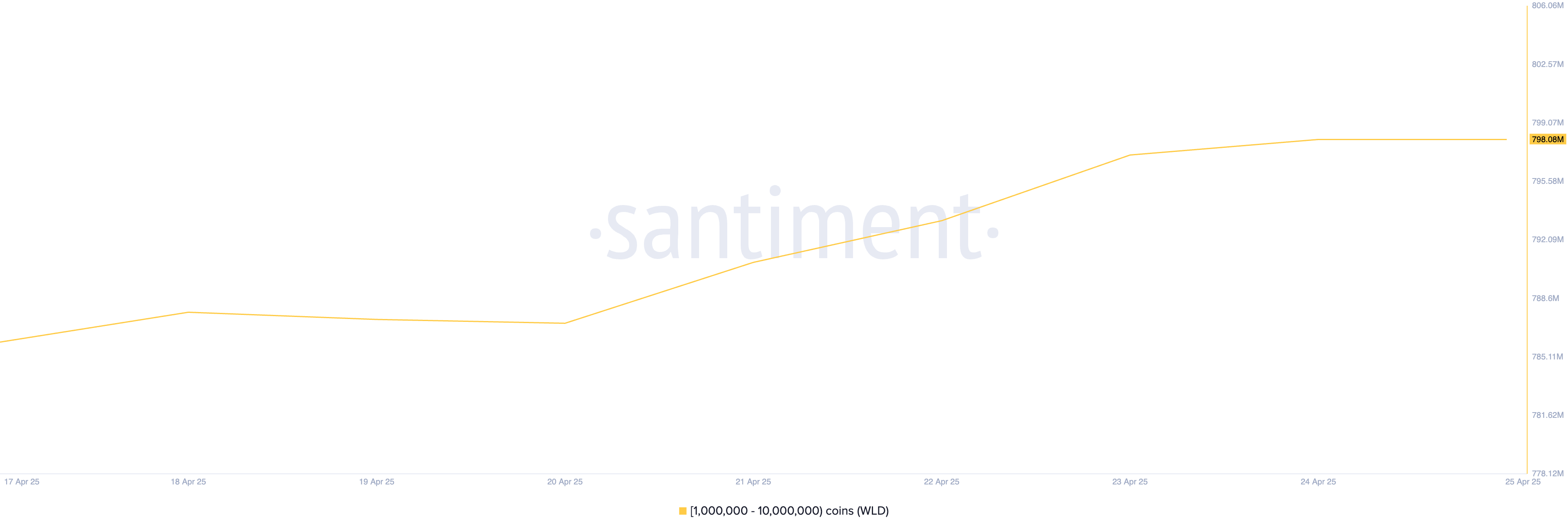

Sam Altman-linked WLD is another altcoin that crypto whales bought this week. On-chain data shows that whales holding between 1 million and 10 million tokens have acquired 13 million WLD over the past week.

This group of WLD investors holds 798.06 million tokens at press time, marking their highest recorded balance. If WLD whales increase their accumulation, its price could rally back above $1.

On the other hand, if selloffs continue, it could fall to $0.57.