Commerce Secretary’s Son Fronts $3B Bitcoin Mega-Deal—SoftBank, Tether, Bitfinex Back Crypto Power Play

A high-stakes crypto venture just landed Wall Street-grade firepower—and a whiff of political theater. The US Commerce Secretary’s son is spearheading a $3 billion Bitcoin initiative, with SoftBank writing checks and Tether/Bitfinex providing the stablecoin artillery. Critics whisper about regulatory déjà vu (’Remember Libra?’), while backers tout ’institutional adoption.’ Either way, the money’s moving—just don’t ask who’s auditing those reserves.

Is Cantor Fitzgerald Trying to Replicate Strategy’s Bitcoin Success?

Financial Times, citing sources close to the matter, revealed that Lutnick’s special purpose acquisition company (SPAC), Cantor Equity Partner, raised $200 million in January. The money will fund the creation of a new firm named 21 Capital.

The cryptocurrency companies involved in the initiative are contributing large sums of Bitcoin to 21 Capital. Stablecoin giant Tether will contribute $1.5 billion worth of BTC. Meanwhile, the Bitfinex exchange will contribute $600 million, and SoftBank, the Japanese multinational investment firm, will provide $900 million.

This brings the total Bitcoin contribution from the partners to $3 billion. Furthermore, the move also highlights SoftBank’s increased interest in the cryptocurrency space.

“Masayoshi Son’s biggest Bitcoin bet yet,” VanEck’s Matthew Sigel noted on X.

The cryptocurrency investments will be converted into shares of 21 Capital at $10 per share, with Bitcoin valued at $85,000 per coin. In addition to the partner contributions, the SPAC plans to raise further funds through a $350 million convertible bond and a $200 million private equity placement to acquire additional Bitcoin.

“While the deal was likely to be announced in the coming weeks, it could still fail to materialise, and the numbers could change, the people cautioned,” FT wrote.

The initiative aims to emulate the success of the largest corporate holder of BTC, Strategy (formerly MicroStrategy). The firm has been acquiring BTC since 2020, amassing a total of 538,200 coins worth $50.14 billion at press time, according to SaylorTracker. The company holds an unrealized profit of approximately 39.8%.

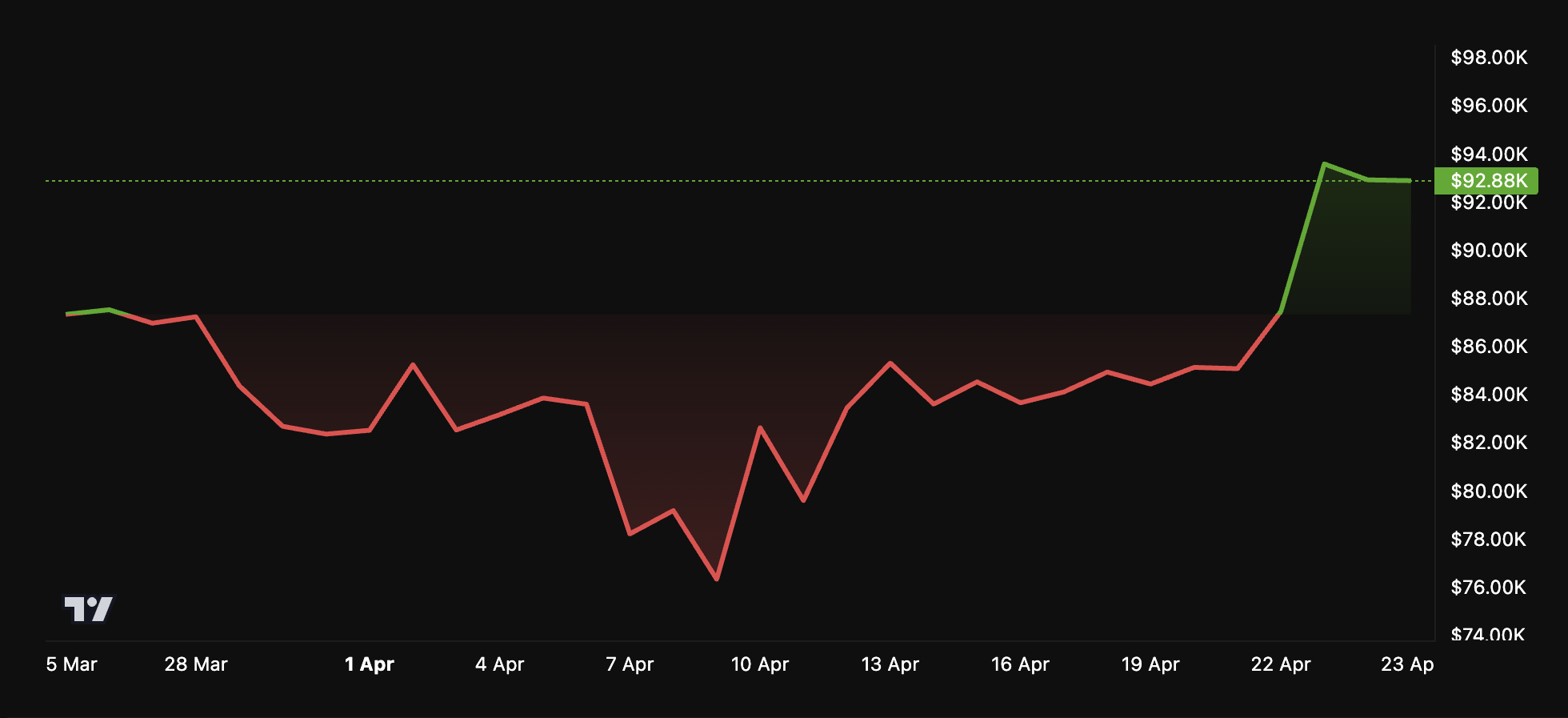

Meanwhile, Bitcoin, the initiative’s centerpiece, has seen a significant recovery recently. As BeInCrypto reported earlier, the largest cryptocurrency surged past the $90,000 mark for the first time in seven weeks. Over the past day, it ROSE by 5.3% to trade at $92,862.

“You start to think that Bitcoin is rallying as a sound money store of value inflation hedge but the market gods have a sick sense of humor and it turns out it was just a cantor/softbank/tether MSTR 2.0 all along,” an analyst posted on X.

As the consortium moves forward, its success will likely depend on Bitcoin’s long-term performance and the broader regulatory outlook for cryptocurrencies.