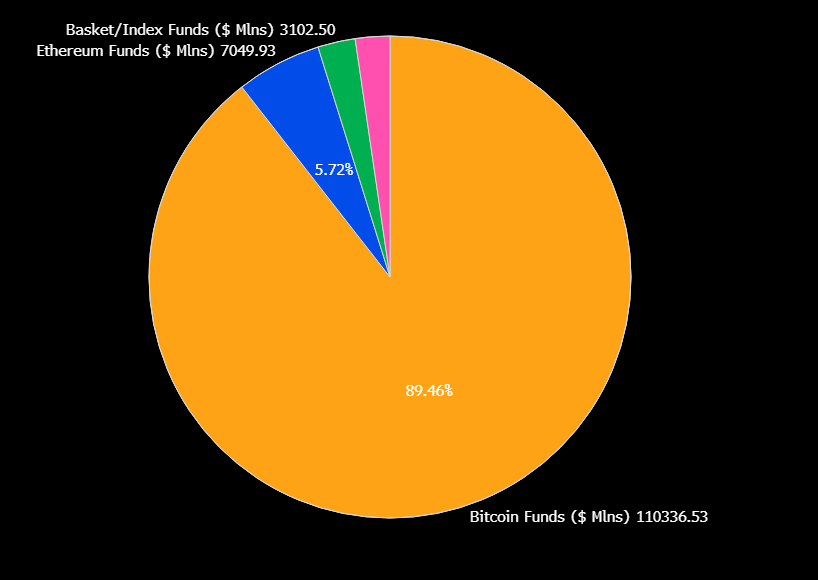

72 Cryptocurrency ETFs Await Regulatory Approval as Bitcoin Dominates with 90% Market Share in Fund Investments

As of April 2025, the financial markets are witnessing a significant surge in cryptocurrency-related investment products, with 72 crypto exchange-traded funds (ETFs) currently under review by regulatory authorities. Despite this growing diversification in the crypto ETF space, Bitcoin continues to maintain its overwhelming dominance, accounting for approximately 90% of total fund investments in the digital asset sector. This trend highlights the persistent investor preference for Bitcoin as the primary store of value in the cryptocurrency ecosystem, even as regulators consider expanding the range of approved investment vehicles. Market analysts suggest this concentration reflects Bitcoin’s established position as the market leader, though the potential approval of these new ETFs could gradually alter the investment landscape by introducing more options for institutional and retail investors alike.

Bitcoin Dominates the ETF Market

Bitcoin ETFs dramatically changed the global digital assets market over the past month, and they are performing quite well at the moment. In the US, total net assets have reached $94.5 billion, despite continuous outflows in the past few months.

Their impressive early success opened a new market for crypto-related assets, and issuers have been flooding the SEC with new applications since.

This flood has been so intense that there are currently 72 active proposals for the SEC’s consideration:

“There are now 72 crypto-related ETFs sitting with the SEC awaiting approval to list or list options. Everything from XRP, Litecoin and Solana to Penguins, Doge and 2x MELANIA and everything in between. Gonna be a wild year,” claimed ETF analyst Eric Balchunas.

The US regulatory environment has become much friendlier toward crypto, and the SEC is signaling its willingness to approve new products. Many ETF issuers are attempting to seize the opportunity to create a product as successful as Bitcoin.

However, Bitcoin has a sizable head start, and it’s difficult to imagine any newcomer disrupting its 90% market share.

To put that into perspective, BlackRock’s Bitcoin ETF was declared “the greatest launch in ETF history.” Any new altcoin product would need a significant value-add to encroach upon Bitcoin’s position.

Recent products like Ethereum ETF options have attracted fresh liquidity. Yet, Bitcoin’s dominance in the institutional market remains unchanged.

Of these 72 proposals, only 23 refer to altcoins other than Solana, XRP, or Litecoin, and many more concern new derivatives on existing ETFs.

Some analysts claim that these products, taken together, couldn’t displace more than 5-10% of Bitcoin’s ETF market dominance. If an event significantly disrupted Bitcoin, it would also impact the rest of crypto.

Still, that doesn’t mean that the altcoins ETFs are a futile endeavor. These products have continually created new inflows and interest in their underlying assets, especially with issuers acquiring token stockpiles.

However, it’s important to be realistic. While XRP and Solana ETF approvals could drive new bullish cycles for the altcoin market, Bitcoin will likely dominate the ETF market by a large margin — given its widespread recognition as a ‘store of value’.