ETF Investors Re-Enter Market Amid Mixed Signals in Bitcoin’s Fundamental Indicators | ETF Update

As of April 18, 2025, Bitcoin’s market dynamics present a complex picture. While ETF buyers have resumed accumulating positions, the cryptocurrency’s underlying metrics—including network activity, hash rate, and on-chain liquidity—continue to show divergent trends. This suggests a cautious market environment where institutional inflows through regulated products like ETFs aren’t yet translating into uniform strength across all technical indicators. Analysts highlight that such divergence often precedes periods of consolidation, requiring traders to monitor both spot market depth and derivatives positioning for clearer directional signals.

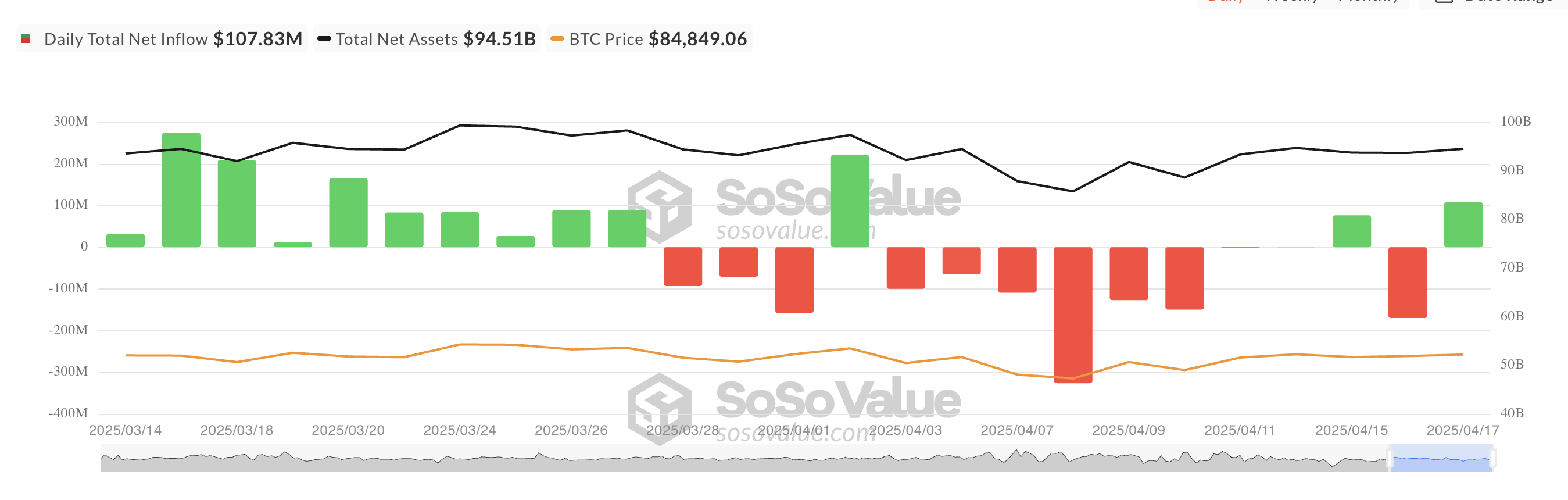

Institutional Confidence Returns Amid Midweek Setback

This week’s resurgence in institutional inflows signals revived confidence among ETF investors. After Wednesday’s outflows, the immediate rebound in inflows suggests the dip was merely a brief setback rather than the start of another bearish turn in market sentiment.

The renewed demand reflects growing conviction in Bitcoin’s long-term potential, even as short-term technical indicators continue to send mixed signals.

On Thursday, BlackRock’s ETF IBIT recorded the largest daily net inflow, totaling $80.96 million, bringing its total cumulative net inflows to $39.75 billion.

Fidelity’s ETF FBTC came in second place with a net inflow of $25.90 million. The ETF’s total historical net inflows currently stand at $11.28 billion.

Bitcoin Gains Modestly as Futures Open Interest Surges

Bitcoin’s price has gained a modest 0.30% over the past 24 hours. Trading activity has also soared, reflected by its rising futures open interest. At press time, this is at $54.93 billion, climbing 5% over the past day.

An asset’s open interest measures its total number of outstanding derivative contracts, such as futures or options that have not been settled or closed.

When BTC’s open interest rises along with its price, it indicates that more traders are entering the market, either opening new long or short positions. This confirms growing investor interest as it reflects heightened speculative activity around the leading coin.

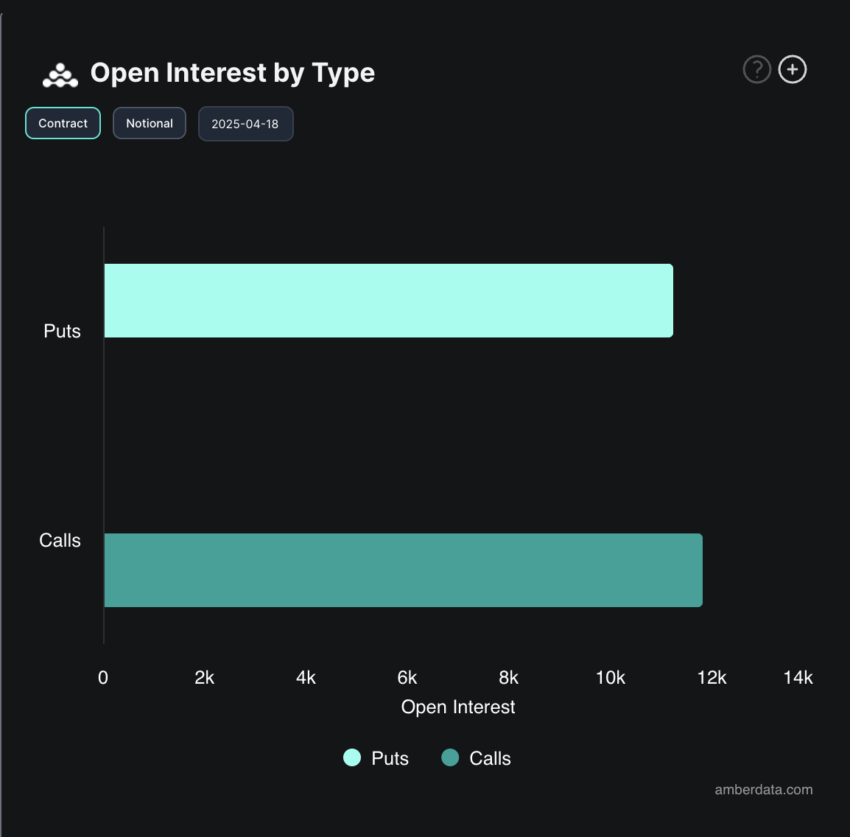

Moreover, the high demand for calls in the BTC options market supports this bullish outlook. Call options are used by traders who expect prices to rise, so increased activity in this segment suggests that many are positioning for upward movement.

However, not all traders share this bullish bias.

Today, BTC’s funding rate has flipped negative, signaling a high demand for short positions among its futures market participants. At press time, this is at -0.0006%.

When the coin’s funding rate is negative like this, short positions are paying longs, signaling that bearish sentiment dominates and traders expect prices to decline.