Binance Leads Centralized Exchange Market in Q1 2025 with Record $8.4 Trillion Volume

Binance has solidified its position as the dominant force in the centralized exchange (CEX) sector during the first quarter of 2025, achieving an unprecedented $8.4 trillion in total trading volume. This milestone underscores the platform’s continued market leadership despite evolving regulatory landscapes and increasing competition. The exchange’s performance reflects strong liquidity provision, diverse asset offerings, and robust institutional participation. Analysts note this achievement comes as Binance maintains its technological edge through advanced trading infrastructure and competitive fee structures. The Q1 figures position Binance well ahead of rival platforms in terms of market share and trading activity across both spot and derivatives markets.

Binance is Winning the CEX Race By a Mile

Binance suffered a few setbacks in this period, but it still comfortably leads the CEX market in a few key areas. Its token listings are not performing like they used to, prompting community backlash, and its potential ties with the Trump family are also raising concerns.

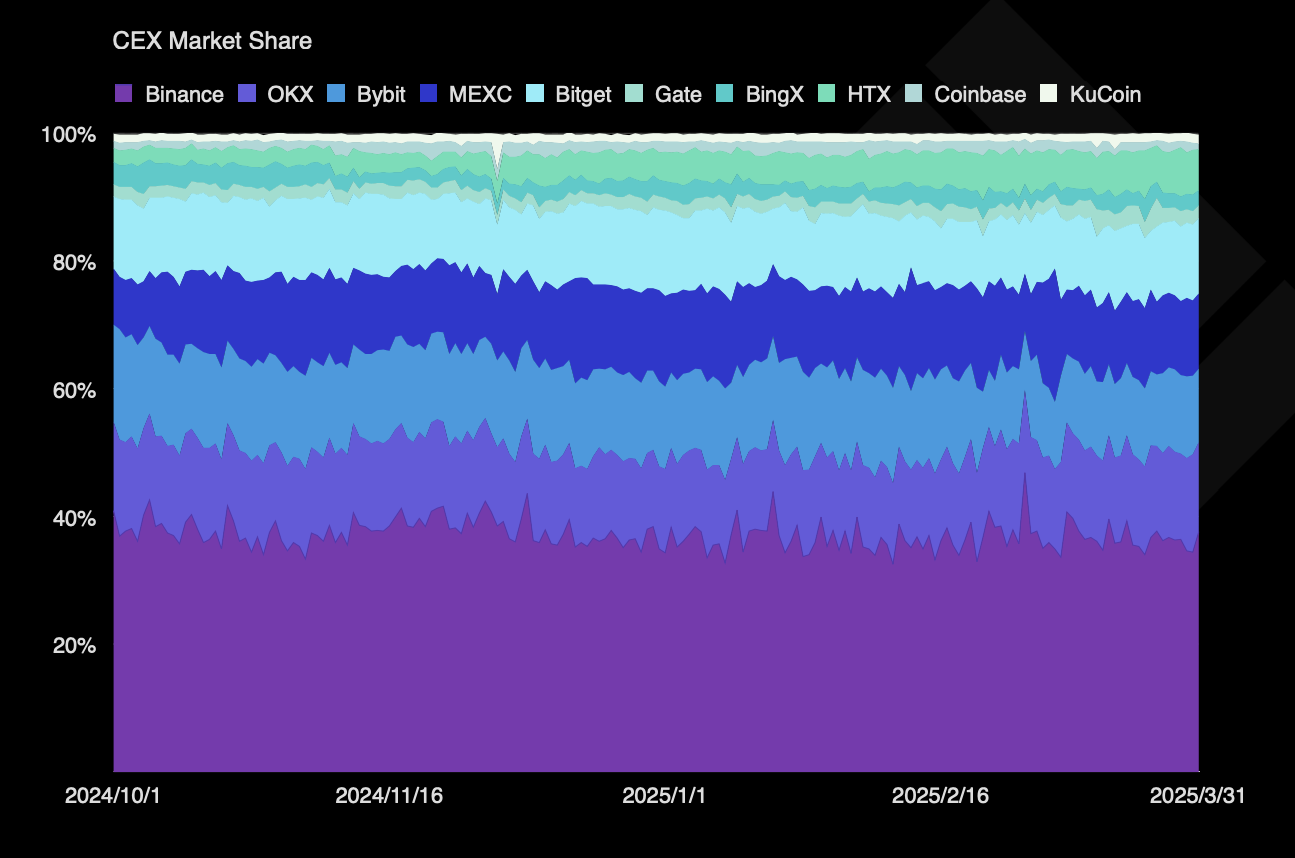

However, the exchange had a strong Q1 2025, as its trading volume continued to dominate one-third of the CEX market.

“Binance maintained its market-leading position in both quarters, with a trading volume of $9.95 trillion in Q4 2024. Due to market volatility, its trading volume in Q1 2025 was approximately $8.39 trillion. Binance continued to lead in market share, holding 36.5% in Q1 2025,” the report claimed.

In terms of total market share, Binance isn’t completely surpassing the CEX market. In fact, its control actually decreased by 1.38%.

No other exchange saw this level of decline, as Bybit only lost 0.89% after the infamous hack. Nonetheless, most of the biggest CEXs also declined slightly, and none of the growing exchanges managed to compete with its head start.

Binance Is Larger than Any CEX. Source: TokenInsight

Binance Is Larger than Any CEX. Source: TokenInsight

Binance accounts for nearly 36% of the CEX market share, but this isn’t its only advantage. It also leads in both spot trading and derivatives volumes, controlling 45% of the former and maintaining a 17% lead with the latter.

Additionally, TokenInsight determined that it had the most stable platform structure, keeping its ratio of spot to derivatives trading very consistent.

The firm also ranked number one in open interest market share, but this was its least comfortable lead. However, TokenInsight identified a few intangibles that significantly impacted Binance’s CEX performance.

Crypto Spot Market Share. Source: TokenInsight

Crypto Spot Market Share. Source: TokenInsight

In its list of noteworthy industry events for Q1 2025, Binance was mentioned more than any other exchange. In one such mention, Forbes listed it as one of the world’s most trusted crypto exchanges.

Overall, despite ongoing regulatory scrutiny in several different regions, the exchange seemingly holds a firm grip on the market.