CoinGecko Report Reveals $633 Billion Wiped from Crypto Market in First Quarter of 2025

The cryptocurrency sector experienced a significant downturn in Q1 2025, with total market capitalization plummeting by $633 billion according to CoinGecko’s latest industry analysis. This sharp decline marks one of the most substantial quarterly losses in recent crypto history, reflecting heightened market volatility and shifting investor sentiment. The report highlights widespread corrections across major digital assets, with both established cryptocurrencies and altcoins facing substantial valuation pressures. Market analysts attribute this contraction to a combination of macroeconomic factors, regulatory developments, and profit-taking following previous bullish cycles. The data underscores the inherent volatility of digital asset markets and serves as a reminder of the risks associated with crypto investments during periods of market turbulence.

Crypto Suffered Heavy Losses in Q1

The latest CoinGecko report shows just how bearish the first quarter of the year has been. Although the crypto market started January with a major bullish cycle, macroeconomic factors have heavily impacted market sentiment for the past two months.

Crypto Market Cap Fell in Q1 2025. Source: CoinGecko

Crypto Market Cap Fell in Q1 2025. Source: CoinGecko

According to this report, crypto’s total market cap fell 18.6% in Q1 2025, a staggering $633.5 billion. Investor activity fell alongside token prices, as daily trading volumes fell 27.3% quarter-on-quarter from the end of 2024. Spot trading volume on centralized exchanges fell 16.3%, which CoinGecko at least partially attributes to the Bybit hack.

The report mostly focused on concrete numbers, but it pointed to a few specific events that impacted crypto. Markets hit a local high around Trump’s inauguration, thanks to market euphoria over possible friendly policies.

His TRUMP meme coin fueled a brief frenzy in Solana meme coin activity, but this quickly slumped. The LIBRA scandal had a further dampening impact.

Bitcoin increased its dominance in Q1 2025, accounting for 59.1% of crypto’s total market cap. It hasn’t maintained that share of the market since 2021, symbolizing how much more stable it’s been than altcoins.

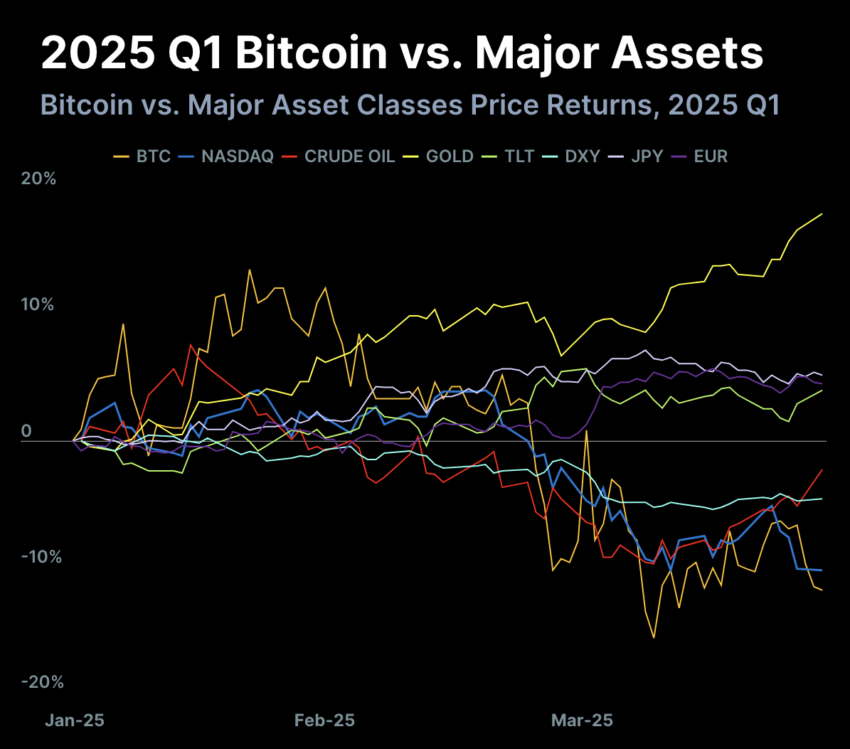

Nevertheless, BTC also fell 11.8% and was outperformed by gold and US Treasury bonds.

Bitcoin Slumps Despite Market Cap Dominance. Source: CoinGecko

Bitcoin Slumps Despite Market Cap Dominance. Source: CoinGecko

This data point is especially worrying because Trump’s tariffs have wrought havoc on Treasury yields. Even so, the report clearly shows that the rest of crypto suffered even more. Ethereum’s entire 2024 gains vanished in Q1 2025, and multichain DeFi TVL fell 27.5%. C

ountless other areas saw similar results, but they’re too numerous to easily summarize.

That is to say, almost every quantifiable positive development came with at least one major caveat. Solana dominated the DEX trade, but its TVL declined by over one-fifth.

Bitcoin ETFs saw $1 billion in fresh inflows, but total AUM fell by nearly $9 billion due to price drops. The reports reflect that recession fears are gripping the crypto market.