Binance Futures Trading Activity Sparks Sharp Decline in Story (IP) and ACT Token Prices

Why Did ACT and IP Suddenly Crash and Rebound?

Binance Futures is a popular trading platform launched by the world’s largest crypto exchange, and its listings can spike the prices of various assets.

Today, however, the community is left with many questions, as speculation on Binance Futures apparently caused ACT and IP to tank in price.

ACT is an AI token, and IP aims to put intellectual property on the blockchain. Both of these tokens plummeted rapidly, by 27% and 21.5%, respectively.

However, they both managed to shoot back up after, with ACT even having a net 24-hour growth of 2.5%. IP has been a top-performing asset for several months, and its sudden drop sparked fear among holders. The subsequent recovery suggested the volatility was short-term.

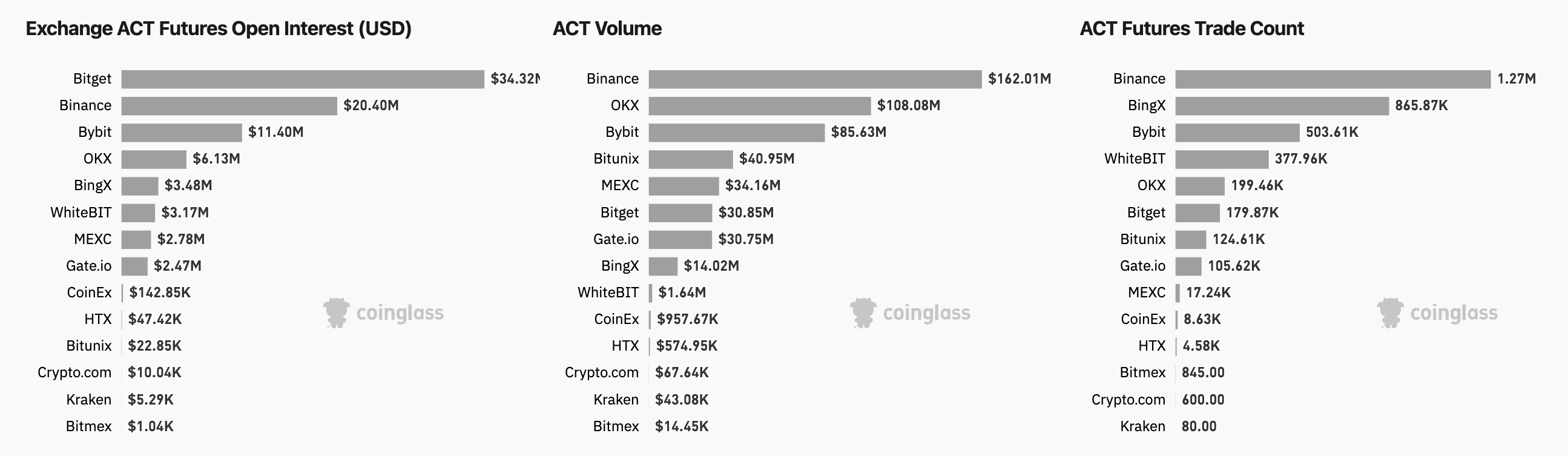

According to Coinglass data, over 1.27 million ACT futures trades were executed on Binance—more than double the second-highest exchange, BingX. Binance also holds over $20.4 million in ACT futures open interest.

This concentration makes Binance a critical price discovery engine. When large positions are quickly liquidated—often triggered by stop-losses, margin calls, or algorithmic trading—it can create an outsized impact on underlying token prices.

Futures markets now frequently surpass spot markets in volume and velocity. While this enhances liquidity, it also increases fragility.

A liquidation cascade—where long positions are forcefully closed due to declining prices—can accelerate downward momentum. Today’s synchronized drop in both IP and ACT suggests that excessive leverage and crowded positions may have triggered such a cascade on Binance.

These moves reaffirm that token prices, particularly for emerging or mid-cap assets, are increasingly shaped by derivatives markets. As more projects are listed on futures platforms early, volatility driven by short-term positioning rather than long-term value creation is becoming the norm.