MicroStrategy and Metaplanet Expand Bitcoin Holdings Amid Market Downturn: Strategic Accumulation?

Strategy and Metaplanet Resume Bitcoin Accumulation

Strategy (formerly MicroStrategy) is one of the world’s largest Bitcoin holders, and it’s been going through a chaotic period. In recent weeks, it has alternated between massive BTC purchases and abrupt acquisition pauses, prompting a great deal of speculation.

Today, however, its Chair, Michael Saylor, announced a major new Bitcoin buy at $285 million:

“Strategy has acquired 3,459 BTC for ~$285.8 million at ~$82,618 per bitcoin and has achieved BTC Yield of 11.4% YTD 2025. As of 4/13/2025, Strategy holds 531,644 BTC acquired for ~$35.92 billion at ~$67,556 per bitcoin,” Saylor claimed via social media.

A lot of this chaos is due to fears of a US recession, which has made the price of Bitcoin swing wildly. When Bitcoin was down, it prompted speculation that MicroStrategy may have to dump its assets.

However, since BTC has started to recover, Michael Saylor’s firm is back on the market.

Critically, Strategy isn’t alone in its Bitcoin acquisitions. Metaplanet is a Japanese firm with substantial BTC holdings and ambitions to acquire even more.

Two days before Strategy made its own major purchase, Metaplanet CEO Simon Gerovich announced a similar investment:

“Metaplanet has acquired 319 BTC for ~$26.3 million at ~$82,549 per bitcoin and has achieved BTC Yield of 108.3% YTD 2025. As of 4/14/2025, we hold 4525 BTC acquired for ~$386.3 million at ~$85,366 per bitcoin,” Gerovich claimed.

Metaplanet’s commitment here is particularly noteworthy because it contradicts near-term macroeconomic headwinds. The global market is filled with risk-averse behavior right now, and Japan’s 30-year bond yields surged to the highest level in over two decades.

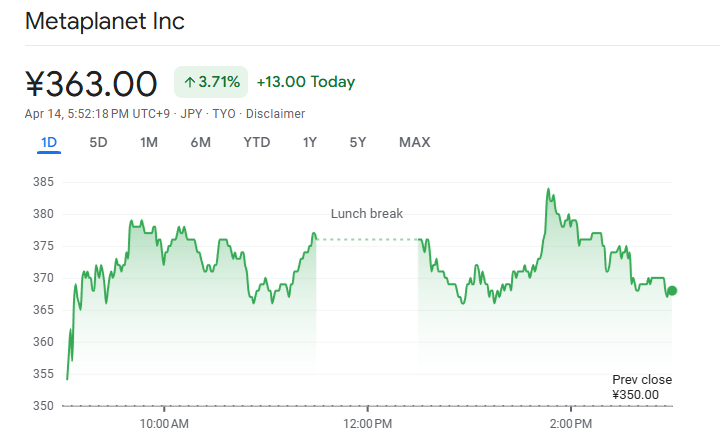

Despite this clear signal, the Japanese Metaplanet is continuing to make major Bitcoin investments. The latest purchases also had a positive impact on the company’s stock market. It’s currently up by 3% today, after suffering notable losses the past month.

In short, major corporate Bitcoin holders like Strategy and Metaplanet aren’t interested in tapering off yet. Despite the recent chaos, there is serious confidence that BTC will either gain in price or represent a stable store of value.

Either way, when public firms like this publicly take a bullish stance, it can shore up confidence across the entire market.