October 2025 Bitcoin Accumulation Signals Historic Market Bottom Formation

Bitcoin whales are loading up while retail investors panic-sell—classic reversal pattern emerging.

The Accumulation Game

October 2025 is shaping up as the stealth accumulation month that future crypto historians will study. Major wallets are scooping up BTC at levels that scream generational buying opportunity, while mainstream media obsesses over short-term volatility.

Market Mechanics Don't Lie

Exchange reserves are draining faster than a Bitcoin miner's energy bill during a bull run. The numbers tell the real story: when weak hands capitulate, strong hands accumulate. It's the oldest play in the financial markets—just with digital gold instead of the shiny yellow stuff.

Wall Street's predictable 'risk-off' rhetoric misses the bigger picture. While traditional finance types rearrange deck chairs on the Titanic, Bitcoin's underlying network strength continues growing exponentially.

Remember: the best time to buy is when there's blood in the streets—even if it's digital blood on blockchain streets.

October’s Downturn Spurs Accumulation—Echoes of Past Cycles

Some traders are drawing parallels between today’s market and late 2020, when Bitcoin traded around $12,000, far below its prior all-time high, before surging 170% in a single quarter.

“It felt dead. Everyone had moved to equities, SPACs, GME. crypto was hopeless… and then the mother of all outperformances took place. None of this price action can psyop me,” one investor stated.

On-chain data supports that sentiment. Glassnode reports strong net accumulation among smaller bitcoin holders (1–1,000 BTC) since early October, even as prices slid from $118,000 to $108,000.

The platform’s Trend Accumulation Score shows renewed conviction from retail and mid-sized wallets, while large holders have paused their distribution.

Smaller $BTC holders are stepping up.

Strong accumulation is underway among small to mid-sized cohorts (1–1000 BTC), while large holders have slowed distribution, signaling renewed confidence in spite of the recent shakeout. pic.twitter.com/LYFeGjrc3k

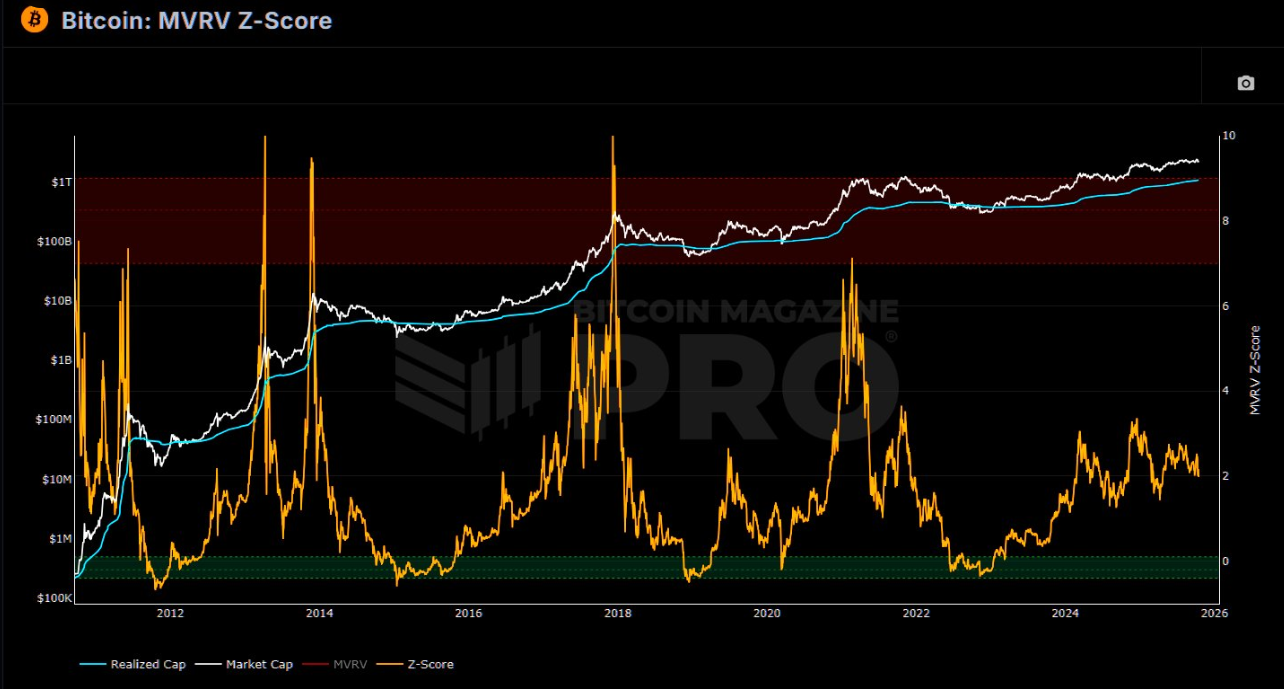

Meanwhile, Stockmoney Lizards notes that Bitcoin’s MVRV Z-Score, a metric comparing market value to realized value, sits NEAR 2.15, a zone historically associated with accumulation rather than euphoria.

“The pattern’s crystal clear…Below 2 means pain city for holders—smart money accumulates. We’re far from overheat, plenty of runway left,” they wrote.

Analyst Axel Adler identifies $106,000–$107,000 as Bitcoin’s key support range, warning that losing this level could trigger a retest of $100,000, where the yearly moving average lies.

As long as this base holds, “the market structure remains bullish,” Adler says

The main support zone is currently concentrated in the $106K–107K range (STH 1M-3M Realized Price – SMA 200D). Loss of this zone will lead to a test of $100K, where the yearly moving average (SMA 365D) passes. As long as this base holds, the market structure remains bullish. pic.twitter.com/1D9PWhViCs

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 17, 2025Secular Shifts and Cyclical Exhaustion

Still, macro voices like CredibleCrypto caution against ignoring the bigger picture. He points out that Bitcoin’s entire 16-year history has overlapped with equities’ own 16-year bull cycle, both potentially nearing exhaustion.

“Crypto will be entering its first secular bear market at the same time traditional equities may face theirs,” they said, predicting “devastation across the board.”

That scenario contrasts sharply with the view of analyst Miles Deutscher, who maintains that Bitcoin’s digital Gold narrative will eventually decouple it from risk assets.

In the short term, $BTC is behaving as a risk asset (been the case this entire year).

This trend is correct until proven otherwise.

But, I have belief longer term that the "digital gold" narrative will prove true. And when this happens, the ceiling is now much higher.. https://t.co/XB4bxyAqJH

AI Forecasts, Cycle Theories, and Market Psychology

Quant-based forecaster Timothy Peterson adds nuance to the debate. His AI model still gives Bitcoin a 75% chance of finishing October above $114,000, arguing that “even the bad scenario has 50% upside from here.”

Updated AI forecast for Bitcoin, based on hundreds of simulations and historical seed values. There is still a 75% chance October is a positive month (> $114,000) for Bitcoin. https://t.co/pjFF3hpIQb pic.twitter.com/UMDu8kNNAy

— Timothy Peterson (@nsquaredvalue) October 16, 2025Notably, with just about two weeks left to the end of October, Bitcoin was trading for $105,232, down by over 4% in the last 24 hours.

Cycle analysts echo that optimism. Trader Cyclop calculates that Bitcoin’s prior bull markets each lasted roughly 1,064 days, placing the current cycle within 90 days of a potential peak in November or December 2025.

“We’re entering the bull market’s most dangerous yet rewarding stage,” he warned. “Winners average winners—losers average losers.”

Meanwhile, JDK Analysis dismisses bearish victory laps as premature, reminding followers that every prior bull cycle has lengthened over time.

Sentiment’s low.

Emotional unstable bears are already taking victory laps.

So reduced volatility & shorter cycles?

When every past bull cycle, no matter how you look at it, got longer?

Nah! The top’s NOT in yet.

(Short-term pain might not be over though)

(NFA) #Bitcoin $BTC pic.twitter.com/s6HmYHj7Nz

Technicals Tighten With Bulls on Defense

Technically, Bitcoin now clings to its 200-day EMA, which investor Lark Davis calls the bull-bear line. A failure to hold could open the path toward $100,000 support, but a bounce from here might validate the accumulation thesis.

“Bitcoin clinging onto the 200 day EMA. This is the bull bear line. BULLS need to get their shit together and defend this line. Failure to do so could see us testing 100k as support,” wrote Davis.

With on-chain data flashing strength beneath the surface and traders split between despair and determination, Bitcoin’s October lull is shaping up as a pivotal inflection point.

However, it is conviction from the market’s smallest buyers that could determine whether there is a pause before breakdown, or the quiet before another parabolic run.