Solana Stumbles Below $200 Threshold as $130 Million SOL Floods Market

Massive sell-off triggers critical support breach

The $200 psychological barrier crumbled under relentless selling pressure—$130 million worth of SOL changing hands in coordinated moves that left bulls scrambling.

Market mechanics exposed

Liquidity vanished faster than a DeFi exploit when large holders initiated their exit strategies. The precise $130 million figure represents one of the largest single-day disposal events in recent months, creating cascading effects across derivative markets.

Technical breakdown accelerates

Support levels that held through previous volatility collapsed like a poorly coded smart contract. The breach signals potential further downside as algorithmic traders pile on momentum plays.

Remember when 'number go up' was the only crypto strategy? Some investors just discovered what the 'sell' button does—and they're using it enthusiastically.

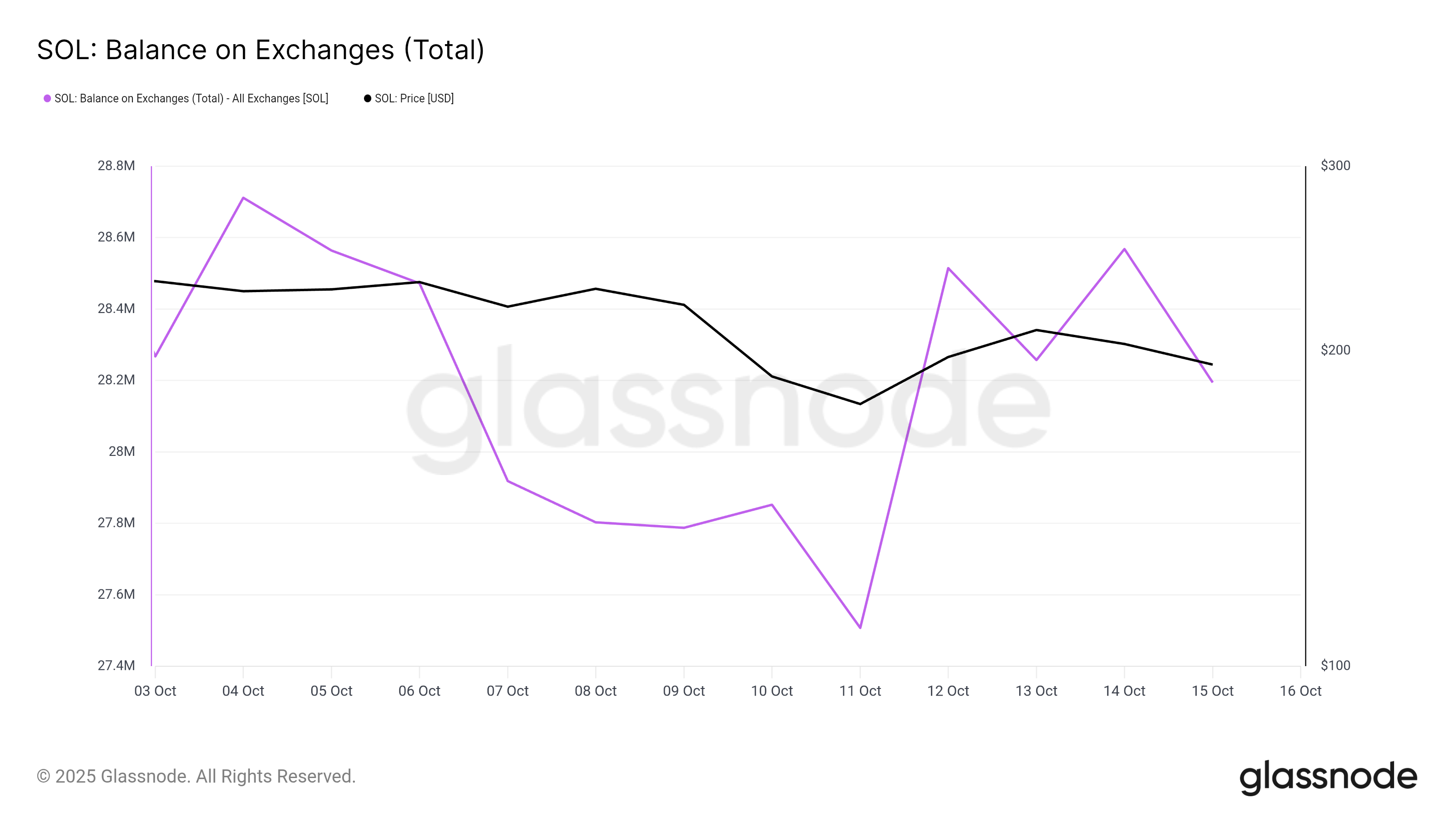

Solana Investors Sell Sharply

Over the past week, solana investors have been turning to the selling side. On-chain data shows that more than $132 million worth of SOL has been sent to exchanges during this period. This influx reflects heightened sell-side pressure as traders move to secure gains or exit amid uncertainty.

Even though the SOL sold is relatively less, it does show that panic selling has been evident; others are liquidating positions at minor rallies, suggesting a lack of confidence in sustained price growth. However, this selling is not strong enough to hold Solana price’s recovery back even if it caused a minor dip in price.

Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

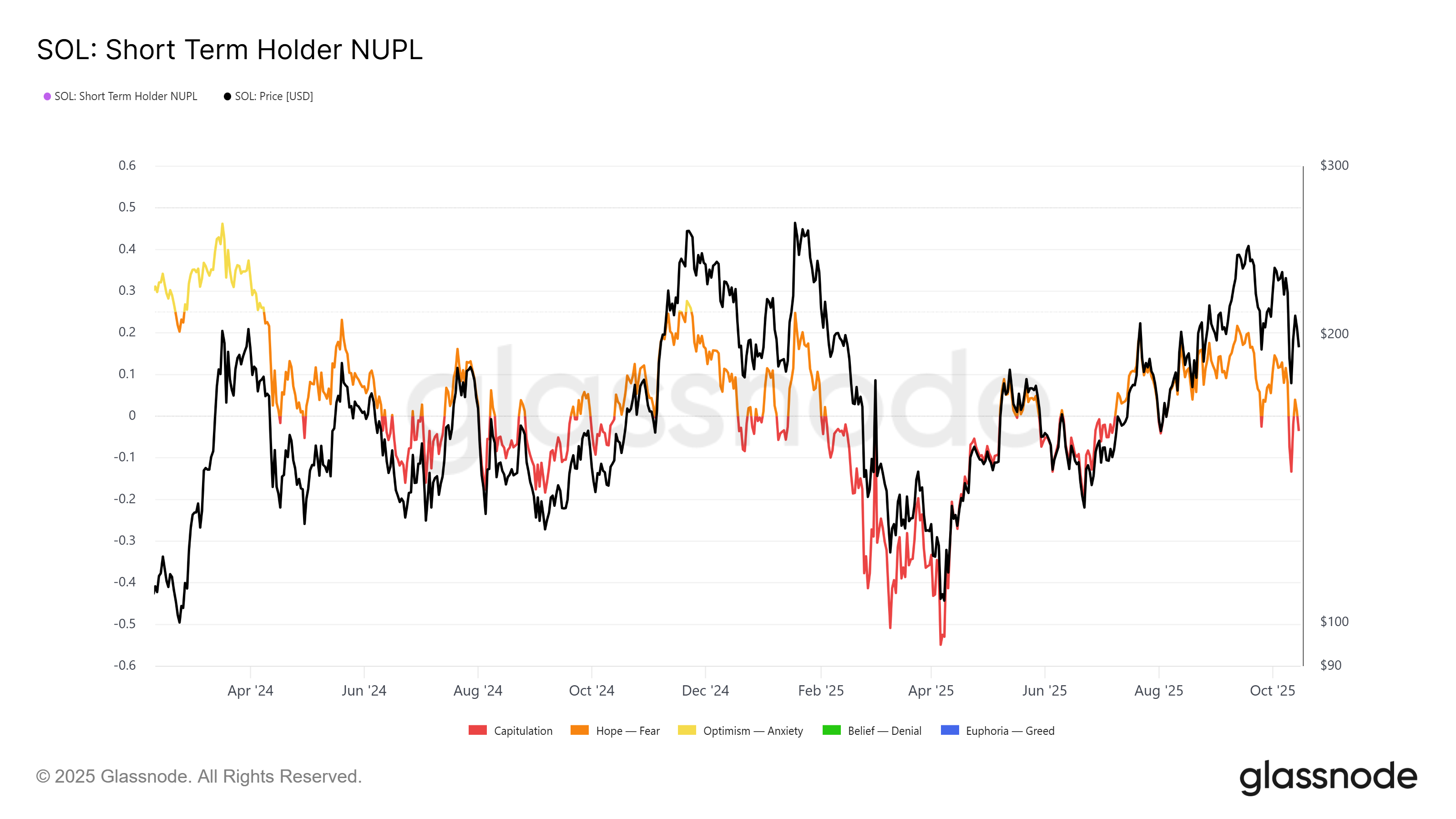

The short-term holder Net Unrealized Profit/Loss (STH NUPL) indicator currently sits in the capitulation zone, signaling that most short-term holders are selling at a loss. Historically, when this occurs during a broadly positive market, it has marked the beginning of a rebound phase. This pattern has been observed multiple times in Solana’s previous cycles.

When investors stop selling at losses and begin waiting for profit-taking opportunities instead, market pressure tends to ease. This dynamic could trigger a shift toward accumulation, potentially leading to a short-term rally.

SOL Price Can Bounce Back

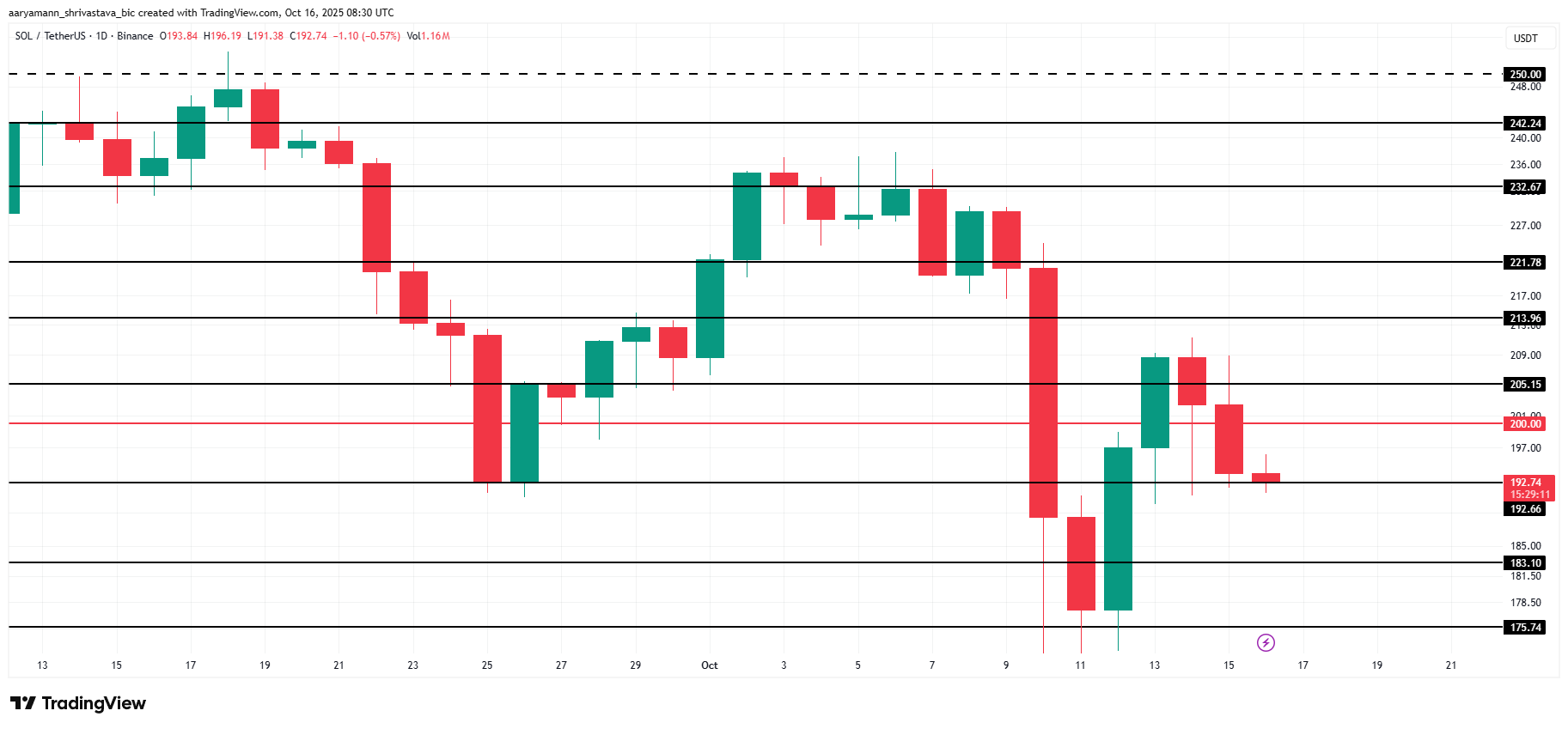

Solana’s price currently stands at $192, holding just above a key support level at the same mark. The altcoin recently dipped after failing to secure a foothold above $200, but resilience at this level remains a positive sign.

Given the current on-chain dynamics, SOL may soon reverse its recent losses. A successful breakout above $200 and $205 could pave the way toward $213, signaling renewed bullish momentum.

However, if selling continues to dominate and confidence remains weak, Solana’s price could fall to $183. Such a decline WOULD invalidate the bullish outlook and deepen the short-term downtrend.