Dash Primed for $100 Breakout in October: 4 Catalysts Fueling the Privacy Coin’s Ascent

Privacy coins are making moves while regulators scramble to keep up.

Network Upgrades Hit Critical Mass

Dash's evolution beyond simple privacy features positions it uniquely in the crowded crypto space.

Institutional Adoption Quietly Accelerating

While Wall Street debates Bitcoin ETFs, real money flows into privacy-focused assets through back channels.

Regulatory FUD Creating Buying Opportunities

Every regulatory crackdown announcement creates temporary dips that savvy investors quickly snap up.

Technical Setup Screens Bullish

The charts don't lie—key resistance levels are breaking faster than politicians can draft new crypto regulations.

Privacy isn't going away, no matter how many suits in Washington pretend it's just for 'bad actors.' Sometimes the best investments are the ones that make bankers uncomfortable.

1. Rising Interest in Privacy Coins

According to a recent report from Milkroad, only two sectors remained profitable over the past month: exchange tokens and privacy coins. The report highlights Zcash, Dash, and Monero as key representatives of the privacy coin resurgence.

Only 2 crypto sectors made money this month.

Privacy Coins and Exchange Tokens, everything else bled out.

That tells you a lot about where capital hides when markets turn risk off.

If you’re building a portfolio for the next leg, don’t just chase hype sectors. pic.twitter.com/UZ60jXane1

The growing public interest in privacy has become the first major catalyst behind Dash’s rebound. Analysts note that privacy coins have been the best-performing group in the market, posting an average gain of more than 60%.

Search interest and media coverage for privacy-focused cryptocurrencies have also reached their highest levels since 2017, suggesting that the “privacy culture” within blockchain is awakening once again.

2. Explosive Trading Volume

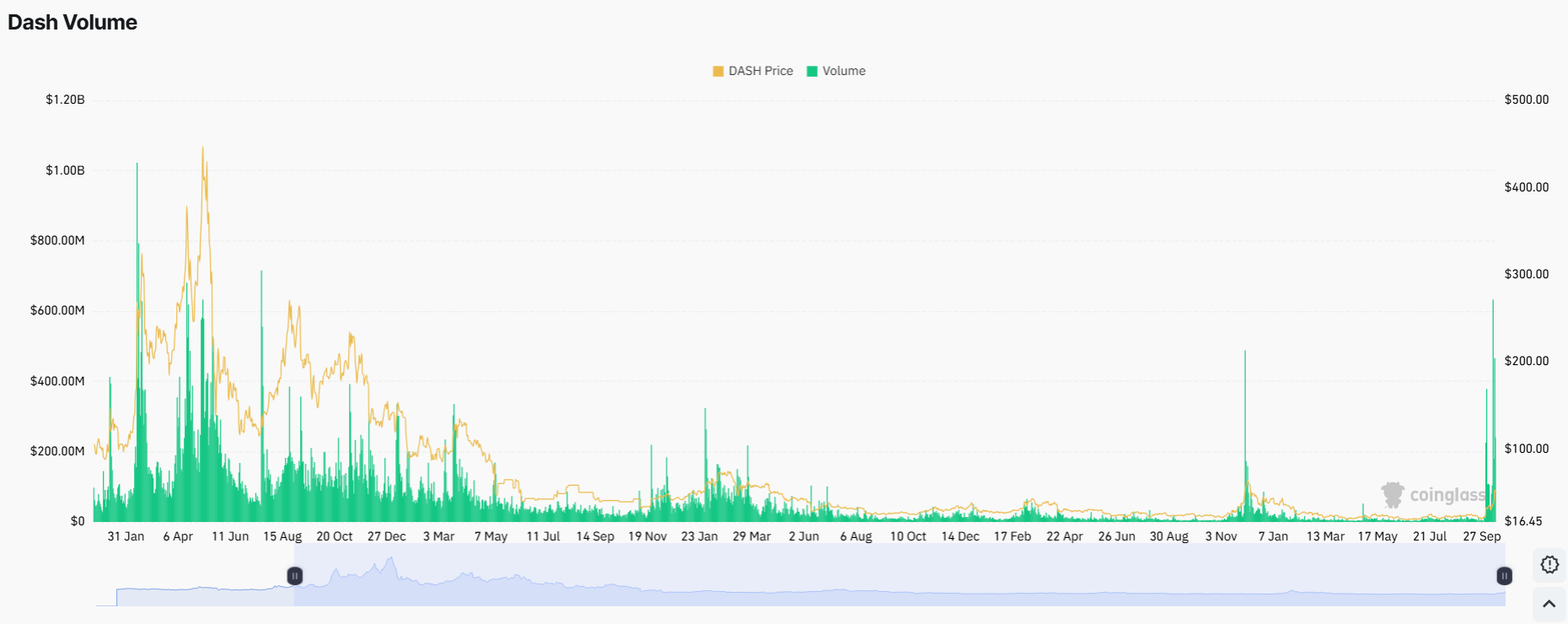

Dash’s daily trading volume in October reached a record high of over $600 million. Data from CoinGecko shows that the current daily volume remains in the $200–$300 million range, 10 times higher than at the beginning of the month.

The last time DASH saw such strong volume was in early 2021, when the surge in activity fueled a rally to $400.

This renewed trading activity signals growing investor confidence in the altcoin and could provide the foundation for another bullish move, potentially mirroring the rally seen in 2021.

3. Whale Accumulation

Another bullish sign comes from the accumulation pattern among top DASH wallets.

Data from BitInfoCharts shows that the top 100 addresses have increased their DASH holdings from 25% of the total supply in early 2025 to more than 36%, marking a 10-year high.

The concentration of supply among large holders has not decreased, even after DASH ROSE over 100% in October. This stability indicates that whales are not taking profits yet, suggesting continued confidence and readiness for another leg up.

4. Technical Breakout

From a technical perspective, DASH has confirmed a breakout from a multi-year descending wedge pattern during October’s volatile price action.

This breakout is a classic bullish signal that often precedes major upward momentum. Analysts believe it could propel DASH to $100 or beyond in the coming weeks.

$DASH is trying to escape this (almost) 3000 days long falling wedge.

If #DASH closes this week above (approx) $40 and then next week as well, this thing could shoot for a breakout target of $1K (ish)

After that we can reach all the way up to the extensions from 2017 highs at… pic.twitter.com/GhoFGBOxTG

“Dash may soon reach $100, and if things heat up, it could jump past $200,” Joao Wedson, Founder & CEO of

Alphractal, predicted.

Despite these positive signs, these catalysts are short-term in nature. If market interest cools, trading volume declines, or whales begin distributing their holdings, DASH’s ability to sustain its growth will depend on how widely it achieves real-world adoption.

Ultimately, lasting growth for DASH will require more than market excitement—it will depend on whether the coin can demonstrate genuine utility and continued demand in the broader crypto ecosystem.