CEXs vs DEXs: The Ultimate Battle for Crypto Trading Supremacy in 2025

Centralized exchanges face their toughest challenge yet as decentralized platforms surge past $100B in monthly volume.

The Speed vs Security Standoff

CEXs still dominate with lightning-fast execution and regulatory compliance frameworks. Traditional finance veterans flock to platforms offering familiar KYC processes and instant fiat onboarding. Meanwhile, institutional money pours into regulated venues—because nothing says 'innovation' like filling out paperwork.

DeFi's Silent Revolution

DEXs bypass middlemen entirely, slashing fees by 80% compared to traditional models. Automated market makers now handle positions that would make legacy systems choke. Users control their keys while yield farming protocols generate returns that would get traditional bankers arrested.

The Hybrid Horizon

Next-gen platforms merge CEX liquidity with DEX security. Semi-decentralized architectures capture the best of both worlds—until regulators figure out how to tax them. Cross-chain interoperability becomes the new battleground as traders demand access to every obscure token.

The future isn't about one model winning—it's about which exchange can disappear with your funds faster when the music stops.

IPO Momentum Signals a Shift in Exchange Models

Latest UpdateKraken secured $500 million to speed its IPO and strengthen links with traditional finance. Meanwhile, Gemini capped proceeds at $425 million after heavy demand.

Revolut is considering a $75 billion dual London–New York listing, which WOULD mark the first debut on both the FTSE100 and the NYSE at once.

Background ContextRevolut, valued at $75 billion with 65 million users, including 12 million in the UK, has raised $3.77 billion to expand into crypto, brokerage, and banking. In addition, a UK rule change allows large firms to join the FTSE100 within five days of listing, boosting index demand.

Shift Markets reported that exchanges are maturing into multi-service hubs. Moreover, Animoca Brands argued these moves show CEX becoming gateways for payments, identity, and tokenized assets.

Exchanges Transform Into Super-Apps for Global Users

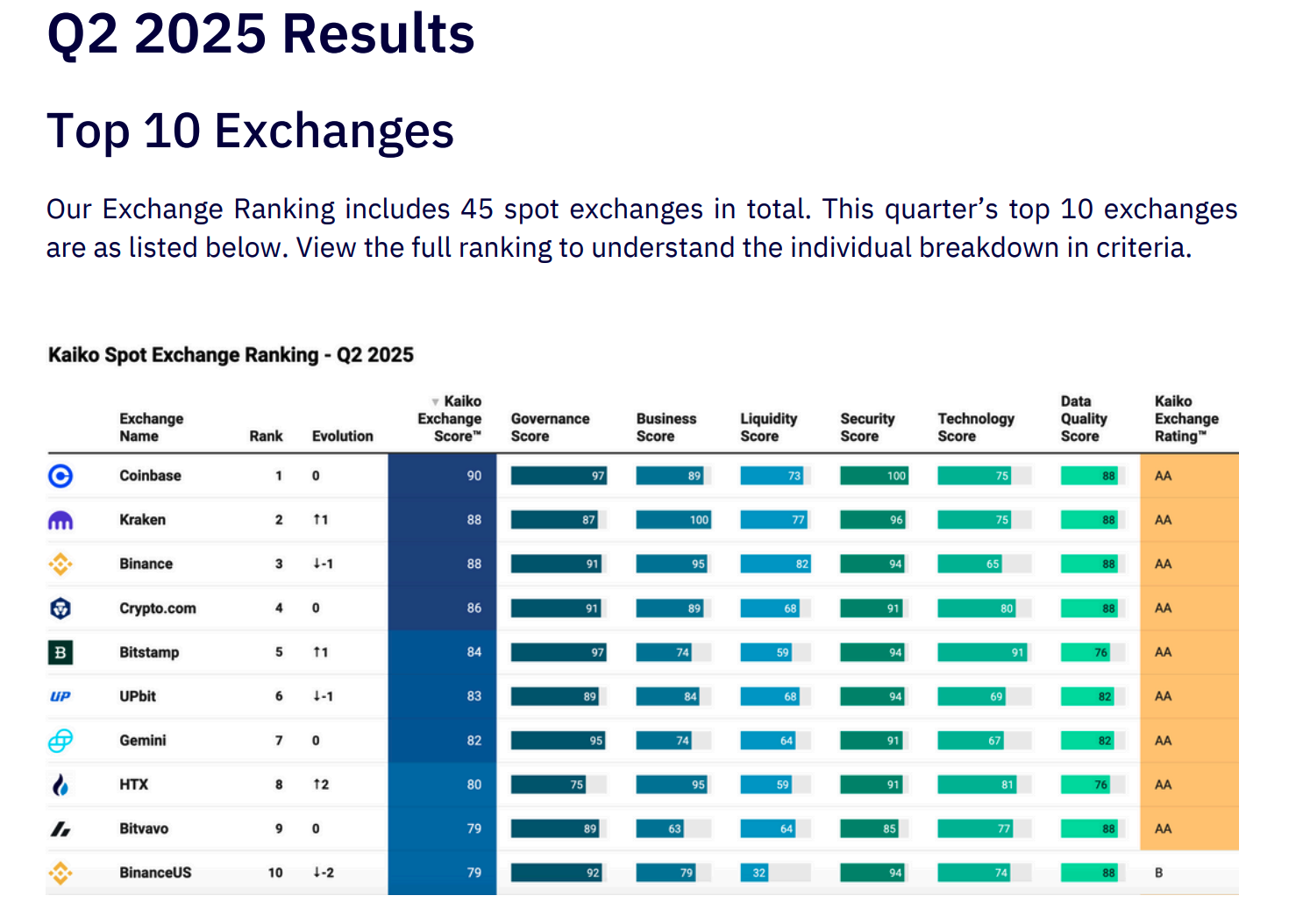

Kaiko found liquidity concentrated in the top five venues, while challengers expand regionally with new services.

Coin Metrics reported that CEXs still dominate volumes even as on-chain settlement grows, suggesting complementary roles. Consequently, Bitwise observed that institutions prefer regulated exchanges for custody and risk management.

Behind the ScenesCoinbase launched Base App, merging trading, payments, and social feeds. In Asia, LINE NEXT and KAIA introduced Unify to embed stablecoin payments. These moves show CEX chasing super-app models that reach daily finance users, not only traders.

Exchanges at Crossroads: Regulation, Risk, Reputation

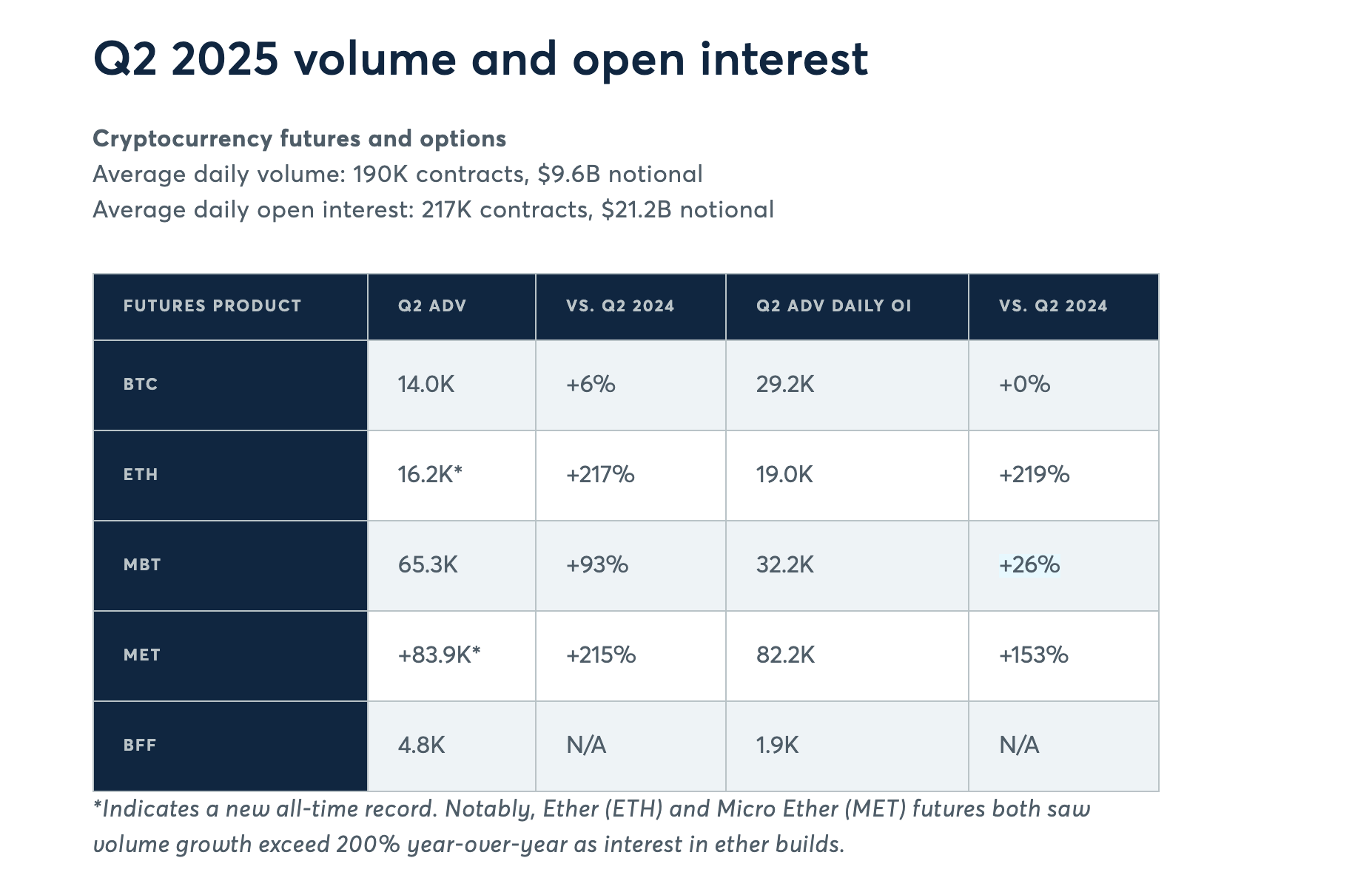

Wider ImpactThe CME highlighted rising institutional demand for derivatives, favoring exchanges that integrate spot, futures, and tokenized assets.

PwC outlined converging rules on custody, capital, and disclosures, and warned CEX may be deemed systemically important, facing bank-like oversight. This would raise costs but also reinforce credibility.

Risks & ChallengesCross-border fragmentation, high compliance spending, and competition from decentralized exchanges remain strong headwinds. However, diversification into payments, tokenization, and identity may support revenues.

Moreover, analysts caution that legal recognition of on-chain settlement and harmonized custody rules will decide which models scale. In addition, DEX market share keeps rising, reminding investors that regulatory delays could speed up user migration away from CEX.

Expert Opinions“Exchanges can no longer be just trading venues. They must act as bridges between centralized and decentralized worlds,” said Gracy Chen, Bitget CEO, in Animoca’s research.

“[Data] shows how exchanges are evolving from liquidity hubs into cultural and financial gateways,” stated Ming Ruan, Head of Research at Animoca Brands.

“CEX are at an inflection point; those that adapt will resemble full-service financial institutions,” said an analyst at Kaiko.

From IPOs to super-apps and tighter rules, CEXs are redefining their role in global finance. Investors could see IPOs and listings channel new capital. Regulators may soon require exchanges to meet bank-level standards.

Even as DEX adoption grows, users still rely on CEX as the main gateway. The sector’s future depends on combining innovation with oversight while providing simple, secure access to both crypto and traditional markets.