Ethereum Plunges to 6-Week Low - Now Enters Prime Buying Territory

Ethereum's price just hit a six-week bottom, but smart money sees blood in the water.

The Opportunity Zone Beckons

When assets tumble this hard, they either break or bounce. Ethereum's infrastructure hasn't collapsed—developers keep building, transactions keep finalizing. This looks like classic market panic, not fundamental failure.

Traders who missed the last rally get a second chance here. The same network that powered DeFi summer now trades at fire-sale prices. Meanwhile, traditional finance still debates whether crypto is 'real'—their loss.

Timing beats guessing every time. This dip won't last forever.

Ethereum Investors Have An Opportunity

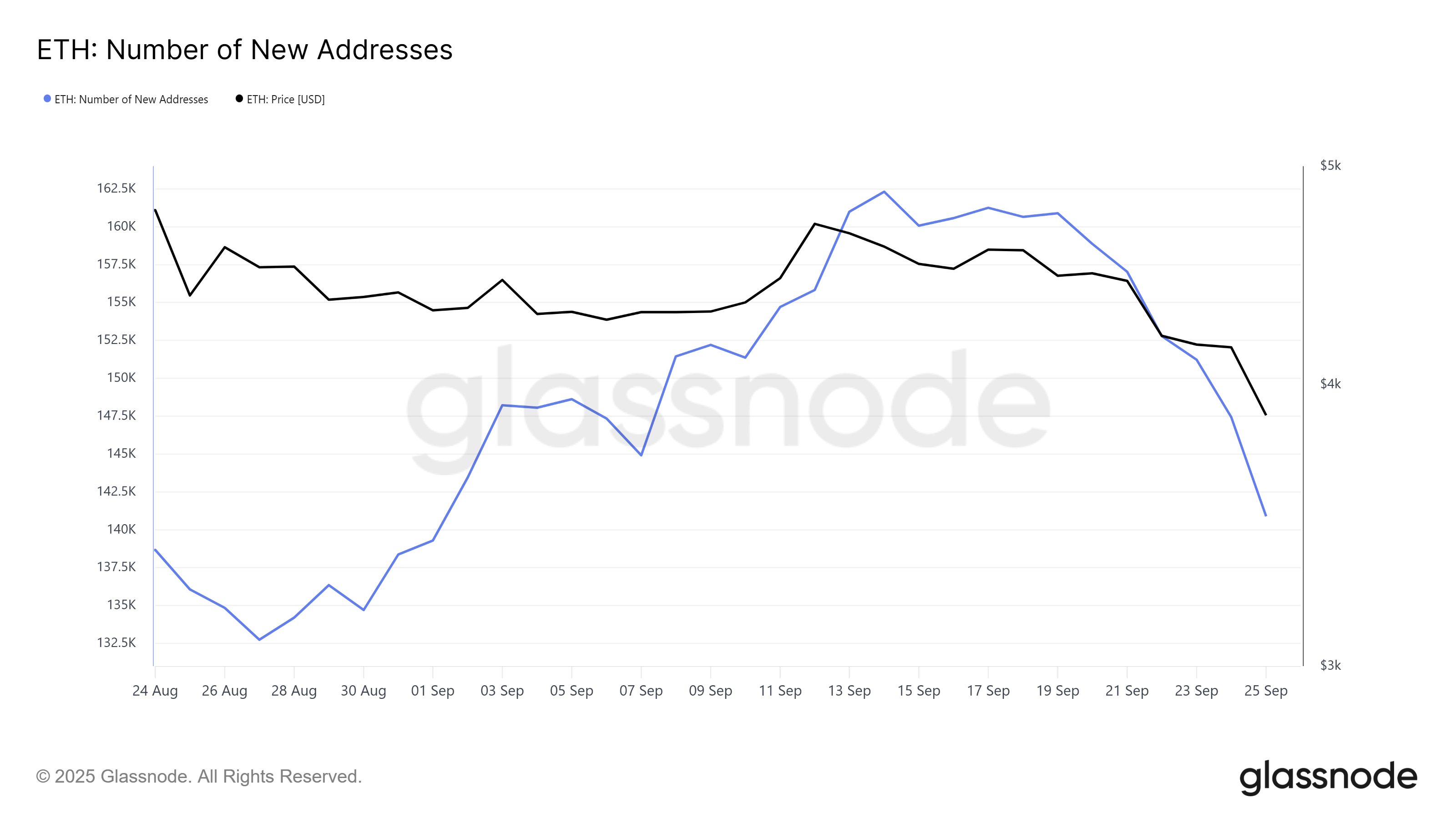

New address creation on the ethereum network has slowed significantly, with activity hitting a near-monthly low. This decline signals waning interest from potential investors, who are hesitant to enter the market while volatility remains high. Without fresh participation, Ethereum struggles to generate upward momentum.

The lack of new entrants into the ecosystem highlights a concerning slowdown in demand. Fresh inflows typically provide crucial support for long-term rallies, as more users adopting the asset can bolster network growth.

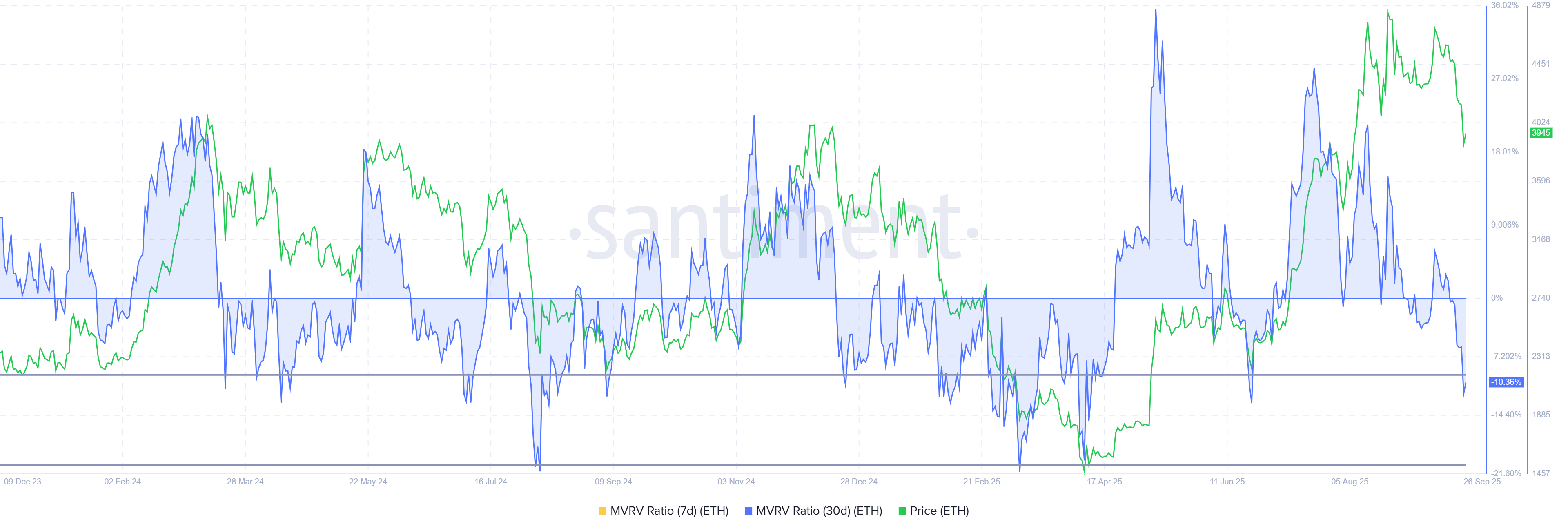

On the other hand, Ethereum’s MVRV ratio presents a more optimistic outlook. The metric currently places ETH within the opportunity zone, which ranges from -9% to -30%. Historically, this zone has marked points where reversals often occur as losses prompt accumulation.

When profits fade and holdings slip into losses, investors tend to hold or buy at lower levels instead of selling. This behavior often creates the base for a recovery. As ETH remains in this zone, the probability of renewed demand building up is significant, even amid bearish pressure.

ETH Price Needs A Push

At press time, Ethereum’s price is at $3,938, attempting to establish $3,910 as a support floor. This decline marks a crucial break below the $4,000 level, highlighting short-term weakness.

Given current signals, ETH may remain rangebound under $4,074 resistance until stronger bullish cues emerge. Market sentiment suggests consolidation rather than a sharp recovery, keeping investors cautious.

However, if Ethereum flips $4,074 into support, a push toward $4,222 could follow. This move would require investor participation and sustained inflows to counter bearish momentum, ultimately invalidating the short-term negative outlook.