Stellar Network’s September Surge: 3 Bullish Signals Defying Price Pressure

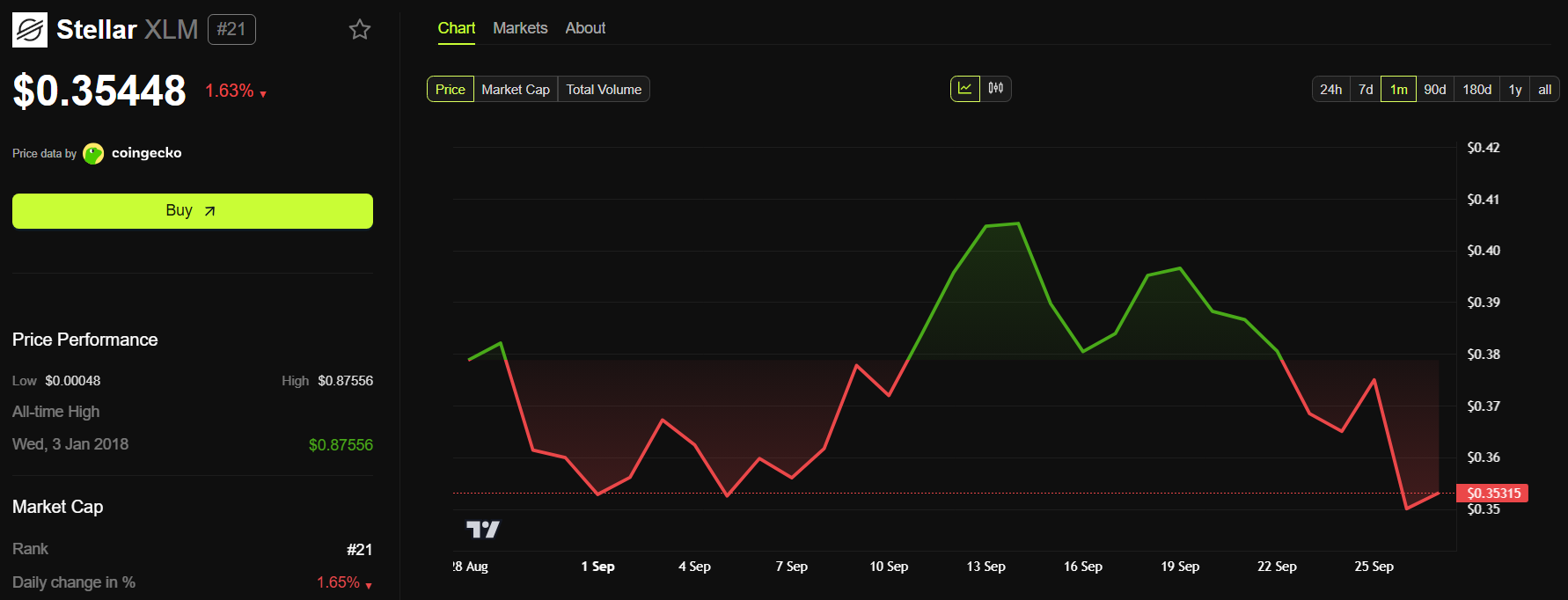

While XLM's price chart bled red, the Stellar network quietly stacked wins that traditional finance can't ignore.

Network Activity Spikes

Transaction volume surged as developers flocked to Stellar's rails—proving real utility trumps speculative froth every time.

Institutional Adoption Accelerates

Three major payment processors integrated Stellar's protocol, signaling that legacy finance finally understands cross-border settlements shouldn't take three business days.

Developer Momentum Builds

Smart contract deployments hit new highs as builders bypassed Ethereum's gas fees—because sometimes the best trade is avoiding Wall Street's crypto-cousin altogether.

Maybe the real bull market was the infrastructure we built along the way.

Stellar’s Total Value Locked Reaches New High in September

Stellar’s Total Value Locked (TVL) hit a record high in September, with more than 400 million XLM locked in protocols.

Data from DeFiLlama shows that this figure has doubled compared to the previous quarter. The increase reflects the community’s growing confidence in locking XLM within the stellar ecosystem.

TVL calculated in XLM is more reliable than in USD terms. This is because XLM’s USD price fluctuates sharply due to market factors, which can distort the actual picture of assets locked.

In fact, since the beginning of the quarter, XLM’s price has fallen more than 30%, but USD-based TVL has remained stable at around $140 million. The main reason is that the amount of XLM locked in protocols has continued to grow instead of declining.

TVL in XLM focuses on intrinsic value. It accurately measures the assets users commit to staking, lending, or liquidity provision. Leading protocols attracting capital include Blend, Aquarius Stellar, and Stellar DEX.

However, objectively, Stellar’s TVL remains small compared to other ecosystems, where TVL reaches into the billions of USD.

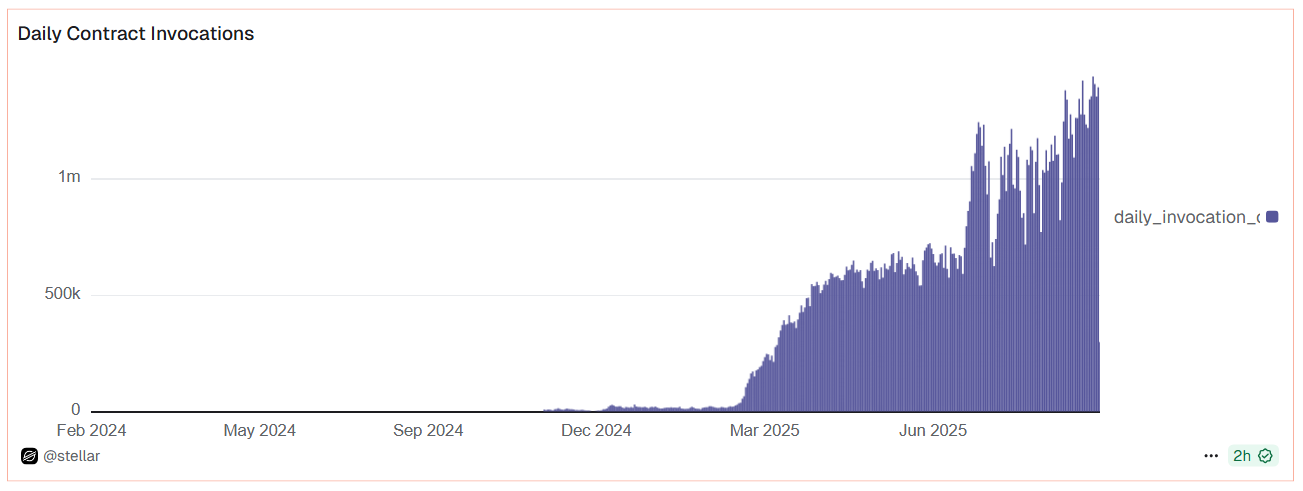

Smart Contract Activity Surged in September

Another highlight for the Stellar network is the sharp increase in smart contract activity.

According to Dune Analytics, smart contract operations surged in September, with more than 1 million daily contract invocations.

This metric measures the average number of successful smart contract calls per day. It helps assess adoption trends and informs decisions on resource allocation and platform development.

The data shows higher transaction volume, greater creativity, and real-world applications from developers. Examples include contracts related to payments, DeFi, or integrations with traditional financial systems.

This surge carries important implications. It proves that Stellar is moving beyond testing phases into real-world adoption. It also strengthens Stellar’s position as a reliable platform for decentralized financial services, attracting more capital and partnerships.

Institutional Interest in Stellar Grew in September

Alongside positive on-chain data, Stellar also expanded its institutional exposure in September.

Mercado Bitcoin, the largest digital asset investment platform in Latin America, recently announced it WOULD issue $200 million worth of tokenized financial assets (stocks and bonds) on the Stellar network.

RedSwan Digital Real Estate also tokenized $100 million of commercial real estate assets (luxury apartments and hotels) on Stellar’s blockchain.

Furthermore, PayPal officially integrated its stablecoin PYUSD on Stellar, enabling fast and low-cost payments.

Notably, the Hashdex Nasdaq Crypto Index US ETF (ticker: NCIQ) filed with the SEC to include NCIQ. The fund consists of five leading crypto assets: Bitcoin (BTC), ethereum (ETH), XRP, Solana (SOL), and Stellar (XLM).

This move is promising after the SEC eased listing standards for crypto ETFs and officially approved the multi-asset Grayscale Digital Large Cap Fund (GDLC).

Despite these positive signals, XLM’s price continues to be heavily affected by bearish market sentiment in late September. Once fear-driven trading subsides, Stellar’s strong fundamentals may have the chance to show their value.