Meteora’s 3% TGE Allocation to JUP Stakers: A Genius Liquidity Play or Just Another Crypto Gimmick?

DeFi protocol Meteora drops a 3% token generation event allocation exclusively for JUP stakers—strategic masterstroke or desperate liquidity grab?

The Liquidity Calculus

Meteora's move targets the most valuable resource in crypto: attention. By allocating precisely 3% of their TGE to JUP loyalists, they're not just rewarding existing supporters—they're engineering a viral feedback loop. Stakers get early access, the protocol gets instant credibility, and everyone gets talking.

Smart Money Mechanics

This isn't charity—it's calculated capital allocation. The 3% figure represents enough skin in the game to matter without diluting the core team's position. It's the Goldilocks zone of tokenomics: substantial enough to move needles but conservative enough to avoid red flags.

Market Reaction Watch

Watch JUP staking metrics spike as yield farmers chase the allocation. The real test comes post-TGE—will this create sustainable liquidity or just another pump-and-dump cycle? In a space where 'community rewards' often mean 'exit liquidity,' skepticism remains the default setting.

Because nothing says 'decentralized finance' like carefully engineered token flows that benefit exactly the people who were already invested. The genius lies in making artificial scarcity feel like organic demand.

3% Allocation for JUP Staker

As BeInCrypto reported, Meteora is preparing for a TGE in October. The platform floated one of the community’s most notable proposals ahead of MET’s TGE.

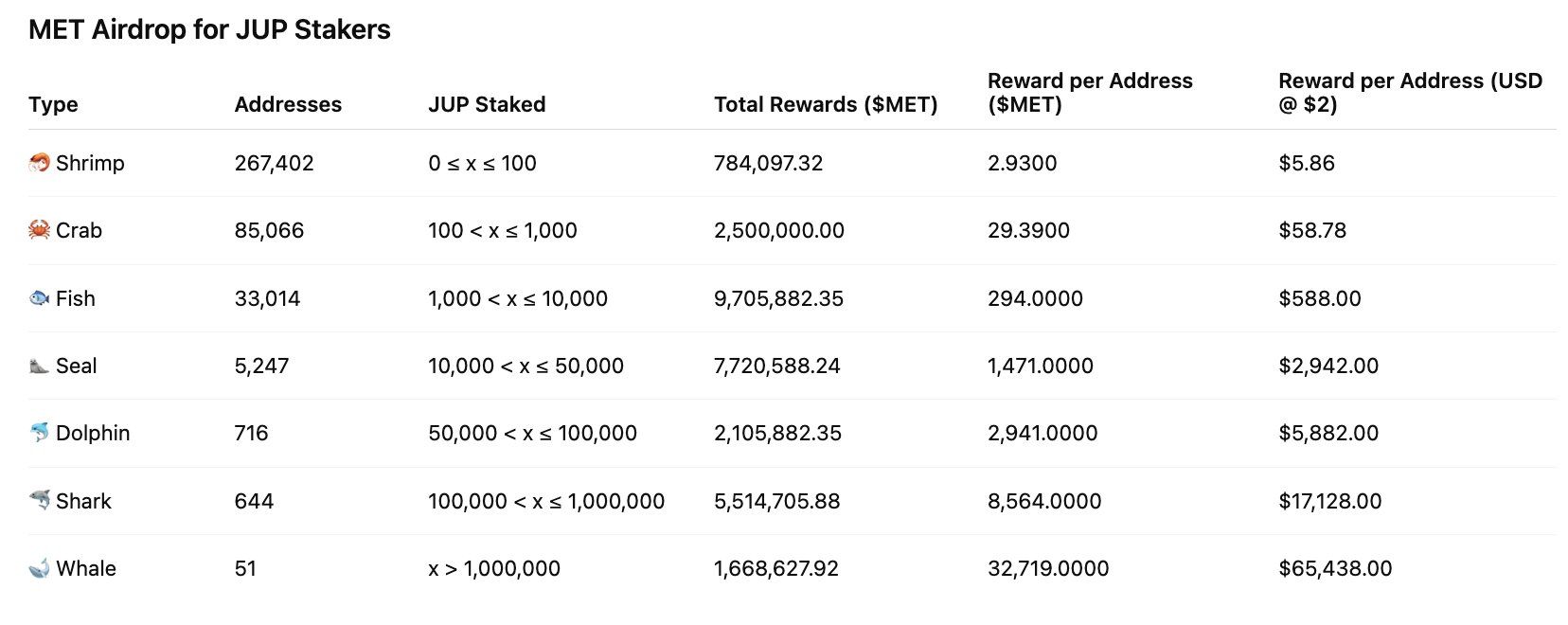

Under the plan, the project intends to allocate 3% of the TGE fund to Jupiter’s JUP stakers as Liquidity Position NFTs. Specifically, Meteora would use the 3% to seed MET liquidity in a Single-Sided DAMM V2 pool, then allocate positions to Jupiter stakers based on time-weighted staking, amount, and voting activity.

The objective is to create MET/USDC liquidity at listing without immediately adding more MET to the circulating supply. The proposal also emphasizes that “no additional tokens circulating will be added due to this proposal.” This is a “liquidity-first” approach rather than a direct token payout.

Meteora’s Co-Lead, Soju, published a public calculation to visualize scale. According to Soju, roughly 600 million JUP are currently staked. A 3% allocation WOULD equal 30 million MET tokens. That works out to about 0.05 MET per staked JUP.

“I think its reasonable,” Soju shared.

A user on X ran some napkin math and produced a similar figure of ~0.05035 MET/JUP depending on FDV assumptions. The per-JUP reward is small but aggregated at scale, so it can serve as a meaningful incentive to convert users into MET liquidity providers.

Pros & Cons

Meteora’s proposal has clear upsides compared to other projects that reward users via airdrops. It explicitly recognizes Jupiter’s role in the solana ecosystem, helps bootstrap MET/USDC liquidity at TGE, and reduces the immediate sell pressure because the initial reward is a liquidity position rather than freely tradable tokens. With careful engineering (time-weighted distribution, vesting attached to NFTs, withdrawal restrictions), this could be an effective bridge between the two communities.

However, significant risks remain. The community has raised fairness concerns: why should JUP stakers receive a large share? Could an “LP Army” or large wallets capture a disproportionate share of the rewards? What will the circulating supply be at TGE immediately? Earlier allocation drafts mentioned up to 25% reserved for liquidity/TGE reserve, so the total initial circulating supply remains a material transparency question.

“Difficult to debate on ‘fairness’ when JUP gave up 5% for Meteora (via mercurial stakeholders). LP army deserves more -> LP Army will capture a significant chunk of all future emissions (ongoing LM rewards), and still possess 20% (8% + 5% + 2% + 3% + 2%) of total supply at TGE,” Soju noted.

From past airdrop events, Meteora’s team must be transparent about tokenomics, clearly disclose the LP NFT redeem/vest mechanics, set per-address caps, and consider additional incentives for MET holders. If executed poorly, concentrated distribution and subsequent sell pressure could erode TGE’s value.